Can Strategic Growth Efforts Aid Clorox (CLX) Amid High Costs?

The Clorox Company CLX looks well-positioned on the back of solid demand, cost-saving efforts, strong execution and pricing actions. Also, its IGNITE strategy and digital investments bode well.

This led to impressive fourth-quarter fiscal 2023, wherein the top and bottom lines beat the Zacks Consensus Estimate for the fourth straight quarter. Adjusted earnings of $1.67 per share surged 80% year over year. Net sales of $2,019 million rose 12% from the year-ago quarter. On an organic basis, sales improved 14%. The increase in sales was attributed to a favorable price mix, partly offset by lower volume and unfavorable currency.

Analysts also seem optimistic about the stock. The Zacks Consensus Estimate for Clorox’s fiscal 2023 sales and EPS is pegged at $7.5 billion and $5.87, suggesting respective growth of 1.4% and 15.3% from the year-ago reported figures. The Zacks Consensus Estimate for CLX’s fiscal 2024 earnings for the current financial year has moved up 3% in the past 60 days.

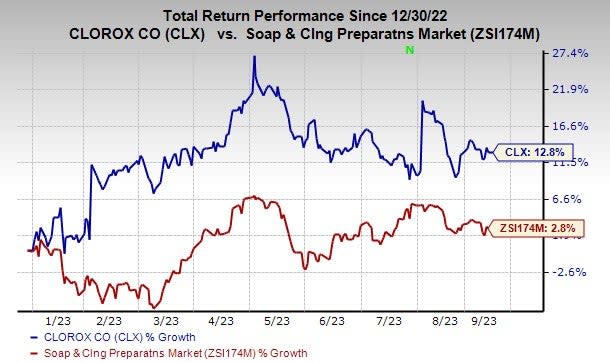

Consequently, shares of this Zacks Rank #3 (Hold) company have gained 12.8% year to date compared with the industry’s growth of 2.8%.

Image Source: Zacks Investment Research

Let’s Delve Deeper

Clorox is witnessing strong progress in the core International business as it continues to build on the success of the segment's Go Lean strategy. These efforts will help in accelerating profitable growth for the segment. Driven by its IGNITE Strategy, which aims to improve profitability in the International business, the company expects to invest selectively in profitable platforms.

Management continues to explore international opportunities, including the acquisition of a majority stake in its joint venture in the Kingdom of Saudi Arabia. The company believes that this acquisition is poised to boost long-term growth in the international segment.

In fourth-quarter fiscal 2023, sales of $305 million were up 4% year over year and beat our estimate of $297 million, driven by a 14-point gain from a favorable price mix, offset by a volume decline of 7 points and a 10-point impact from unfavorable currency. Organic sales for the segment improved 14%.

It is on track with the IGNITE strategy which mainly focuses on the expansion of the key elements under the 2020 Strategy to pace up innovation in each area of business. The IGNITE strategy encompasses the long-term financial targets of achieving net sales growth of 3-5%, an EBIT margin expansion of 25-50 bps and a free cash flow generation of 11-13% of sales.

Management announced a streamlined operating model to create a faster, simpler company through the Reimagine Work under its IGNITE strategy. The operating model implemented in the first quarter of fiscal 2023 will help increase efficiencies and transform the company's operations in the areas of the supply chain, digital commerce, innovation, brand building and more over the long term. The implementation of this new model is likely to be completed in fiscal 2024.

The company expected the operating model to generate ongoing annual savings of $75-$100 million, with benefits likely to occur starting fiscal 2023. Of this, the company expected $40-60 million or 30 cents per share to be recognized in fiscal 2023 under other income and expenses.

As announced in August 2022, Clorox began to implement a streamlined operating model in the first quarter of fiscal 2023. The streamlined operating model is expected to enhance the company's ability to respond more quickly to changing consumer behaviors, innovate faster and increase future cash flow as a result of cost savings that will be generated primarily in the areas of selling and administration, supply chain, marketing, and research and development.

Once fully implemented, the company expects cost savings of $75-$100 million annually. For fiscal 2023, year-over-year savings from this plan are likely to be $35 million compared with the previously stated $25 million.

Clorox previously announced plans to invest $500 million in the next five years in transformative technologies and processes. The investments began in the first quarter of fiscal 2022, and include the replacement of the company's enterprise resource planning (ERP) system, its transition to a cloud-based platform and the implementation of a suite of other digital technologies.

For fiscal 2024, the company envisions sales to be flat to up 2% year over year, in sync with our estimate of 0.6%. Organic sales are anticipated to increase 2-4% compared with our estimate of 2.6%.

The company expects diluted earnings of $4.65-$4.95 per share for fiscal 2024. The guidance suggests a year-over-year increase of 290-315%. On a non-GAAP basis, earnings per share are anticipated to be $5.60-$5.90, suggesting growth of 10-16% from the year-ago period’s reported number and in sync with our estimate of $5.71. This is mainly attributable to robust margins and robust top-line growth amid a challenging economy.

Headwinds to Overcome

Clorox has been reeling under the adverse impacts of inflation, higher manufacturing, logistics and commodity costs. In fourth-quarter fiscal 2023, Clorox’s selling and administrative expenses rose 35% year over year to $329 million. The metric, as a percentage of sales, expanded 280 bps from the prior-year figure at 16.3%, attributable to investments to enhance digital capabilities.

Going into fiscal 2024, management expects selling and administrative expenses to be 15-16% of sales, including 1.5 points of impact from its strategic investments in digital capabilities and productivity enhancements. Clorox anticipates advertising and sales promotion spending to be 11% of sales, driven by its commitment to investing in its brand portfolio. For fiscal 2024, management earlier expected supply-chain inflation of $200 million.

Conclusion

Although cost inflation is a near-term headwind, Clorox is well-placed on the back of solid demand, cost-saving efforts, pricing actions, the IGNITE strategy and digital investments. Topping it, a VGM Score of B and a long-term earnings growth rate of 11.8% speak volumes.

Stocks to Consider

Flowers Foods FLO emphasizes providing high-quality baked items. The company currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 2.3%.

You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

The Zacks Consensus Estimate for Flowers Foods’ current financial-year sales suggests growth of 6.7% from the year-ago period’s actual. FLO has a trailing four-quarter earnings surprise of 7.6% on average.

The J. M. Smucker Company SJM, which manufactures and markets branded food and beverage products, currently carries a Zacks Rank of 2. SJM has a trailing four-quarter earnings surprise of 14% on average.

The Zacks Consensus Estimate for The J. M. Smucker’s current financial-year earnings suggests growth of 6.8% from the year-ago reported figure.

Utz Brands Inc. UTZ manufactures a diverse portfolio of salty snacks, carrying a Zacks Rank #2. UTZ’s expected EPS growth rate for three to five years is 11.4%.

The Zacks Consensus Estimate for Utz Brands’ current fiscal-year sales suggests growth of 3.7% from the year-ago reported number. UTZ has a trailing four-quarter earnings surprise of 12.3% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

The Clorox Company (CLX) : Free Stock Analysis Report

The J. M. Smucker Company (SJM) : Free Stock Analysis Report

Flowers Foods, Inc. (FLO) : Free Stock Analysis Report

Utz Brands, Inc. (UTZ) : Free Stock Analysis Report