STILWELL JOSEPH Bolsters Position in Peoples Financial Corp

Overview of STILWELL JOSEPH (Trades, Portfolio)'s Recent Acquisition

On November 14, 2023, the investment firm STILWELL JOSEPH (Trades, Portfolio) made a notable addition to its portfolio by acquiring 5,003 shares of Peoples Financial Corp (PFBX), a banking and financial services provider. This transaction, executed at a price of $13 per share, increased the firm's total holdings in PFBX to 586,086 shares. Despite the significant share change, the trade did not alter the firm's overall portfolio composition, maintaining a position ratio of 12.55% in the traded stock.

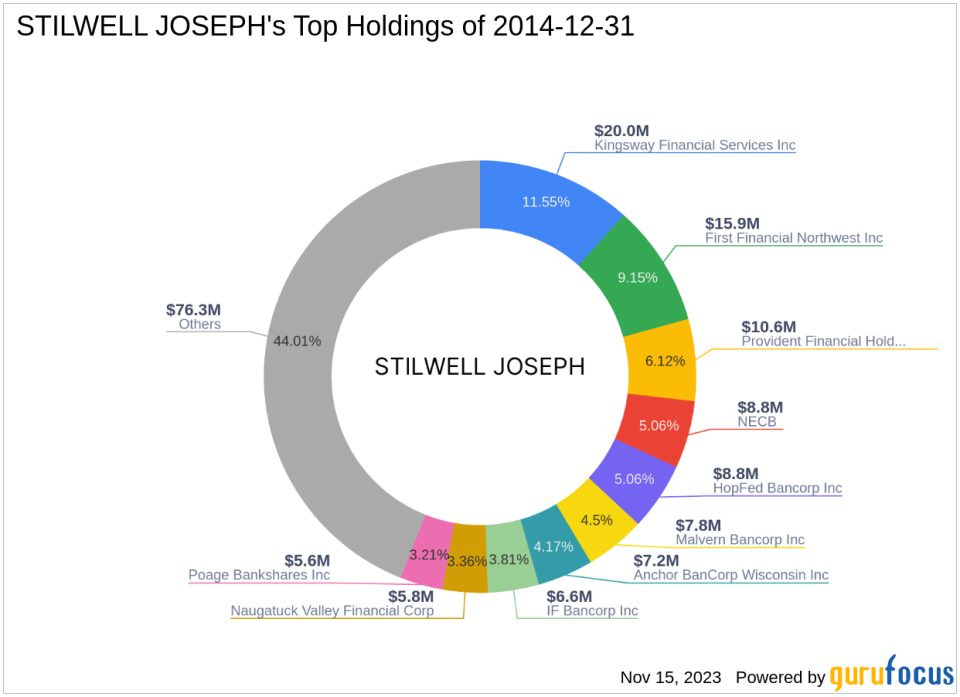

Insight into STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio), a New York-based investment firm located at 111 Broadway, 12th Floor, operates with a clear investment philosophy focused on value. With an equity of $173 million and a portfolio comprising 53 stocks, the firm has a pronounced preference for the Financial Services and Consumer Cyclical sectors. The firm's top holdings and strategic investments reflect a disciplined approach to value investing.

Portfolio Composition of STILWELL JOSEPH (Trades, Portfolio)

The firm's investment portfolio is diverse, with a strong emphasis on the financial sector. The recent acquisition of Peoples Financial Corp shares is consistent with STILWELL JOSEPH (Trades, Portfolio)'s investment strategy, which prioritizes financial institutions and consumer-driven businesses. This strategic move further cements the firm's position in the market and aligns with its long-term investment goals.

Peoples Financial Corp: A Brief Overview

Peoples Financial Corp, operating under the symbol PFBX, is a bank holding company that offers a wide range of banking, financial, and trust services. Since its IPO on July 19, 1999, the company has been serving individuals, small businesses, and commercial clients in Mississippi, Louisiana, and Alabama. PFBX's services include various loan offerings, deposit accounts, and other banking solutions tailored to meet the needs of its customers.

