Strategic Value Investing: Patience Pays Off

"Do you have what it takes to control the urges that get other people into trouble when investing?"

Now it's about you. In previous chapters of "Strategic Value Investing: Practical Techniques of Leading Value Investors," authors Stephen Horan, Robert R. Johnson and Thomas Robinson examined value investing through the lens of fundamental analysis. In other words, it was all about the companies (and in some cases, the industries and economic environment).

In chapter 13, the authors asked us to turn the lens on ourselves. Their temperament profile takes in three aspects of personality: patience, regret aversion and attitude toward risk.

To help you determine if you have enough patience, they had a couple of questions:

Do you check your investment statements quite often? Do you have an emotional reaction when the prices of your stocks go up and down?

Do you think you made a mistake if a stock price goes down soon after you buy? As the authors said, a true value investor considers a price drop an opportunity.

Being able to respond appropriately to these questions is essential because value investing, by its nature, demands a lot of patience. Yet, if you have the patience, you should be rewarded.

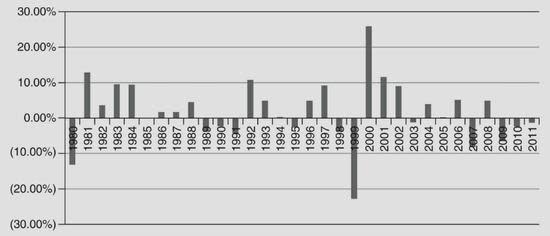

For example, between 1980 and 2011, the Russell 2000 Value Index averaged an annual return of 14%, handily beating the Russell 2000 Index at 12.1%. But to get that return from the Value Index, you had to remain patient through three periods when it underperformed the regular index: 1989 to1991, 1998-99 and 2009 to 2011. This chart from the book shows the returns after the Russell 2000 is subtracted from the Russell Value:

The authors noted that periodically there are death announcements for value investing. That happened in the late 1990s as the dot-com bubble frothed. Then, and at other times, we were told the investing paradigm had been reinvented and that value investing would soon be dead.

The value investors who remained patient knew, of course, that those hot technology stocks were seriously overvalued, that there was little intrinsic value based on earnings power. As it turned out, "This time it's different" was not different after all, and those who believed in the mantra watched in disbelief as their fortunes were savaged.

In the short term, some investors did do well; as the authors observed, "It is psychologically very difficult to remain true to your value investing convictions when day after day, it seems, investors speculating in the latest fad are being rewarded." However, they wrote, "Successful value investors have to have a psychological makeup that will allow them to withstand these extended periods of underperformance and have the courage of their convictions that they will eventually be vindicated in the long run."

A classic case was that of Warren Buffett (Trades, Portfolio) and his skeptics. The authors highlighted a Barron's cover story at the end of 1999; the title asked, "What's Wrong, Warren?" Buffett had not bought into the tech sector and the article accused him of failing to adapt to the market, of being unable to "advance his thinking."

As we all know in hindsight, Buffett's resistance to the allure of the booming tech sector stood him in excellent stead with Berkshire Hathaway (NYSE:BRK.A)(NYSE:BRK.B) investors. Sticking to his "circle of competence" saved them a great deal of money.

The authors followed up by reminding readers of Benjamin Graham's character, Mr. Market, and that he does not correct bad valuations right away. This long wait can ruin the careers of professional money managers, who are expected to meet investors sometimes unrealistic expectations every quarter. They wrote, "There are many tales of prominent value investors who were absolutely correct in the long run, but never got to realize that success because their investors were impatient and withdrew funds from them."

Individual investors do not face that challenge. They can wait as long they like for mispricings to correct themselves- if they have patience. That takes us back to the two tests set out above:

Do you check your investment returns quite frequently, and do you respond emotionally when you see your stocks or your portfolio moving up or down?

Do you kick yourself if you buy a stock and then see its price drop right afterward? Or do you see this as an opportunity?

If you answered "Yes" to one or both of those questions, all is not lost. While some aspects of our psychological limitations are hard to change, patience is something we can work to improve. And there is an incentive; the authors provided this quotation from Buffett: "Success in investing doesn't correlate with I.Q. once you're above the level of 125. Once you have ordinary intelligence, what you need is the temperament to control the urges that get other people into trouble in investing."

Knowing your own personality will also help you choose which valuation models will work best for you. According to the authors, some styles work better with dividend discount models, while others are better suited to cash flow models.

Conclusion

Value investing has outperformed other strategies in building wealth over the long term. But to make the most of the value approach, patience is needed.

During the dot-com expansion, for example, it was difficult to see other investors apparently enjoying success in hot tech stocks. Patient investors like Buffett were sometimes scorned for their failure to exploit the new opportunities, at least until the bubble burst.

If you can develop the patience to wait through value slumps, you should enjoy above-average returns, in part, by avoiding "the urges that get other people into trouble."

Disclosure: I do not own shares in any company listed, and do not expect to buy any in the next 72 hours.

Read more here:

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.