Stock Yards Bancorp Inc (SYBT) Reports Mixed Q4 Results Amid Strong Loan Growth

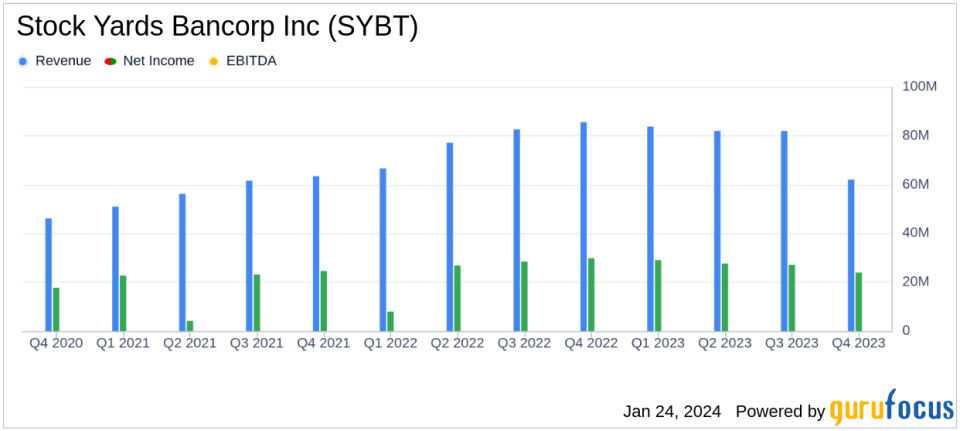

Net Income: Q4 net income of $23.9 million, down from $29.8 million in Q4 2022.

Earnings Per Share: Diluted EPS at $0.82, compared to $1.01 in the same quarter last year.

Net Interest Income: Decreased by 5% year-over-year to $62.0 million in Q4.

Loan Growth: Record organic loan expansion with an 11% increase over the last 12 months.

Deposit Growth: Total deposits rose by 4% year-over-year to $6.67 billion.

Non-Interest Income: Increased by 6% from Q4 2022, reaching $24.4 million.

Efficiency Ratio: Deteriorated to 57.80% in Q4 from 51.85% in the prior year.

On January 24, 2024, Stock Yards Bancorp Inc (NASDAQ:SYBT), a bank with a focus on Commercial Banking and Wealth Management and Trust services, released its 8-K filing, detailing its financial performance for the fourth quarter of 2023. Despite achieving record net income for the year, the company faced a decline in quarterly earnings compared to the same period in the previous year.

Financial Performance and Challenges

Stock Yards Bancorp's Q4 results were a mixed bag, with the company reporting a decline in net income and diluted EPS year-over-year. The bank's net interest income also saw a decrease, primarily due to the compression of the net interest margin, which fell from 3.64% in Q4 2022 to 3.25% in the same quarter of 2023. This margin compression is largely attributed to the rising cost of funds outpacing the growth in yields on earning assets, a trend that may persist into the early part of the following year.

Despite these challenges, the bank's loan growth was a highlight, with a significant 11% increase over the past 12 months. This growth is particularly important for a bank like Stock Yards Bancorp, as it indicates a strong demand for its lending services and potential for interest income. Deposit growth also remained robust, which is essential for the bank's liquidity and funding for loan origination.

Financial Achievements and Industry Importance

The bank's record annual earnings are a testament to its ability to grow its loan portfolio and manage non-interest income effectively. Wealth Management & Trust services contributed significantly to the bank's non-interest income, benefiting from favorable market conditions and new business growth. These achievements are critical in the banking industry, where diversified revenue streams can help mitigate the impact of interest rate fluctuations and market volatility.

Key Financial Metrics

Stock Yards Bancorp's financial health can be further assessed through several key metrics:

"I am pleased with our fourth quarter and record full year 2023 results, highlighted by strong loan production and fee income led by Wealth Management & Trust (WM&T). We continue to see broad-based loan demand from our customers throughout our markets," commented James A. (Ja) Hillebrand, Chairman and Chief Executive Officer.

The bank's efficiency ratio, although worsened from the previous year, still reflects a relatively efficient operation. The tangible common equity to tangible assets ratio improved from 7.44% at the end of 2022 to 8.09% at the end of 2023, indicating a stronger capital position. The annualized return on average assets and equity, however, experienced a decline, reflecting the lower net income for the quarter.

Analysis of Performance

While Stock Yards Bancorp's record annual earnings are commendable, the fourth quarter's performance shows signs of pressure from the rising interest rate environment. The bank's strategic focus on loan growth and fee income diversification has helped cushion the impact of net interest margin compression. However, the bank will need to continue to manage its cost of funds and explore additional avenues for revenue generation to maintain its profitability in a challenging interest rate landscape.

Stock Yards Bancorp's commitment to organic growth and its avoidance of brokered deposits, which are typically more expensive, is a prudent strategy that should serve the bank well in the long term. As the bank prepares to enter its 120th year of operation, it remains focused on cultivating full customer relationships and leveraging its diversified geographic footprint.

For a more detailed analysis and to stay updated on Stock Yards Bancorp Inc's financial journey, investors and interested parties are encouraged to visit GuruFocus.com for comprehensive reports and investment tools.

Explore the complete 8-K earnings release (here) from Stock Yards Bancorp Inc for further details.

This article first appeared on GuruFocus.