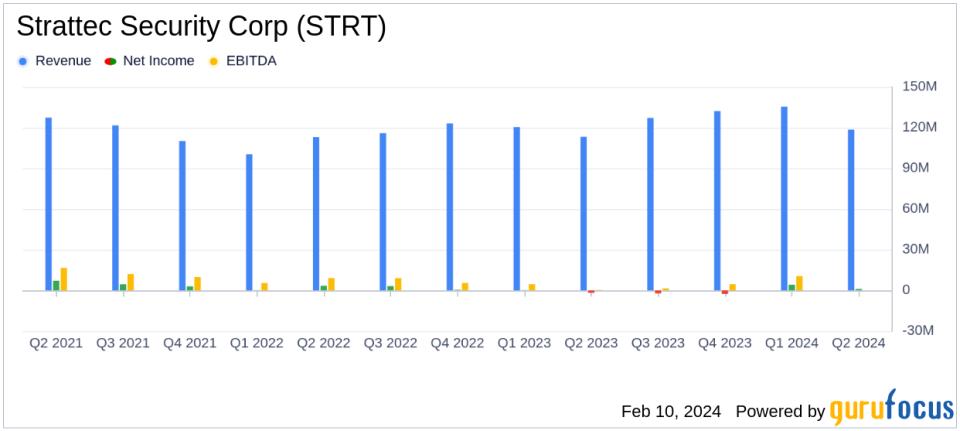

Strattec Security Corp (STRT) Posts Positive Earnings in Fiscal Q2 2024, Reversing Prior Losses

Net Sales: Increased to $118.5 million from $113.2 million in the prior year.

Gross Profit: More than doubled to $13.5 million, with gross margin improving to 11.4%.

Operating Income: Turned positive at $58 thousand, a significant improvement from a $4.7 million loss.

Net Income: Reported at $1.0 million, compared to a $1.8 million loss in the previous year.

Diluted Earnings Per Share (EPS): Increased to $0.26, up from a $0.47 loss per share.

Cash Flow: Operating activities resulted in a cash use of $3.0 million due to temporary increases in working capital.

Balance Sheet: Ended the quarter with $11.6 million in cash and cash equivalents and total debt of $13.0 million.

On February 8, 2024, Strattec Security Corp (NASDAQ:STRT) released its 8-K filing, detailing the financial results for the second quarter of fiscal year 2024. The company, a leader in providing "Smart" Vehicle Power Access and Electronic and Security Solutions, has shown a remarkable turnaround from the previous year's losses, posting positive net income and earnings per share.

Company Overview

Strattec Security Corp designs and manufactures a range of access control products for the automotive industry, including mechanical and electronic locks, ignition lock housings, and various power access systems. The company serves a global market, with operations spanning North America, Europe, South America, and Asia, and offers aftermarket support. Strattec also caters to heavy truck and recreational vehicle markets, as well as providing precision die castings.

Financial Performance and Challenges

The company's net sales saw an increase, primarily due to pricing increases to major customers, which amounted to $8.0 million. However, this was partially offset by a $2.7 million decline in net sales, attributed to lower sales to a major customer and the impact of the UAW strike on the U.S. auto industry. Despite these challenges, Strattec managed to improve its gross margin significantly, which rose from 6.5% to 11.4%. This improvement was driven by the pricing increases, lower raw material costs, higher production levels, and efficiencies from Mexican operations.

However, the company faced headwinds in the form of higher supplier costs, unfavorable currency exchange rates, mandatory wage increases in Mexico, and increased freight costs. These factors, along with one-time costs associated with the retirement of the former CEO and higher development expenses for new products, impacted the operating expenses, which increased by $1.4 million.

Financial Achievements and Importance

Despite the challenges, Strattec's financial achievements are notable. The company's ability to turn a net loss into a net income of $1.0 million is significant, especially in the competitive and volatile automotive industry. The improvement in gross margin is a testament to the company's operational efficiency and pricing strategy. These achievements are crucial as they demonstrate Strattec's resilience and adaptability in a challenging market environment.

Analysis of Financial Statements

The balance sheet reflects a strong financial position with $11.6 million in cash and cash equivalents. The total debt remained manageable at $13.0 million, all of which is held by the ADAC-STRATTEC LLC joint venture. The cash flow from operations was negative $3.0 million, a decrease from the previous year, mainly due to temporary increases in working capital. Capital expenditures were reduced to $1.5 million from $4.8 million in the prior year, indicating a more cautious investment approach.

"This quarter demonstrated the progress we are making in improving our financial performance. It also highlighted opportunities to optimize our working capital and strong balance sheet. We intend to take advantage of a more predictable supply chain to bring greater efficiencies to our operations. Looking forward, we will focus on new product introductions that will expand STRATTECs offerings to our customers," said STRATTEC Interim CEO Rolando Guillot.

The company's focus on new product introductions and operational efficiencies is expected to drive future growth and enhance shareholder value. The appointment of F. Jack Liebau, Jr. as Chairman of the Board and Harold M. Stratton II as Vice Chairman is also anticipated to strengthen governance policies and focus on long-term shareholder returns.

For value investors and potential GuruFocus.com members, Strattec Security Corp's latest earnings report presents a company on the rebound, with improved financial metrics and a clear strategy for future growth. The company's commitment to innovation and operational efficiency, coupled with a solid balance sheet, positions it well in the competitive automotive industry.

For more detailed financial analysis and up-to-date information on Strattec Security Corp (NASDAQ:STRT) and other value investment opportunities, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Strattec Security Corp for further details.

This article first appeared on GuruFocus.