Strategic Collaborations Aid Genpact (G) Amid Rising Costs

Genpact Limited’s G growth is fueled by strategic collaborations, such as the AWS and Amazon Business collaborations, which transform property loss management and financial crime operations. Shareholder value is prioritized through substantial share repurchases and dividends. The integration of generative AI into the Enterprise360 platform enhances operational efficiency, thus exemplifying Genpact's commitment to transformative change.

How is Genpact Doing?

Genpact's commitment to delivering value to shareholders is evident through its strategic initiatives, particularly in share repurchases and dividend payments. In 2022, the company repurchased shares totaling $214.1 million, following repurchases of $298.2 million in 2021 and $137.1 million in 2020. Additionally, Genpact distributed dividends of $91.8 million, $80.5 million, and $74.2 million to shareholders in 2022, 2021 and 2020, respectively. These shareholder-friendly actions not only showcase Genpact's dedication to creating value but also reflect its confidence in the strength of its business.

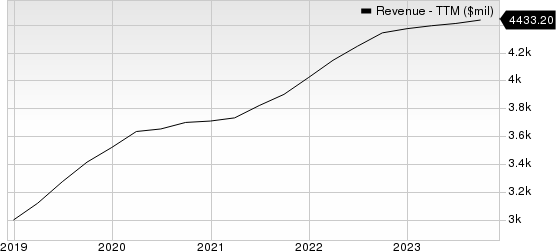

Genpact Limited Revenue (TTM)

Genpact Limited revenue-ttm | Genpact Limited Quote

Artificial Intelligence (AI) presents a significant growth opportunity for Genpact. Genpact has integrated generative AI into its Enterprise360 intelligence platform, enhancing operational efficiency for clients globally. The platform combines digital tools and standardized processes, empowering businesses to address operational issues and optimize performance.

Genpact's playbook, "FMOps – The Generative AI Imperative for Production," offers practical guidelines for building ethical and scalable generative AI solutions, facilitating the transition from pilot projects to production. This initiative reflects Genpact's commitment to driving transformative change and delivering value through the strategic integration of generative AI across sectors.

Genpact's current ratio at the end of second-quarter 2023 was pegged at 1.91, higher than the current ratio of 1.88 reported at the end of prior-quarter and the year-ago quarter’s 1.08. Increasing current ratio bodes well as it indicates that the company will have no problem meeting its short-term debt obligations.

Genpact encounters notable client concentration in terms of geographical distribution. In 2022, more than half of its revenues came from clients in India, and more than 20% from North and Latin America. Moreover, more than 35% of revenues in 2022 were from clients in the High Tech and Manufacturing industry. This industry-specific reliance may pose long-term concerns for investors.

The outsourcing industry is labor-intensive and heavily dependent on foreign talent. Rising talent costs due to competition could curb the industry’s growth. Genpact, being one of the companies in the industry, is likely to be affected.

G currently has Zacks Rank #4 (Sell).

Stocks to Consider

Here are a few better-ranked stocks from the Business Services sector:

Gartner IT: The Zacks Consensus Estimate of Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure while earnings are expected to decline 1.9%. The company has beaten the consensus estimate in all four quarters, with an average surprise of 34.4%.

IT sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

FTI Consulting FCN: The Zacks Consensus Estimate of FCN’s 2023 revenues indicates 12.1% growth from the year-ago figure, while earnings are expected to grow 3.4%. The company has beaten the consensus estimate in three of the four quarters and missed on one instance, the average surprise being 8.5%.

FCN currently has a Zacks Rank #2 (Buy).

Broadridge Financial Solutions BR: The Zacks Consensus Estimate of Broadridge’s 2023 revenues indicates 7.7% growth from the year-ago figure while earnings are expected to grow 10.1%. The company has beaten the consensus estimate in three of the past four quarters and matched on one instance, the average surprise being 5.4%.

BR presently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

FTI Consulting, Inc. (FCN) : Free Stock Analysis Report

Genpact Limited (G) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report