Strategic Education (NASDAQ:STRA) Exceeds Q4 Expectations

Higher education company Strategic Education (NASDAQ:STRA) announced better-than-expected results in Q4 FY2023, with revenue up 12.1% year on year to $302.7 million. It made a non-GAAP profit of $1.68 per share, improving from its profit of $0.78 per share in the same quarter last year.

Is now the time to buy Strategic Education? Find out by accessing our full research report, it's free.

Strategic Education (STRA) Q4 FY2023 Highlights:

Revenue: $302.7 million vs analyst estimates of $297.5 million (1.8% beat)

EPS (non-GAAP): $1.68 vs analyst estimates of $1.34 (25.6% beat)

Free Cash Flow of $20.32 million, down 50.2% from the previous quarter

Gross Margin (GAAP): 49.2%, up from 43.6% in the same quarter last year

Enrolled Students: 86,233

Market Capitalization: $2.30 billion

“During 2023, we delivered strong enrollment, revenue, and earnings growth and are proud of the organization’s ongoing commitment to the success of our students,” said Karl McDonnell, Chief Executive Officer of Strategic Education.

Formed through the merger of Strayer Education and Capella Education in 2018, Strategic Education (NASDAQ:STRA) is a career-focused higher education provider.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

Sales Growth

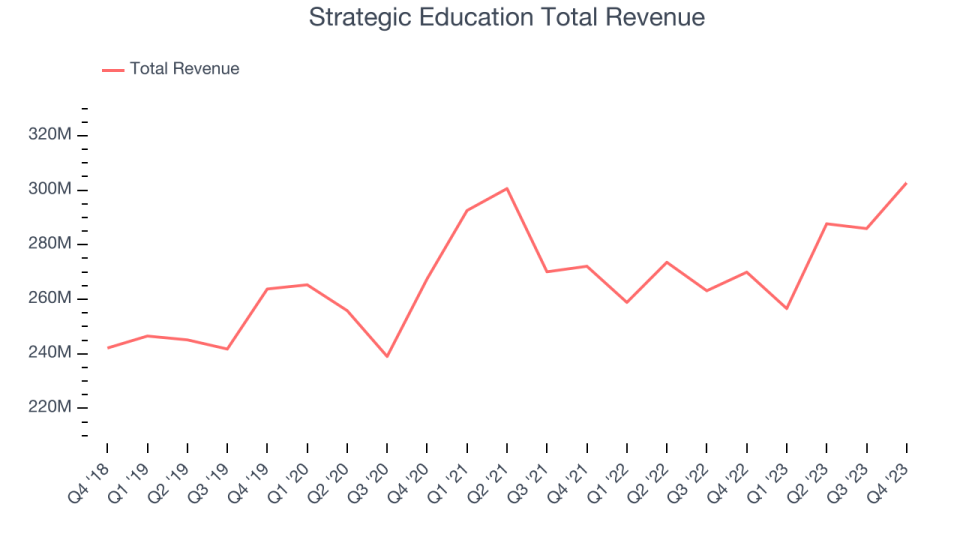

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Strategic Education's annualized revenue growth rate of 12.3% over the last five years was mediocre for a consumer discretionary business.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Strategic Education's recent history shines a dimmer light on the company as its revenue was flat over the last two years.

