STILWELL JOSEPH Bolsters Position in Sound Financial Bancorp Inc

Introduction to the Transaction

On November 13, 2023, STILWELL JOSEPH (Trades, Portfolio), a notable investment firm, expanded its portfolio by adding 398,150 shares of Sound Financial Bancorp Inc (NASDAQ:SFBC). The transaction was executed at a price of $36.36 per share, marking a strategic move by the firm to increase its stake in the financial sector. This addition reflects STILWELL JOSEPH (Trades, Portfolio)'s confidence in SFBC and its future prospects.

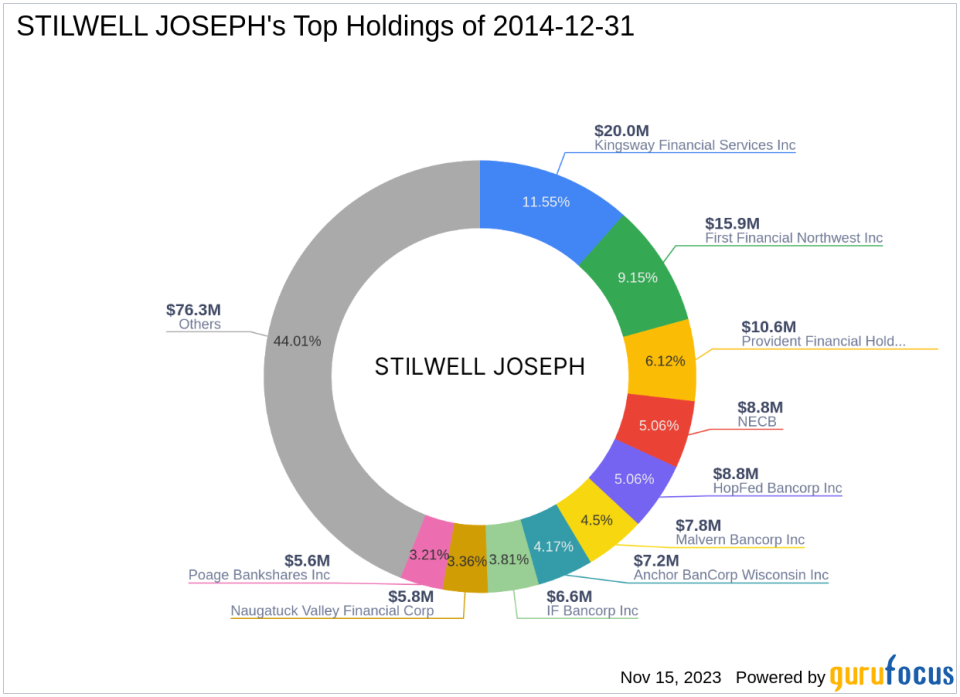

Profile of STILWELL JOSEPH (Trades, Portfolio)

STILWELL JOSEPH (Trades, Portfolio) operates with a clear investment philosophy, focusing on value creation and long-term growth. With a portfolio of 53 stocks and an equity value of $173 million, the firm has a strong presence in the Financial Services and Consumer Cyclical sectors. The firm's top holdings showcase a diversified investment strategy aimed at capitalizing on market opportunities.

Sound Financial Bancorp Inc's Company Overview

Sound Financial Bancorp Inc, headquartered in the USA, has been serving its customers since its IPO on August 24, 2012. The company operates as a holding entity for Sound Community Bank, offering a range of traditional banking and financial services. With a focus on retail and commercial deposits, SFBC invests in various loan products, including mortgages and consumer loans, catering to both individual and business needs.

Analysis of the Trade Impact

The recent acquisition by STILWELL JOSEPH (Trades, Portfolio) signifies a notable impact on its portfolio, with SFBC now representing a 15.49% holding. This move not only underscores the firm's commitment to the financial sector but also its belief in SFBC's growth trajectory and solid market position.

