Stock Yards Bancorp Inc (SYBT): A Deep Dive into Its Dividend Performance and Sustainability

Unveiling the Dividend Aristocrat's Track Record and Future Prospects

Stock Yards Bancorp Inc (NASDAQ:SYBT) recently announced a dividend of $0.3 per share, payable on 2023-10-02, with the ex-dividend date set for 2023-09-15. As investors eagerly await this upcoming payment, it's an opportune time to examine the company's dividend history, yield, and growth rates. Leveraging GuruFocus data, let's delve into Stock Yards Bancorp Inc's dividend performance and assess its sustainability.

A Brief Introduction to Stock Yards Bancorp Inc

Warning! GuruFocus has detected 2 Warning Signs with SYBT. Click here to check it out.

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

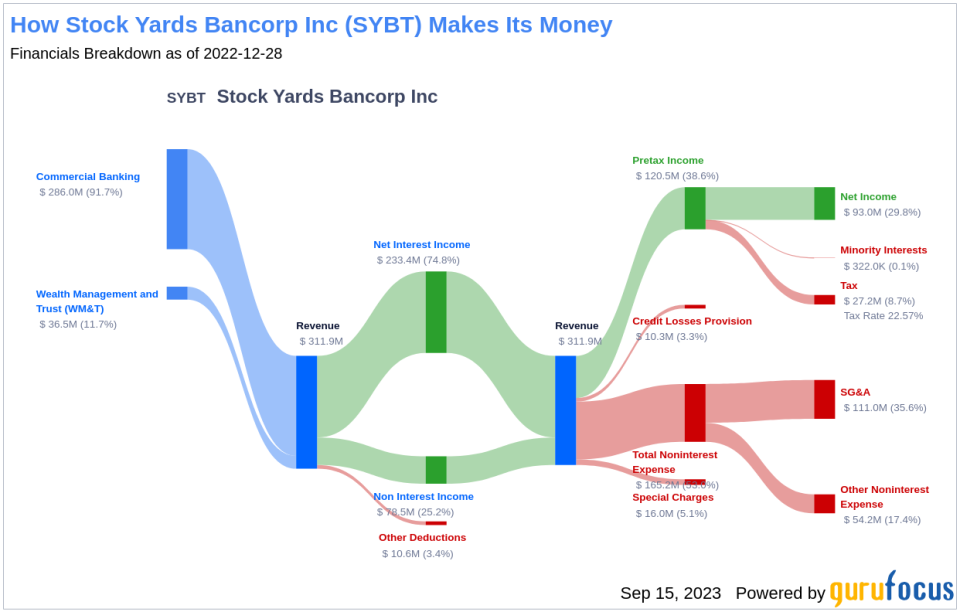

Stock Yards Bancorp Inc operates as a bank with two reportable operating segments: Commercial Banking and Wealth Management and Trust. The bank offers a variety of services, including loan and deposit services, cash management services, securities brokerage activities, and mortgage origination. The Commercial Banking segment forms the core of its revenue generation.

A Glimpse at Stock Yards Bancorp Inc's Dividend History

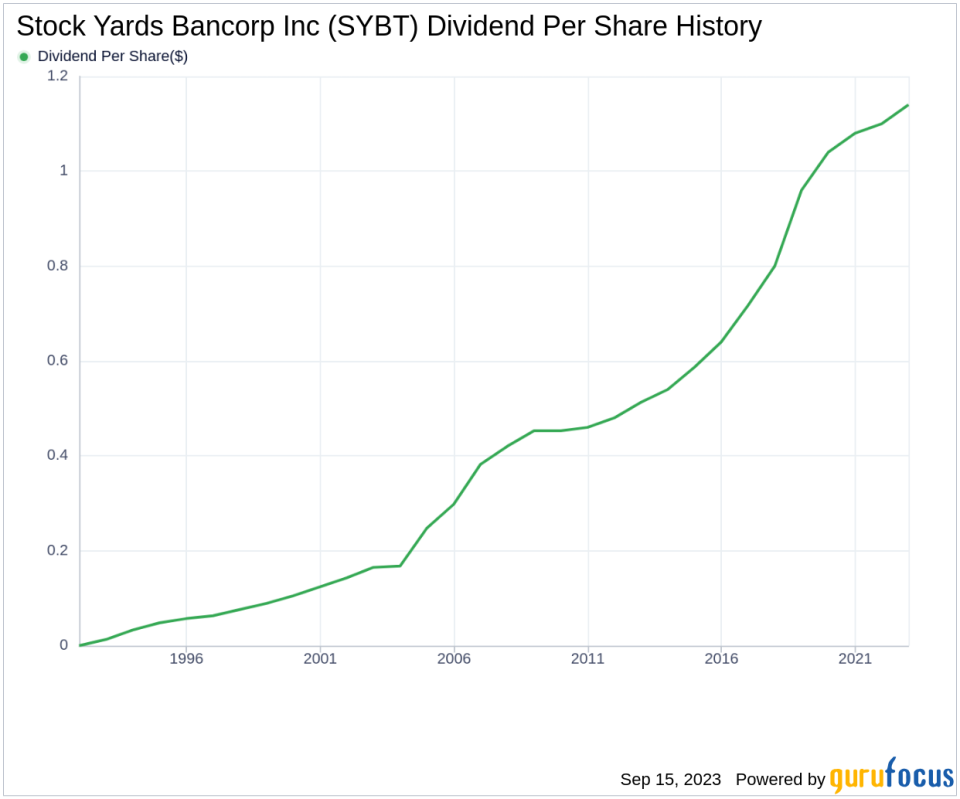

Stock Yards Bancorp Inc has maintained a consistent dividend payment record since 1992, with dividends currently distributed on a quarterly basis. The company has increased its dividend each year since 1992, earning it the status of a dividend aristocrat, a title bestowed on companies that have consistently increased their dividend for at least the past 31 years.

