StoneX Group Inc. Reports Notable 20% Increase in Operating Revenues for Fiscal 2024 Q1

Operating Revenues: StoneX Group Inc. reported a 20% increase in operating revenues, reaching $784.2 million.

Net Income: Net income for the quarter was $69.1 million, with a return on equity (ROE) of 19.3%.

Diluted EPS: Diluted earnings per share (EPS) rose to $2.13, marking a significant increase from the previous year.

Interest Income: Interest income saw a substantial rise of 48%, contributing to the overall revenue growth.

Segment Performance: The Institutional and Retail segments experienced notable revenue growth of 27% and 31%, respectively.

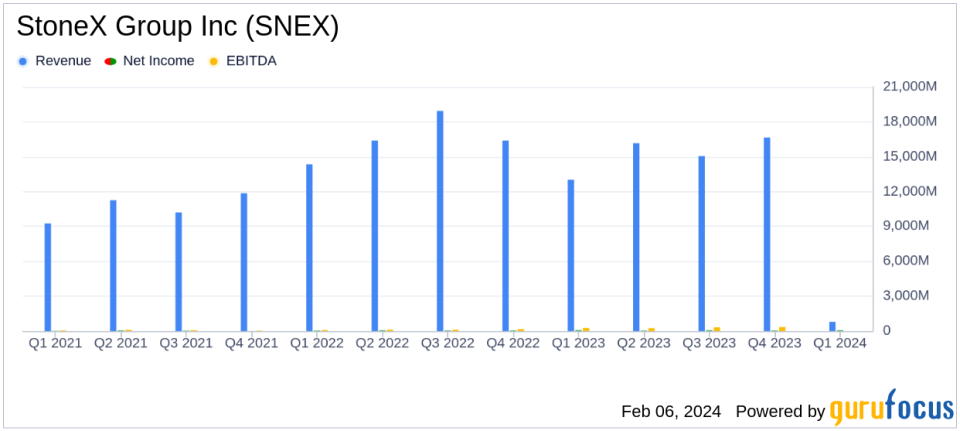

On February 6, 2024, StoneX Group Inc (NASDAQ:SNEX), a global financial services firm, released its 8-K filing, detailing the financial results for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, which provides a comprehensive range of brokerage and financial services including execution, advisory, and global payment solutions, operates across multiple segments with a significant presence in the Middle East and Asia.

Fiscal Performance Overview

StoneX Group Inc. commenced the fiscal year with robust financial results. The company's operating revenues surged by 20% to $784.2 million compared to the same quarter in the previous year. This increase was driven by a 52% rise in sales of physical commodities and a 48% increase in interest income. Despite a challenging market environment, the firm managed to achieve a 19.3% return on equity and a diluted EPS of $2.13, which is a 28.0% increase when adjusted for a one-time gain on acquisition in the prior year.

CEO Sean M. O'Connor commented on the results, stating,

We had a very strong start to fiscal 2024, with net income of $69.1 million representing a 19.3% return on equity... We continue to see a constructive market environment with good client engagement, and increased interest earnings on our client float. We are pleased to see that our business continues to deliver what we believe to be superior returns to our shareholders."

Financial Highlights and Segment Performance

The company's performance was bolstered by significant contributions from its Institutional and Retail segments, which saw revenue growth of 27% and 31%, respectively. The Commercial and Payments segments also reported growth, contributing to the overall positive financial results. StoneX Group Inc.'s balance sheet remained solid, with a focus on maintaining a strong equity position and managing liabilities effectively.

StoneX Group Inc.'s financial achievements are particularly important in the capital markets industry, where client engagement and market volatility can significantly impact performance. The company's ability to increase interest income and manage expenses effectively demonstrates its resilience and adaptability in a dynamic market landscape.

Key Financial Metrics and Commentary

StoneX Group Inc.'s financial metrics reflect the company's strong market position and operational efficiency. The increase in net income and EPS is a testament to the company's ability to capitalize on market opportunities and manage costs. The growth in operating revenues indicates a healthy demand for the company's services, while the rise in interest income suggests effective capital management.

The company's financial tables provide a detailed breakdown of revenues and expenses, highlighting the areas of growth and the segments that contributed most to the company's success. These tables are essential for investors to understand the company's financial health and the factors driving its performance.

Looking Ahead

StoneX Group Inc.'s strong start to the fiscal year sets a positive tone for future quarters. The company's strategic focus on client engagement and market expansion, combined with its robust financial management, positions it well for continued success. Investors and stakeholders can look forward to the company's sustained growth and profitability as it navigates the evolving financial landscape.

For a more comprehensive analysis of StoneX Group Inc.'s financial results, interested parties are encouraged to review the full 8-K filing and attend the upcoming conference call, where further details and insights will be shared by the company's management.

StoneX Group Inc. remains committed to transparency and excellence in serving its clients and shareholders, as evidenced by its detailed financial reporting and proactive communication strategies.

For additional information and to access the conference call, please visit StoneX Group Inc.'s corporate website at www.stonex.com.

Explore the complete 8-K earnings release (here) from StoneX Group Inc for further details.

This article first appeared on GuruFocus.