Stride's (LRN) MedCerts Unveils Healthcare Courses via Coursera

MedCerts, a subsidiary of Stride, Inc. LRN, partnered with the online learning platform Coursera to launch its healthcare courses for learners around the world.

Of these courses, the new, beginner-level Specialization program in Medical Billing and Coding is now available to the more than 124 million registered learners on Coursera. LRN plans to introduce many other courses that will be completed in a matter of weeks and will incorporate MedCerts’ 12 Elements of eLearning in a digestible, accessible format.

Being an innovation leader in online career training in allied health and information technology, MedCerts has helped more than 55,000 students earn credentials and start new careers in these in-demand fields. It has also developed approximately 50 emerging online national certification training programs.

Recently, MedCerts joined Mason Center for the expansion of the healthcare education program in Tennessee.

LRN is highly focused on its business expansion strategy, especially in the healthcare division. Per the U.S. Bureau of Labor Statistics, employment in the healthcare sector is expected to grow by 13% from 2021 to 2031.

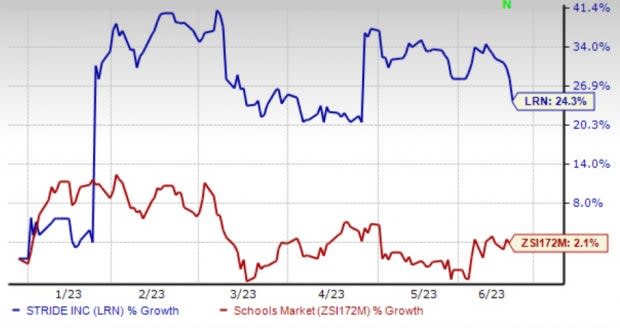

Stride’s Price Performance

Shares of Stride have risen 24.3% in the year-to-date period compared with the Zacks Schools industry’s growth of 2.1%.

Image Source: Zacks Investment Research

Stride is witnessing consistent strength in its Career Learnings segment, thanks to its growth strategy. In third-quarter fiscal 2023, total enrollment in this segment grew 60% from the prior-year quarter to 67,200 students. Also, enrollment in the General Education segment witnessed sequential growth of 3.1% to 114,600 students in the reported quarter, backed by the sustained demand for virtual options in the K-12 space.

In third-quarter fiscal 2023, total revenues of Stride were $470.3 million compared with $421.7 million in the year-ago period, courtesy of continued enrollment strength, an increase in revenue per enrollment and Adult Learning growth. Considering the growth momentum, the company increased its fiscal 2023 revenue guidance in the range of $1.805-$1.825 billion, up from the previous guidance of $1.775-$1.815 billion.

Zacks Rank & Key Picks

LRN carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the Zacks Consumer Discretionary sector include Royal Caribbean Cruises Ltd. RCL, Skechers U.S.A., Inc. SKX and Crocs, Inc. CROX.

Royal Caribbean Cruises presently sports a Zacks Rank #1. RCL has a trailing four-quarter earnings surprise of 26.4%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for RCL’s 2023 sales and earnings per share (EPS) indicates a rise of 48.5% and 162.8%, respectively, from the year-ago period’s levels.

Skechers currently sports a Zacks Rank #1. SKX delivered a trailing four-quarter earnings surprise of 18.8%, on average.

The Zacks Consensus Estimate for SKX’s 2023 sales and earnings per share (EPS) indicates a rise of 7.8% and 31.9%, respectively, from the year-ago period’s levels.

Crocs currently carries a Zacks Rank #2 (Buy). CROX has a trailing four-quarter earnings surprise of 19.6%, on average.

The Zacks Consensus Estimate for CROX’s 2023 sales and EPS indicates a rise of 13.2% and 5.7%, respectively, from the year-ago period’s levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Royal Caribbean Cruises Ltd. (RCL) : Free Stock Analysis Report

Skechers U.S.A., Inc. (SKX) : Free Stock Analysis Report

Crocs, Inc. (CROX) : Free Stock Analysis Report

Stride, Inc. (LRN) : Free Stock Analysis Report