Strategies Bode Well for Waste Management (WM) Amid Seasonality

Waste Management, Inc. WM is gaining from continuous improvement and a focused differentiation strategy. The growing environmental awareness and adoption of advanced recycling and waste management techniques are boding well for the company. However, seasonality woes pertain.

Waste Management reported impressive first-quarter 2023 results, wherein both earnings and revenues surpassed the respective Zacks Consensus Estimate. Adjusted earnings per share (excluding 1 cent from non-recurring items) of $1.31 beat the consensus estimate by 3.2% and improved 1.6% year over year. Total revenues of $4.89 billion surpassed the consensus estimate by 1% and increased 5% year over year.

Current Situation of Waste Management

Increasing awareness of the environment, rapid industrialization and an expected rise in non-hazardous waste as a result of rapid economic growth are creating scope for Waste Management to grow in the upcoming years. Per a report from allied market research, the global waste management market is expected to reach $2,483.0 billion by 2030 from $1,612.0 billion in 2020, witnessing a CAGR of 3.4% from 2021 to 2030. The company uses advanced waste collection and recycling techniques which are expected to help the company to reap the benefits of such favorable conditions.

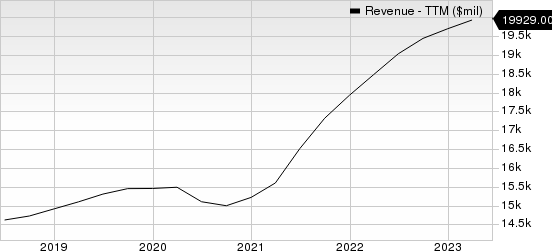

Waste Management, Inc. Revenue (TTM)

Waste Management, Inc. revenue-ttm | Waste Management, Inc. Quote

Waste Management is applying a focused differentiation strategy along with targeting continuous improvement. The combination of the two initiatives is one of the foremost catalysts of the company’s growth. This instills price and cost disciplines thereby enabling WM to get better financial results. The company also enjoys a favorable liquidity position indicating it might not face difficulties meeting its short-term debt obligations. Waste Management's current ratio at the end of first-quarter 2023 was pegged at 0.87, higher than the prior-year quarter’s figure of 0.80.

The company has been gaining from its shareholder-friendly approach and its commitment to return value to its shareholders. It has been a regular dividend payer and remains consistent with its share repurchases. In 2022, 2021 and 2020, the company repurchased shares worth $1.5 billion, $1.35 billion and $402 million, respectively. It paid $1.1 billion, $970 million and $927 million in dividends in 2022, 2021 and 2020, respectively.

Some Concerning Points

Seasonality causes considerable fluctuations in Waste Management's revenues. Revenues in the first and fourth quarters are significantly lower than the second and third quarters.

Waste Management operates in a highly competitive industry with pressures emanating from national, regional and local companies. Counties and municipalities are particularly a threat to the company's market share as these maintain their own waste collection and disposal activities and benefit from the availability of tax revenues and tax-exempt financing.

Zacks Rank and Stocks to Consider

WM currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.5% year over year to $339.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 2.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently sports a Zacks Rank of 1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Waste Management, Inc. (WM) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report