STILWELL JOSEPH Acquires Shares in Sound Financial Bancorp Inc

Overview of the Transaction

On November 3, 2023, STILWELL JOSEPH (Trades, Portfolio), a renowned investment firm, added 394,436 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC) to its portfolio. The shares were acquired at a price of $36.84 each. This transaction resulted in a 0.05% change in the firm's portfolio, with an impact of 0%. The firm now holds a 15.35% stake in SFBC, making it a significant part of its investment portfolio.

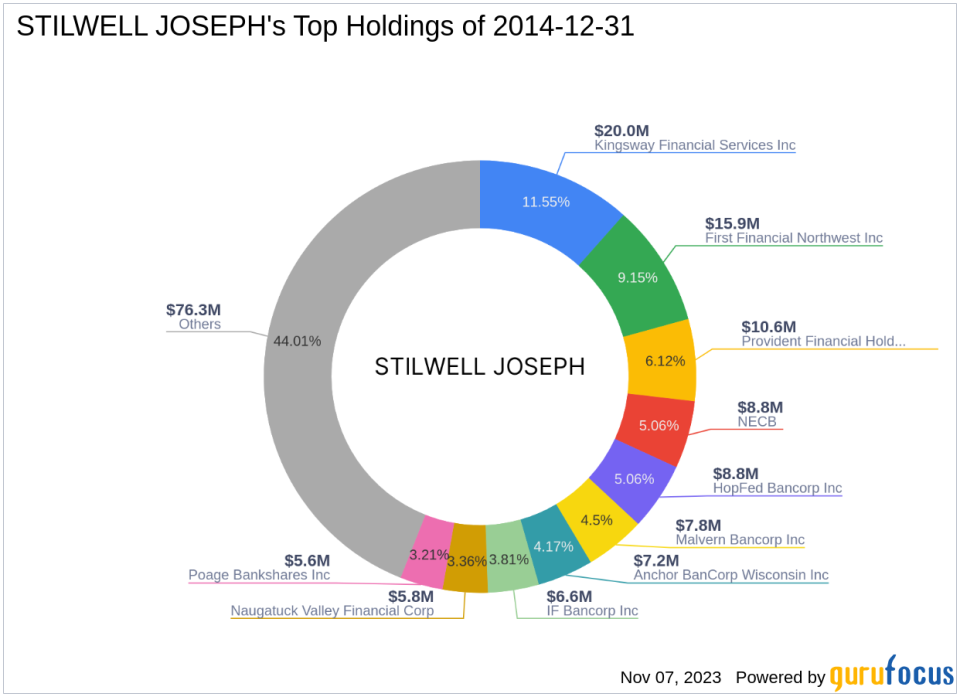

Profile of STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) is a New York-based investment firm with a portfolio of 53 stocks, valued at $173 million. The firm's top holdings are primarily in the Financial Services and Consumer Cyclical sectors. STILWELL JOSEPH (Trades, Portfolio)'s investment philosophy is centered on value investing, focusing on companies that are undervalued by the market but have strong fundamentals and growth potential.

Introduction to Sound Financial Bancorp Inc

Sound Financial Bancorp Inc (NASDAQ:SFBC), a USA-based company, operates as a holding company for Sound Community Bank. The bank provides traditional banking and other financial services for individuals and businesses. With a market cap of $94.376 million, SFBC's stock is currently priced at $36.75, with a PE percentage of 10.47. According to GuruFocus, the stock is modestly undervalued with a GF Value of $45.39.

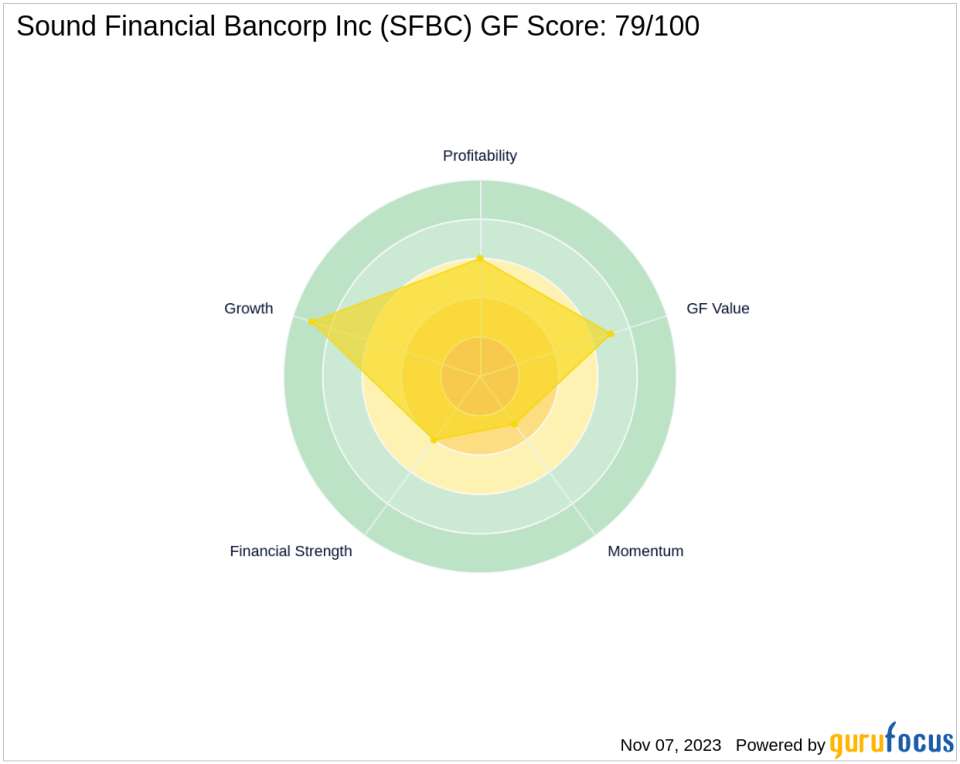

Performance Analysis of SFBC

Since its IPO in 2012, SFBC has seen a 263.86% increase in its stock price. However, the year-to-date performance shows a decrease of 6.42%. The stock's GF Score is 79/100, indicating a likely average performance in the future. SFBC's Financial Strength is ranked 4/10, while its Profitability Rank and Growth Rank are 6/10 and 9/10 respectively.

Evaluation of SFBC's Financial Health

Sound Financial Bancorp Inc has a cash to debt ratio of 1.80, ranking 583rd in the industry. The company's ROE and ROA are 9.31 and 0.91 respectively, ranking 860th and 769th. Over the past three years, the company has seen a revenue growth of 8.30% and an earnings growth of 9.20%.

Examination of SFBC's Momentum

The company's RSI 5 Day, RSI 9 Day, and RSI 14 Day are 61.16, 55.07, and 51.82 respectively. The Momentum Index 6 - 1 Month is 3.04, while the Momentum Index 12 - 1 Month is -8.53. These figures indicate a mixed momentum for the stock.

Conclusion

In conclusion, STILWELL JOSEPH (Trades, Portfolio)'s recent acquisition of SFBC shares is a strategic move that aligns with the firm's value investing philosophy. Despite the stock's modest undervaluation and mixed momentum, its strong growth rank and profitability rank suggest potential for future performance. This transaction is likely to have a significant impact on both the guru's portfolio and the traded stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.