Service Stocks' Nov 2 Earnings Roster: BR, APTV & PLTR

The widely diversified Zacks Business Services sector, which houses consulting, outsourcing, staffing and waste management companies, to name a few, is a major beneficiary of economic health.

The sector benefited from the reviving broader economy in the third quarter of 2023. Strengthening of service activities and improving supply chains, along with sector-specific factors like service essentiality, successful work-from-home models and digital transformation, fueled growth in the quarter.

Some major players like Broadridge Financial Solutions, Inc. BR, Aptiv PLC APTV and Palantir Technologies Inc. PLTR are set to reveal their Q3 numbers tomorrow.

Q3 Tailwinds for Business Services

According to the "advance" estimate released by the Bureau of Economic Analysis, GDP grew at an annual rate of 4.9% in the quarter compared with 2.1% growth in the second quarter.

With service activities in the pink, the demand for business services rose steadily. The Services PMI, measured by the Institute for Supply Management, had stayed above the 50% mark for nine consecutive months by the end of the third quarter.

Among services industries, retail trade, mining, utilities, construction, health care & social assistance, finance & insurance, information, educational services, professional, scientific & technical services and transportation & warehousing stayed healthy.

Earnings Picture So Far and Expectations

The third-quarter earnings for the S&P 500 members of the business services sector have been impressive so far. The latest Earnings Outlook suggests that earnings of those S&P 500 members of the business services sector that have reported results grew 11% year over year on 4.7% revenue growth, with 72.7% of the companies beating EPS estimates and 54.5% topping sales projections.

Total quarterly earnings of the S&P 500 members of the sector are currently anticipated to display 7.6% year-on-year growth. Revenues will likely reflect a 5.3% rise. This compares with 6.5% and 5.7% growth in earnings and revenues in the second quarter of 2023, respectively.

BR, APTV, PLTR in Spotlight

Here, we have discussed three business services companies scheduled to report their third-quarter 2023 numbers on Nov 2.

Our quantitative model suggests that the combination of the following two key elements — a positive Earnings ESP and a Zacks Rank #3 (Hold) or better — increases the odds of a positive earnings surprise. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Broadridge: The company is a provider of investor communications and technology-driven solutions that currently has an Earnings ESP of 0.00% and currently carries a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for revenues in the to-be-reported quarter is pegged at $1.37 billion, indicating a year-over-year increase of 7.1%. The company is likely to have benefited from improving segmental performance.

Our estimate for first-quarter fiscal 2024 revenues from the Investor Communication Solutions (ICS) segment is currently pegged at $1.02 billion, indicating a 10.4% increase from the year-ago figure. Our projection for the Global Technology and Operations segment’s revenues is currently pegged at $1.36 billion, implying 6.5% growth from the previous year.

The Zacks Consensus Estimate for quarterly earnings is pegged at 94 cents, suggesting an increase of 11.9% from the year-ago quarter. (Read More: Broadridge to Report Q1 Earnings: What's in the Cards?)

Broadridge Financial Solutions, Inc. Price and EPS Surprise

Broadridge Financial Solutions, Inc. price-eps-surprise | Broadridge Financial Solutions, Inc. Quote

Aptiv:The company is involved in the design, manufacture, and sale of vehicle components globally. Aptiv has an Earnings ESP of +4.94% and a Zacks Rank #3.

The Zacks Consensus Estimate for revenues in the to-be-reported quarter is pegged at $5 billion, indicating year-over-year growth of 8.2%. The top line is likely to have benefited from growth in the Advanced Safety & User Experience and Signal & Power Solutions segments’ revenues.

Our estimate for Advanced Safety & User Experience revenues is pegged at $1.2 billion, indicating a year-over-year increase of 2.1%. Our estimate for the Signal & Power Solutions segment’s revenues stands at $3.7 billion, suggesting year-over-year growth of 7.6%.

The consensus estimate for earnings is pegged at $1.2 per share, indicating a year-over-year decline of 6.3%. We expect increasing operating expenses to have weighed on the bottom line in the quarter. (Read more: Aptiv (APTV) to Report Q3 Earnings: What's in the Offing?)

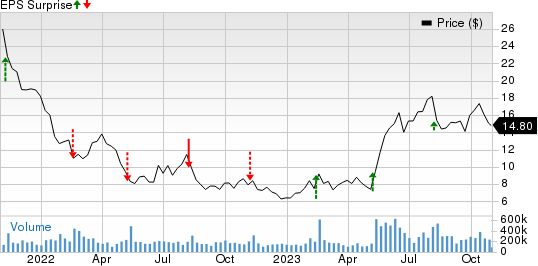

Aptiv PLC Price and EPS Surprise

Aptiv PLC price-eps-surprise | Aptiv PLC Quote

Palantir Technologies: The Zacks Consensus Estimate for this software platform developer’s revenues stands at $555 million, indicating growth of 16.1% from the year-ago reported figure. The top line is expected to have benefited from strength in both the Government and Commercial segments. Both segments are likely to have gained from increased contributions from existing as well as new customers.

The Zacks Consensus Estimate for earnings in the to-be-reported quarter is pegged at $6 cents, indicating growth of more than 100% from the year-ago quarter’s reported figure. Revenue growth and better operating performance are likely to have positively impacted the bottom line in the quarter under discussion.

Palantir has an Earnings ESP of +4.35% and a Zacks Rank #2 (Buy). (Read more: What's in the Offing for Palantir (PLTR) in Q3 Earnings?)

Palantir Technologies Inc. Price and EPS Surprise

Palantir Technologies Inc. price-eps-surprise | Palantir Technologies Inc. Quote

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Aptiv PLC (APTV) : Free Stock Analysis Report

Palantir Technologies Inc. (PLTR) : Free Stock Analysis Report