Can Strategic Pricing Augment Boston Beer's (SAM) Positioning?

The Boston Beer Company, Inc. SAM has been benefiting from its continued focus on pricing, product innovation, growth of non-beer categories alongside brand development. The company has maintained a premium positioning in the market through strategic pricing actions to reflect the craft beer experience it offers. It benefited from strong price realization and procurement savings in third-quarter 2023, which more than offset increased inflationary costs.

Boston Beer’s third-quarter 2023 top and bottom lines beat the Zacks Consensus Estimate and improved year over year. The performance mainly reflected strong growth in Twisted Tea and Hard Mountain Dew brands, offset by continuing challenges in Truly, Angry Orchard, Samuel Adams and Dogfish Head brands.

Despite the strong performance, the company anticipates soft volume trends for the fourth quarter. Consequently, it provided an adverse volume view for 2023 and lowered the earnings per share guidance.

Nonetheless, the company’s focus on improving the Truly brand trends through a renewed focus on the core business, smart brand innovation, and strong distributor support and retail execution bodes well. Its advancement in the non-beer categories, including ciders and hard seltzer, should continue to drive progress.

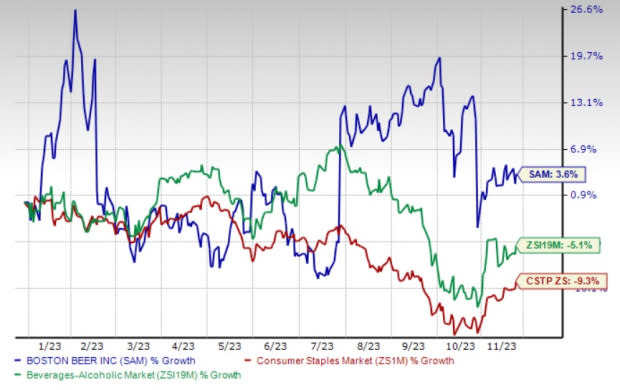

Shares of Boston Beer have risen 3.6% in the year-to-date period against the industry and the Consumer Staples sector’s declines of 5.1% and 9.3%, respectively.

The Zacks Consensus Estimate for the Zacks Rank #3 (Hold) company’s current financial year’s earnings suggests growth of 4.4% from the year-ago period’s reported number.

Image Source: Zacks Investment Research

Pricing & Other Actions to Drive Growth

Boston Beer has long been a key player in the craft beer revolution. In recent years, the company has implemented strategic pricing actions that have boosted its position in the competitive landscape. Craft beer enthusiasts are known for their willingness to pay a premium for unique and high-quality brews. Boston Beer has leveraged this consumer mindset by strategically pricing its products to reflect the craft beer experience it offers.

The company is optimistic about continued pricing gains in the near term. It estimates price increases of 2-3% for 2023 versus 1-3% growth mentioned previously. It anticipates positive price realization in the fourth quarter but at a lower level due to lower third-quarter price increases from the prior year.

SAM's focus on innovation to revive the Truly brand and expand Twisted Tea’s potential bodes well. Boston Beer is keen on bringing excitement to the Truly brand’s core flavors through innovation. The company expects to improve Truly brand trends through a renewed focus on core business, smart brand innovation, and strong distributor support and retail execution. The company's Truly flavored bottle Vodka and Truly Vodka Seltzer have been performing well.

Coming to Twisted Tea, the brand drove most growth of Boston Beer in the third quarter. Being one of the fastest-growing brands, Twisted Tea rose in the double-digits and emerged as the number one in FMB in 2022 by increasing 3 share points.

Improved geographic, channel and package distribution; effective brand-building campaign; increased media investment; and optimized packaging design have been aiding the performance of the Twisted Tea brand. Its growing brand awareness and household penetration also bode well. The company further expanded its light portfolio offerings with a new variety pack available in select highly developed markets, and has received positive feedback for the same.

SAM recently announced the testing of the higher ABV version of Twisted Tea, called Twisted Tea Extreme, in select markets this summer. Consequently, the brand is likely to witness strong double-digit growth for the remainder of 2023.

We note that Boston Beer has made successful innovations in craft beer, and hard cider and iced tea categories over the years. The company is on track with growth of its Beyond Beer category, wherein it currently holds the second position. Beyond Beer is growing faster than the traditional beer market. The company expects the trend to continue for the next several years.

For 2023, management envisions GAAP earnings per share of $6.00-$10.00 for 2023, whereas it reported $5.44 in the prior year.

Headwinds to Overcome

Boston Beer has been witnessing a slowdown in the hard seltzer category and the demand for the Truly brand in recent quarters. The slowing hard seltzer trends hurt the company’s depletions to some extent in third-quarter 2023.

The hard seltzer category witnessed a continued decline in the third quarter. The hard seltzer category’s decelerating trend has mainly been attributed to the loss of novelty among consumers due to the entry of several beyond-beer products in the marketplace. Additionally, the decline has resulted from the ongoing dismal macroeconomic environment, which has caused a volume shift from hard seltzers back to premium light beers due to their lower pricing.

For 2023, the company expects overall volumes to decline due to continued weakness in Truly volume, which is expected to partly offset strong growth in Twisted Tea. Depletions and shipments are expected to decline 5-7% compared with a dip of 2-8% stated earlier. This view includes the adverse impact of 1% due to an additional 53rd week in 2022, while 2023 will have 52 weeks.

On a 52-week comparable basis, the company expects depletions and shipments to decline 4-6% compared with a dip of 1-7% stated earlier. The 53rd week is likely to negatively impact the fourth-quarter volume trends by 6%.

Stocks to Consider

We highlighted some better-ranked stocks from the broader Consumer Staples space, namely Molson Coors TAP, Dutch Bros BROS and Fomento Economico Mexicano FMX.

Molson Coors is a global manufacturer and seller of beer and other beverage products. It currently has a Zacks Rank #1 (Strong Buy). TAP has a trailing four-quarter earnings surprise of 41.3%, on average. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Molson Coors’ current financial-year sales and earnings per share suggests growth of 9.1% and 28.8%, respectively, from the year-ago period’s reported figures.

Dutch Bros is an operator and franchisor of drive-thru shops that focus on serving high-quality, hand-crafted beverages with unparalleled speed and superior service. BROS has a trailing four-quarter earnings surprise of 57.1%, on average.

The Zacks Consensus Estimate for Dutch Bros’ current financial-year sales and earnings suggests growth of 30.6% and 75%, respectively, from the year-ago period's reported figures. It currently sports a Zacks Rank #1.

Fomento Economico Mexicano, alias FEMSA, operates as a bottler of Coca-Cola trademark beverages. FMX currently has a Zacks Rank #2 (Buy). FEMSA has a trailing four-quarter earnings surprise of 23.2%, on average.

The Zacks Consensus Estimate for FEMSA’s current financial-year sales and earnings suggests growth of 32.3% and 60.3%, respectively, from the year-ago period’s reported figures.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Molson Coors Beverage Company (TAP) : Free Stock Analysis Report

The Boston Beer Company, Inc. (SAM) : Free Stock Analysis Report

Dutch Bros Inc. (BROS) : Free Stock Analysis Report