It's A Story Of Risk Vs Reward With Chamberlin plc (LON:CMH)

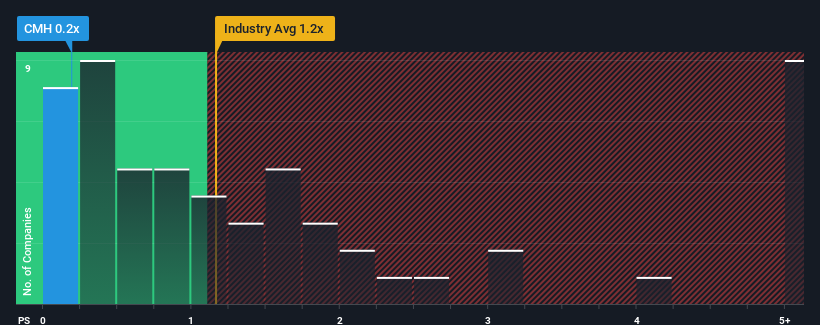

Chamberlin plc's (LON:CMH) price-to-sales (or "P/S") ratio of 0.2x might make it look like a buy right now compared to the Metals and Mining industry in the United Kingdom, where around half of the companies have P/S ratios above 1.2x and even P/S above 4x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Chamberlin

How Chamberlin Has Been Performing

Chamberlin certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting future revenue performance to follow the rest of the industry downwards, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Keen to find out how analysts think Chamberlin's future stacks up against the industry? In that case, our free report is a great place to start.

How Is Chamberlin's Revenue Growth Trending?

In order to justify its P/S ratio, Chamberlin would need to produce sluggish growth that's trailing the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 23%. Still, revenue has fallen 18% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 16% during the coming year according to the one analyst following the company. With the rest of the industry predicted to shrink by 1.4%, that would be a fantastic result.

In light of this, it's quite peculiar that Chamberlin's P/S sits below the majority of other companies. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

What Does Chamberlin's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Chamberlin's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't contributing to its P/S anywhere near as much as we would have predicted. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. Perhaps there is some hesitation about the company's ability to keep swimming against the current of the broader industry turmoil. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 4 warning signs we've spotted with Chamberlin (including 3 which can't be ignored).

If you're unsure about the strength of Chamberlin's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.