Financial Metrics of Sound Financial Bancorp Inc

Sound Financial Bancorp Inc boasts a market capitalization of $93.991 million and a current stock price of $36.6. The stock is considered modestly undervalued with a GF Value of $45.48 and a price to GF Value ratio of 0.80. The company's PE Ratio stands at 10.43, indicating a profitable operation despite the broader market conditions.

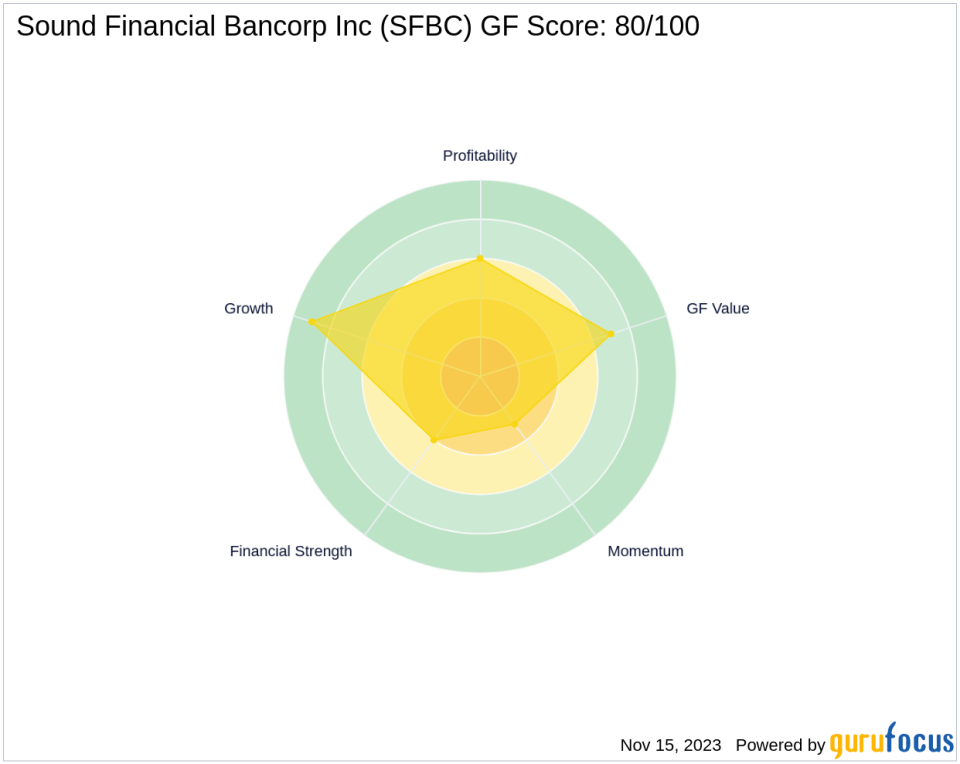

Sound Financial Bancorp Inc's Stock Performance Indicators

Since its IPO, SFBC's stock has seen a price change of 262.38%, reflecting a strong historical performance. However, the year-to-date price change ratio stands at -6.8%, suggesting some recent market challenges. The stock's GF Score of 80/100 indicates a likelihood of average performance in the future, supported by a solid Growth Rank of 9/10 and a GF Value Rank of 7/10.

Market Response and Future Outlook

The market has shown a moderate response to SFBC, with RSI indicators such as the 14-day RSI at 51.28. Looking ahead, the stock's growth potential and profitability outlook remain promising, with a Piotroski F-Score of 6 and a strong Revenue Growth 3 Year of 8.30%.

Conclusion

STILWELL JOSEPH (Trades, Portfolio)'s recent trade in Sound Financial Bancorp Inc underscores the firm's strategic investment approach and belief in the company's value proposition. SFBC's alignment with STILWELL JOSEPH (Trades, Portfolio)'s investment strategy, coupled with its solid financial metrics and market performance, positions it as a noteworthy player in the financial sector. Investors will be watching closely to see how this addition to STILWELL JOSEPH (Trades, Portfolio)'s portfolio will perform in the dynamic market landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.