Breaking Down Stock Yards Bancorp Inc's Dividend Yield and Growth

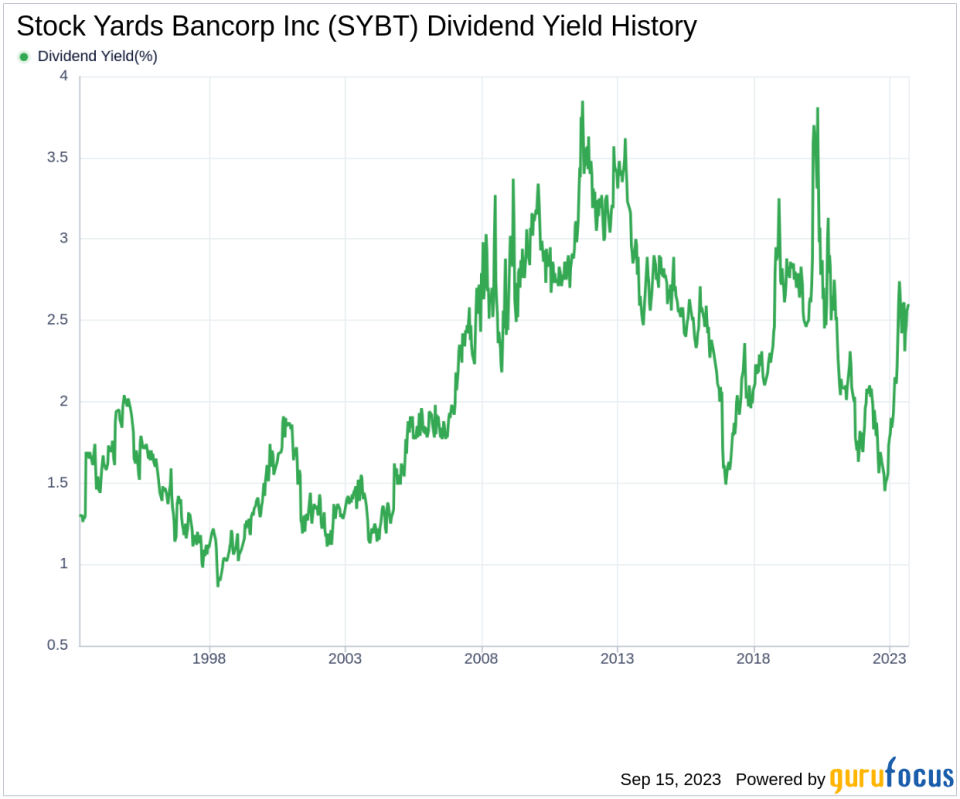

As of today, Stock Yards Bancorp Inc has a 12-month trailing dividend yield of 2.61% and a 12-month forward dividend yield of 2.70%, indicating an expectation of increased dividend payments over the next 12 months.

Over the past three years, the company's annual dividend growth rate was 3.10%. This rate increased to 6.50% per year over a five-year horizon. Over the past decade, its annual dividends per share growth rate stands at 9.50%.

Given Stock Yards Bancorp Inc's dividend yield and five-year growth rate, the 5-year yield on cost of the stock is approximately 3.58% as of today.

The Sustainability Question: Payout Ratio and Profitability

To assess the sustainability of the dividend, it's crucial to evaluate the company's payout ratio. The dividend payout ratio provides insights into the portion of earnings the company distributes as dividends. A lower ratio suggests that the company retains a significant part of its earnings, ensuring the availability of funds for future growth and unexpected downturns. As of 2023-06-30, Stock Yards Bancorp Inc's dividend payout ratio is 0.30.

Stock Yards Bancorp Inc's profitability rank of 6 out of 10 as of 2023-06-30 suggests fair profitability. The company has reported positive net income for each year over the past decade, further solidifying its high profitability.

Growth Metrics: The Future Outlook

For dividends to be sustainable, a company must exhibit robust growth metrics. Stock Yards Bancorp Inc's growth rank of 6 out of 10 suggests a fair growth outlook. The company's revenue per share and 3-year revenue growth rate indicate a strong revenue model. Stock Yards Bancorp Inc's revenue has increased by approximately 12.90% per year on average, outperforming approximately 77.29% of global competitors.

The company's 3-year EPS growth rate showcases its capability to grow its earnings, a critical component for sustaining dividends in the long run. During the past three years, Stock Yards Bancorp Inc's earnings increased by approximately 3.60% per year on average, outperforming approximately 33.21% of global competitors.

The company's 5-year EBITDA growth rate of 11.50% outperforms approximately 60.24% of global competitors, further highlighting its growth potential.

Final Thoughts

Stock Yards Bancorp Inc's consistent dividend payment record, coupled with its robust growth metrics, underscores its commitment to rewarding shareholders while ensuring the sustainability of its dividends. The company's fair profitability and growth outlook further cement its position as a reliable dividend payer. Investors seeking high-dividend yield stocks can leverage GuruFocus's High Dividend Yield Screener for informed decision-making.

This article first appeared on GuruFocus.