Strong Margins, AI Tools Make Wix a Compelling Pick

With interest rates rising, it has become increasingly difficult for tech companies to grow using the growth-at-all-cost model. Investors are being very picky with the companies they invest in while punishing companies that show no discipline in their expenses.

Over the past months, companies have learned to pivot to newer cost models to survive in high-rate environments by reigning in their expenses while growing their businesses.

Wix.com Ltd. (NASDAQ:WIX) is one such company that has very quickly adapted to the current economic environment while gaining significant market share, showing promising signs of the new era of tech companies that can grow even at high interest rates.

About Wix

Wix is a leading global cloud-based web development platform for millions of users and creators all around the world. The company operates a freemium business model, offering code-free website building solutions for creators to create their digital presence online. Wix's website builder tool is used by creators to build websites such as personal blogs, online forums, e-commerce sites and much more.

According to market research by Statista, Wix is the leading website builder solution by volume of registered users, with a 43% global market share for web development platforms.

Wix derives all its revenue from a combination of subscriptions and solution revenue. Approximately three-fourths of its revenue comes from Creative Subscriptions sold to users who subscribe to its SaaS platform to build websites. The rest of the revenue comes from selling Business Solutions and third-party apps such as Wix Payments Solutions, Google Workspace and Online Ad Campaigns.

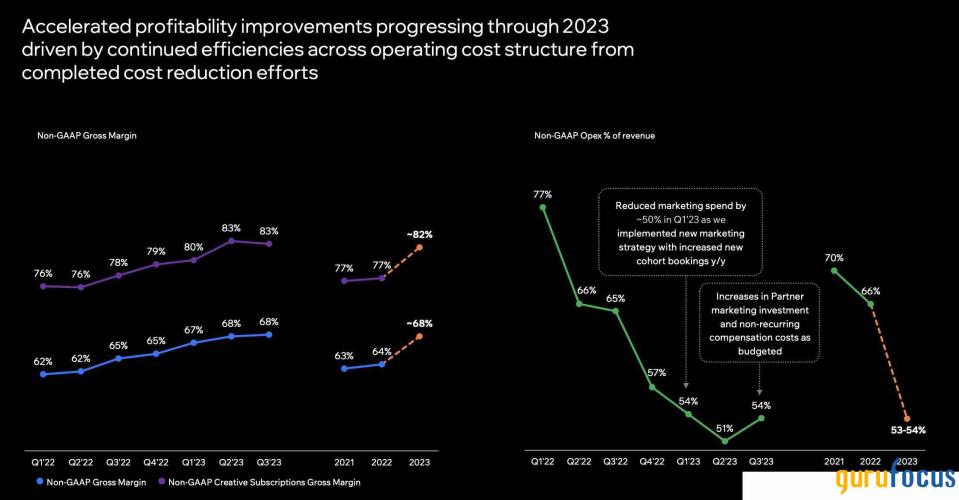

Significant margin improvements driving profitability

In the past year, Wix has shown thoughtful urgency in turning around its cost profile and reducing expenses. And the results have started to show as the company's gross margins have begun turning up again.

The company has been focusing on cost efficiencies in three areas to improve its margins across the board.

First is the launch and adoption of Wix Payments. More creators and agencies are turning to the company's website-building tools to create e-commerce websites and online stores. The increase in e-commerce websites on its platform has led to Wix launching its own Wix Payment solutions, giving it the opportunity to collect economic rent per transaction. Per its own support page, Wix's take rate can be 2.5% on average for card transactions, lower than the 2.9% rate Stripe and other payment processors charge, giving many Wix users a compelling reason to switch to Wix Payments. This could be another avenue for the company to collect higher-margin revenue.

The second area is cloud infrastructure and web hosting cost benefits. Wix has been able to successfully renegotiate its cloud infrastructure contracts with Google Cloud. These savings will continue to drive improvements in gross margins over the next few quarters.

The third and final area of focus is reducing customer care costs. Wix has started reducing the overhead from customer care teams by making them leaner. Part of this was the introduction of more internal tools to help the teams and the introduction of artificial intelligence solutions to help customers in their website-building journey.

