STILWELL JOSEPH Acquires Significant Stake in Provident Bancorp Inc

Introduction to the Transaction

On August 30, 2023, STILWELL JOSEPH, a renowned investment firm, added a substantial number of shares to its portfolio from Provident Bancorp Inc (NASDAQ:PVBC). The firm acquired 1,781,394 shares at a trade price of $9.71 per share. This transaction resulted in a 10.35% change in the firm's holdings, increasing the total shares by 167,085. Despite this significant acquisition, the impact on the firm's portfolio and the position in the traded stock remains at 0% and 10.07% respectively.

Profile of the Guru

STILWELL JOSEPH is a prominent investment firm based in New York. The firm manages a diverse portfolio of 53 stocks, with a total equity of $173 million. The firm's top holdings are primarily in the Financial Services and Consumer Cyclical sectors. The firm's investment philosophy is centered around value investing, focusing on companies that are undervalued in the market.

Overview of the Traded Stock

Provident Bancorp Inc, trading under the symbol PVBC, is a US-based banking institution that went public on January 8, 1999. The company offers a wide range of banking products and services to small and medium-sized commercial customers. It operates as a single segment, attracting deposits from the general public to originate various types of loans and invest in securities. As of the date of this article, the company's market capitalization stands at $175.618 million, with a current stock price of $9.93.

Analysis of the Stock's Performance

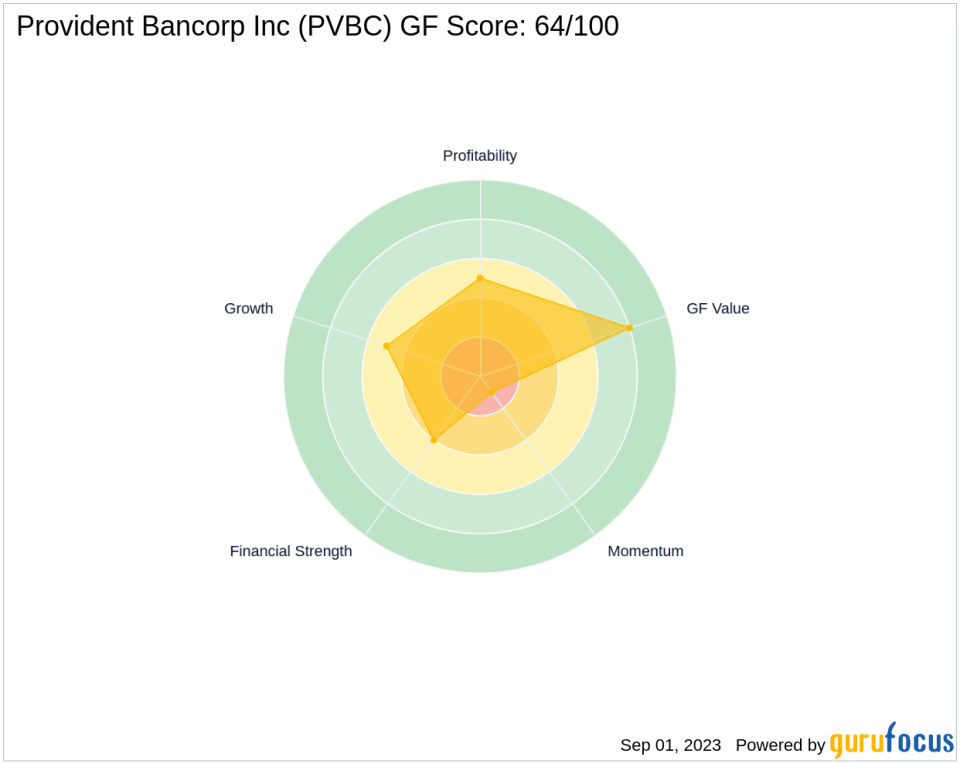

Despite having a PE percentage of 0.00, indicating a loss, Provident Bancorp Inc is significantly undervalued according to the GF-Score, with a GF Value of 17.88 and a Price to GF Value ratio of 0.56. Since its IPO, the stock has seen a decrease of 18.94%, but it has gained 2.27% since the transaction and has a YTD percent of 36.59. The stock's GF Score is 64/100, indicating a potential for average performance.

Evaluation of the Stock's Financial Health

Provident Bancorp Inc has a Financial Strength rank of 4/10, a Profitability Rank of 5/10, and a Growth Rank of 5/10. The company's GF Value Rank is 8/10, while its Momentum Rank is 1/10. The company's Piotroski F-Score is 4, and its Altman Z score is 0.00, indicating potential financial distress. However, the company's cash to debt ratio is 3.55, ranking 372nd in the industry.

Industry Context of the Stock

Provident Bancorp Inc operates in the banking industry, with a ROE of -12.55 and a ROA of -1.56. The company's gross margin growth and operating margin growth are both at 0.00, while its 3-year revenue growth is 22.80. Despite these figures, the company's revenue growth 3-year rank is 105, indicating a relatively strong performance within the industry.

Stock's Future Predictability

The predictability rank of Provident Bancorp Inc is not available. However, the stock's RSI 5 Day is 76.26, RSI 9 Day is 65.86, and RSI 14 Day is 62.04. The stock's momentum index 6 - 1 month is 5.34, while its momentum index 12 - 1 month is -33.33. These figures suggest a mixed outlook for the stock's future performance.

Conclusion

In conclusion, STILWELL JOSEPH's recent acquisition of Provident Bancorp Inc shares represents a significant addition to its portfolio. Despite the stock's mixed performance and financial health indicators, the firm's investment could potentially yield positive returns given the stock's undervalued status and the firm's expertise in value investing. This transaction provides valuable insights for value investors, highlighting the importance of thorough analysis and strategic decision-making in the investment process.

This article first appeared on GuruFocus.