STILWELL JOSEPH Acquires Shares in Sound Financial Bancorp Inc

Introduction to the Transaction

On October 27, 2023, investment firm STILWELL JOSEPH (Trades, Portfolio) added 391,736 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The transaction was executed at a trade price of $35.78 per share. This acquisition resulted in a trade change of 1.15 and a share change of 4,470. Despite the significant addition, the trade had no immediate impact on the firm's portfolio. The traded stock now represents 15.24% of the guru's holdings in SFBC.

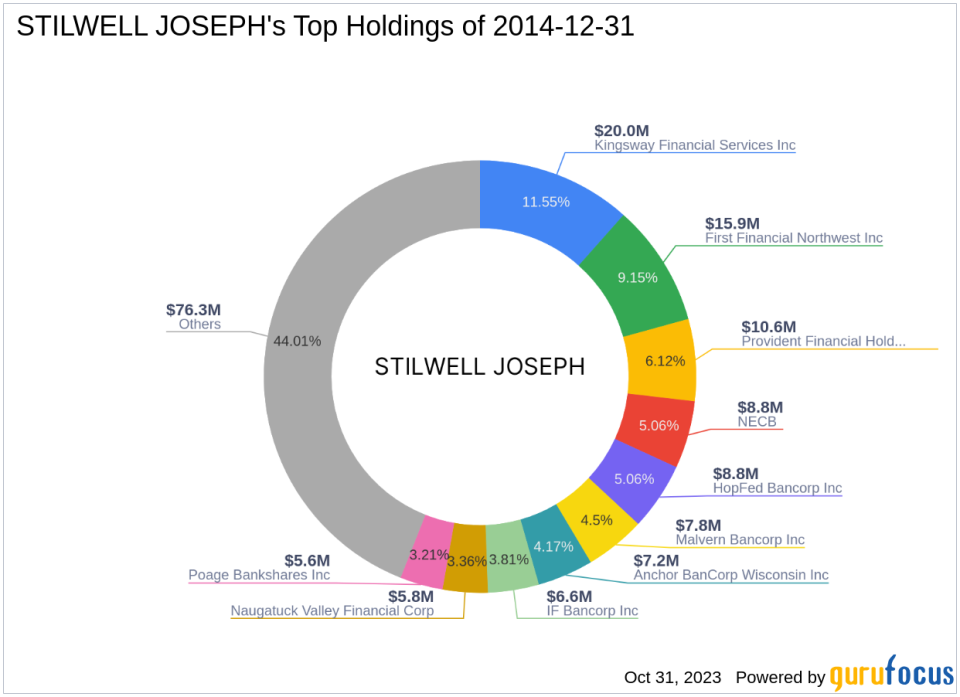

Profile of the Guru

STILWELL JOSEPH (Trades, Portfolio) is a renowned investment firm based in New York. The firm manages a diverse portfolio of 53 stocks, with a total equity of $173 million. The firm's top holdings are primarily in the Financial Services and Consumer Cyclical sectors. The firm's investment philosophy is centered on value investing, focusing on companies with strong fundamentals and potential for long-term growth.

Overview of the Traded Stock

Sound Financial Bancorp Inc (NASDAQ:SFBC), based in the USA, is a holding company for Sound Community Bank. The company, which went public on August 24, 2012, provides traditional banking and other financial services for individuals and businesses. With a market capitalization of $91.217 million, SFBC's business is organized into a single segment. The company's current stock price is $35.52, with a PE percentage of 8.81. According to GuruFocus, the stock is modestly undervalued with a GF Value of $45.32 and a Price to GF Value ratio of 0.78.