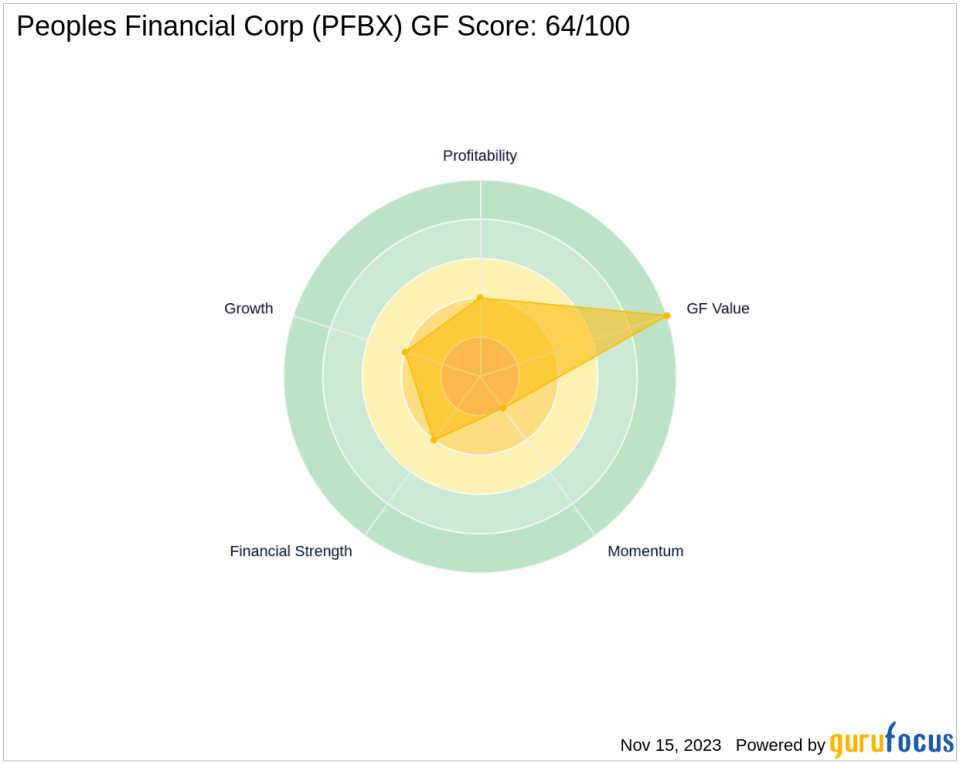

Financial Health and Market Position of Peoples Financial Corp

With a market capitalization of $60.745 million and a stock price of $13, Peoples Financial Corp is currently assessed as significantly undervalued, according to the GF Value, with a GF Value of $20.83. The stock's PE Ratio stands at 4.80%, indicating a potentially attractive valuation for investors. The company's financial strength and market position are further underscored by its GF Value Rank of 10/10, suggesting a strong potential for future growth.

Performance Metrics of Peoples Financial Corp

Peoples Financial Corp's stock performance has seen various fluctuations since its IPO, with a -56.67% change in stock price. The year-to-date performance also shows a decline of -10.34%. However, the company's GF Score of 64/100 indicates a moderate potential for future performance. The stock's financial ranks, including a Financial Strength of 4/10 and a Profitability Rank of 4/10, provide a comprehensive view of its current standing.

Implications of STILWELL JOSEPH (Trades, Portfolio)'s Trade

The recent acquisition by STILWELL JOSEPH (Trades, Portfolio) is a strategic move that could have a significant impact on both the firm's portfolio and Peoples Financial Corp's stock. The firm's increased stake in PFBX demonstrates confidence in the company's value proposition and future prospects. This trade could potentially influence the stock's performance and investor perception in the near term.

Concluding Thoughts on the Transaction

For value investors, STILWELL JOSEPH (Trades, Portfolio)'s recent transaction in Peoples Financial Corp represents a noteworthy development. The firm's decision to bolster its position in PFBX aligns with its investment strategy and highlights the potential undervaluation of the stock. As the market digests this move, it will be interesting to observe the subsequent performance of PFBX and its alignment with STILWELL JOSEPH (Trades, Portfolio)'s value-driven approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.