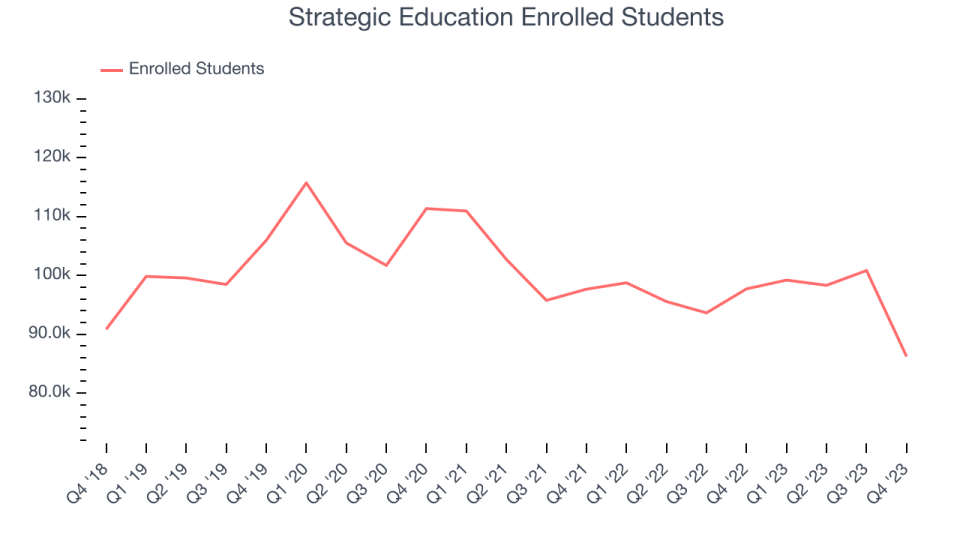

We can better understand the company's revenue dynamics by analyzing its number of enrolled students, which reached 86,233 in the latest quarter. Over the last two years, Strategic Education's enrolled students averaged 2.6% year-on-year declines. Because this number is lower than its revenue growth during the same period, we can see the company's monetization has risen.

This quarter, Strategic Education reported robust year-on-year revenue growth of 12.1%, and its $302.7 million of revenue exceeded Wall Street's estimates by 1.8%. Looking ahead, Wall Street expects sales to grow 4.8% over the next 12 months, a deceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

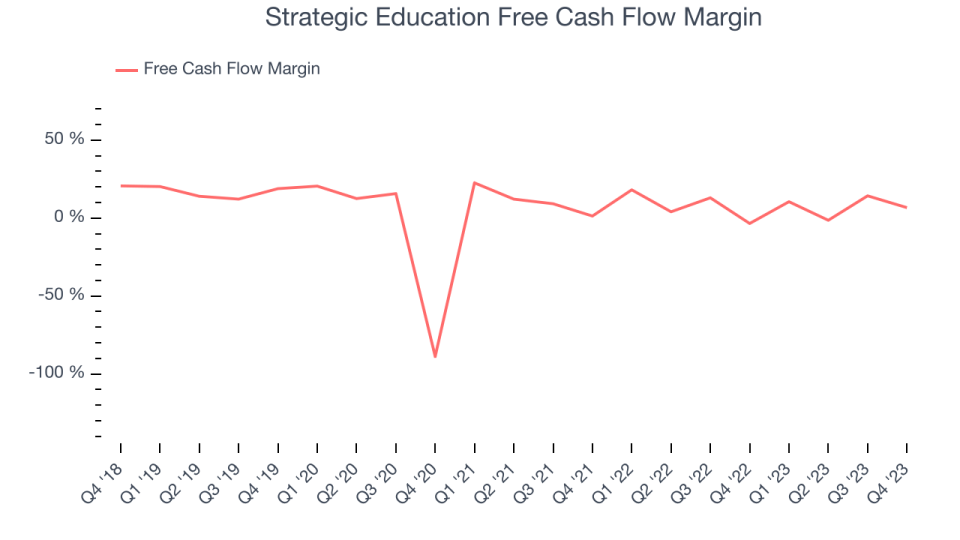

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Strategic Education has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 7.6%, subpar for a consumer discretionary business.

Strategic Education's free cash flow came in at $20.32 million in Q4, equivalent to a 6.7% margin. This result was great for the business as it flipped from cash flow negative in the same quarter last year to cash flow positive this quarter. Over the next year, analysts predict Strategic Education's cash profitability will improve. Their consensus estimates imply its LTM free cash flow margin of 7.4% will increase to 8.6%.

Key Takeaways from Strategic Education's Q4 Results

We were impressed by how significantly Strategic Education blew past analysts' operating margin expectations this quarter. We were also excited its EPS outperformed Wall Street's estimates. On the other hand, its number of enrolled students unfortunately missed. Overall, we think this was a really good quarter that should please shareholders. The stock is up 2.1% after reporting and currently trades at $97.24 per share.

Strategic Education may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.