Stitch Fix (SFIX) is Poised on Operational Excellence & Growth

Stitch Fix, Inc. SFIX is embedding the best retail practices throughout the organization, focusing on operational excellence in all aspects of its business. This approach is comprehensive, covering merchandising, pricing, transportation and warehouse operations.

The company’s private brands’ sales increased from about one-third to nearly 50% of the total sales over the last few years. These brands have higher keep rates and margins, contributing positively to client outcomes and profitability. The company is also refining its brand portfolio to better serve clients and build deeper relationships with national brand partners.

SFIX has observed healthier client engagement, with a higher three-month active revenue per active client (RPAC) and increased fix frequency among newer client cohorts. This trend suggests that recent client acquisitions are of higher quality and more engaged with the service. Also, continued investment in CRM capabilities, especially SMS and push notifications, to engage and re-engage clients, is showing positive early results.

Image Source: Zacks Investment Research

Enhancing Technology With Generative AI

Stitch Fix is enhancing its technological capabilities with Generative AI initiatives. The company introduced an AI-enabled tool that updates the personalization of client notes, informed by past purchases and specific item details. This innovation not only enriches client experiences but also reduces service costs and allows stylists to focus more on client relationships and curated selections.

Additionally, the company is scaling up its AI buying tool, which has already shown improved keep rates and is expected to influence more than 50% of unit orders by the end of fiscal 2024. New seasoned leaders with experience from Amazon Fashion, eBay, Airbnb and Nike have joined product and technology organizations, adding expertise and driving results.

Fulfillment Center Strategy Bodes Well

Stitch Fix's Fulfillment Center Strategy involves transitioning to a three-fulfillment center model. This move is aimed at achieving cost savings and reaching cash flow neutrality during the transition phase. The company successfully ceased operations of its Bethlehem, PA-based warehouse and is on track to do the same in Dallas by the end of third-quarter fiscal 2024.

The long-term benefits expected from this strategy include improvements in inventory efficiencies. This shift in fulfillment strategy is part of Stitch Fix's broader efforts to enhance operational efficiencies and align its resources more effectively to meet its business goals.

Active Client Hurdles

The company experienced a decline in active clients from fiscal 2023 and first-quarter fiscal 2024, contributing to revenue headwinds. This decline in active client base also impacted Stitch Fix's growth potential. The company’s top line moved down 17.8%, while the net revenue per active client declined 6.5% in the fiscal first quarter. SFIX expects macro headwinds from challenges in acquiring and retaining active clients to persist, and continue to influence customer purchase behavior, impacting discretionary spend.

Stitch Fix's focus on private brands, strategic brand portfolio management and innovative client engagement strategies position it well for success and growth in the competitive retail landscape. However, a decline in net active clients and a reduction in revenue per client are concerning. Nonetheless, as the consumer environment improves, there is an opportunity for Stitch Fix to leverage strengths to attract clients and re-engage with existing ones.

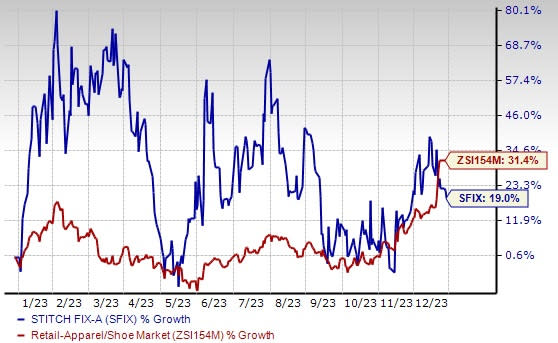

In the past year, shares of this Zacks Rank #3 (Hold) company have gained 19% compared with the Zacks Retail-Apparel and Shoes industry’s growth of 31.4%.

3 Promising Stocks

A few better-ranked stocks in the same space are The Gap, Inc. GPS, Abercrombie & Fitch Co. ANF and American Eagle Outfitters Inc. AEO.

The Gap is a premier international specialty retailer offering a diverse range of clothing, accessories and personal care products. The company currently sports a Zacks Rank #1 (Strong Buy). GPS delivered a significant earnings surprise in the last reported quarter.

You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for The Gap’s current fiscal-year earnings implies growth of 387.5% from the previous year’s reported number. GPS has a trailing four-quarter average earnings surprise of 137.9%.

Abercrombie & Fitch is a specialty retailer of premium, high-quality casual apparel. The company currently flaunts a Zacks Rank #1. ANF delivered a 60.5% earnings surprise in the last reported quarter.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current fiscal-year sales implies growth of 13.3% from the previous year’s reported number. ANF has a trailing four-quarter average earnings surprise of 713%.

American Eagle Outfitters is a specialty retailer of casual apparel, accessories and footwear for men and women. It currently carries a Zacks Rank #2 (Buy).

The Zacks Consensus Estimate for American Eagle Outfitters’ current fiscal-year earnings and sales indicates growth of 39.2% and 4%, respectively, from the previous year’s reported figures. AEO has a trailing four-quarter average earnings surprise of 23%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

The Gap, Inc. (GPS) : Free Stock Analysis Report

Stitch Fix, Inc. (SFIX) : Free Stock Analysis Report