Analysis of the Stock's Performance

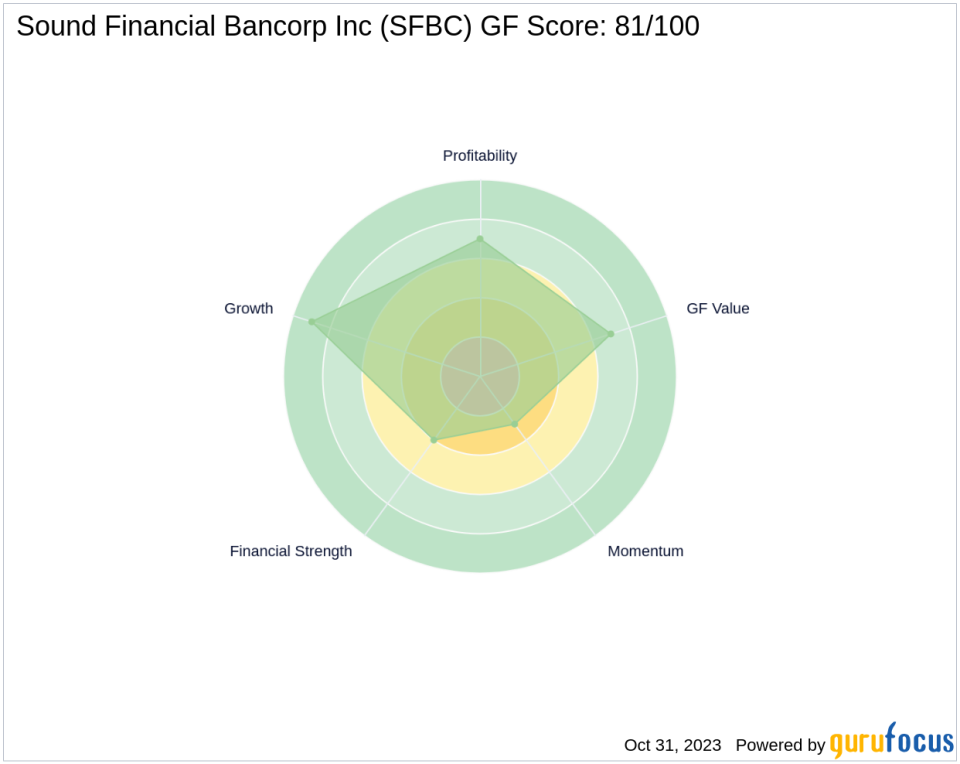

Since its IPO, SFBC has seen a price change of 251.68%. However, the year-to-date price change ratio stands at -9.55%. The stock's gain percent since the transaction is -0.73%. SFBC has a GF Score of 81/100, indicating good outperformance potential.

Evaluation of the Stock's Financial Health

Sound Financial Bancorp Inc has a balance sheet rank of 4/10, a profitability rank of 7/10, and a growth rank of 9/10. The company's GF Value Rank is 7/10, and its momentum rank is 3/10. The company's Piotroski F-Score is 6, and its Altman Z score is 0.00. SFBC's cash to debt ratio is 1.30, ranking 696th in its industry.

Analysis of the Stock's Industry Performance

Operating in the banking industry, SFBC has a return on equity (ROE) of 10.87 and a return on assets (ROA) of 1.07. The company ranks 695th in ROE and 613th in ROA. The company's gross margin growth and operating margin growth are both 0.00.

Evaluation of the Stock's Growth Over the Past Three Years

Over the past three years, SFBC has seen a revenue growth of 8.30% and an earning growth of 9.20%. The company's revenue growth rank is 544. However, the company's predictability rank is not applicable.

Analysis of the Stock's Momentum

The stock's RSI 5 day is 5.69, RSI 9 day is 14.62, and RSI 14 day is 22.75. The stock's momentum index 6 - 1 month is -0.88, and momentum index 12 - 1 month is -9.83. The stock's RSI 14 day rank is 97, and its momentum index 6 - 1 month rank is 937.

Transaction Analysis

The acquisition of SFBC shares by STILWELL JOSEPH (Trades, Portfolio) is a strategic move that aligns with the firm's value investing philosophy. Despite the stock's modest undervaluation and good outperformance potential, it's important to note that the stock's momentum rank is relatively low. This suggests that the stock may face challenges in the short term. However, the firm's significant stake in SFBC indicates a strong belief in the company's long-term growth potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.