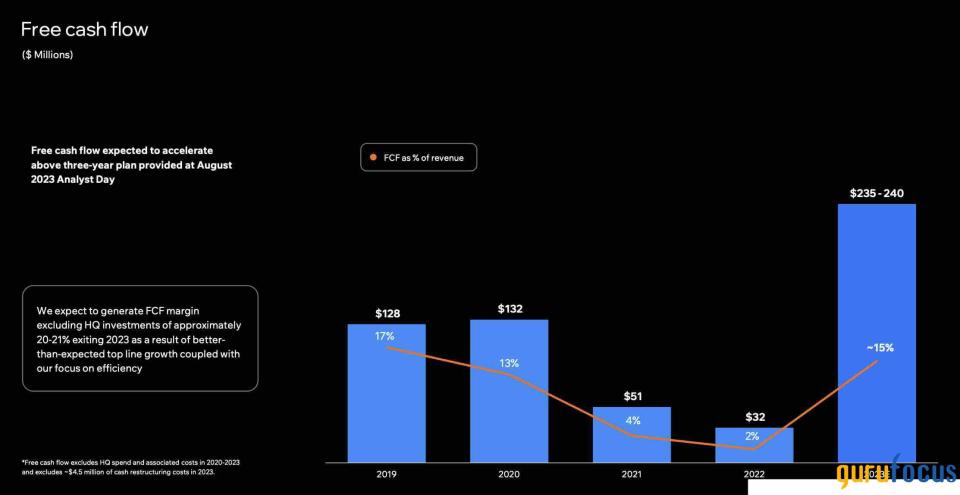

Higher profitability projected to drive record free cash flow margins

Wix is reaping the benefits of its focus on driving cost efficiencies, with high profitability driving record free cash flow margins. As per the company's own forecasts, it is projected to achieve about 15% FCF margins in 2023 after diminishing margins for the past few years, as can be seen in the chart below.

However, the highlight of Wix's FCF performance so far in 2023 is that much of the operating cash flows are being driven by higher operating margins, which are now averaging 1.3% for the first nine months of the year. This means the company is relying less on stock-based compensation to boost its operating cash flow.

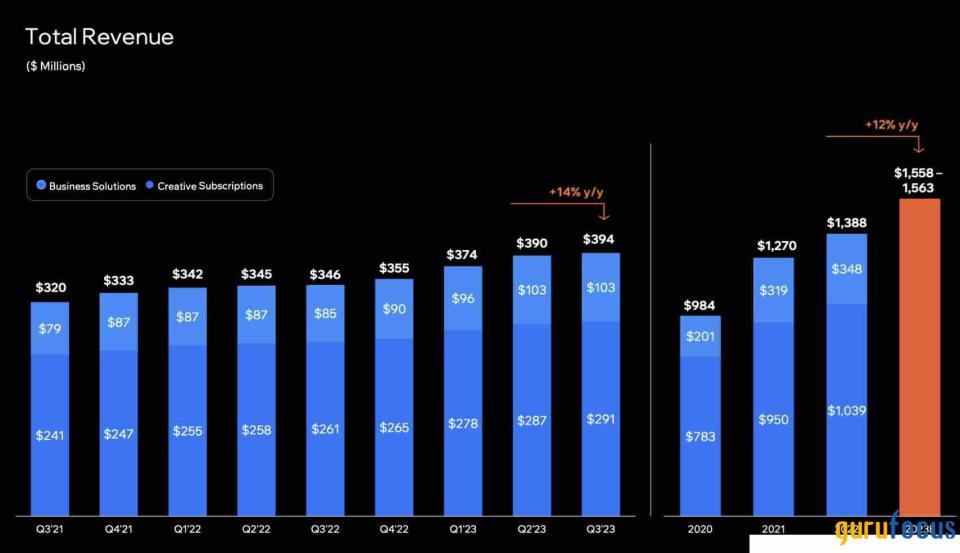

Growth story remains intact

After laying out its targets for fiscal 2023 and beyond at the start of this year, the company has pleasantly surprised many analysts on Wall Street with the momentum in its business.

The Israel-based company has outperformed on all fronts and raised its financial targets in all three earnings calls this year so far. Its main growth engine, Creative Subscriptions, is continuing to expand as more users subscribe to Wix's drag-and-drop web-building services. These catalysts are crucuial in keeping it on track to achieve record revenues this year, as can be seen in the chart below.

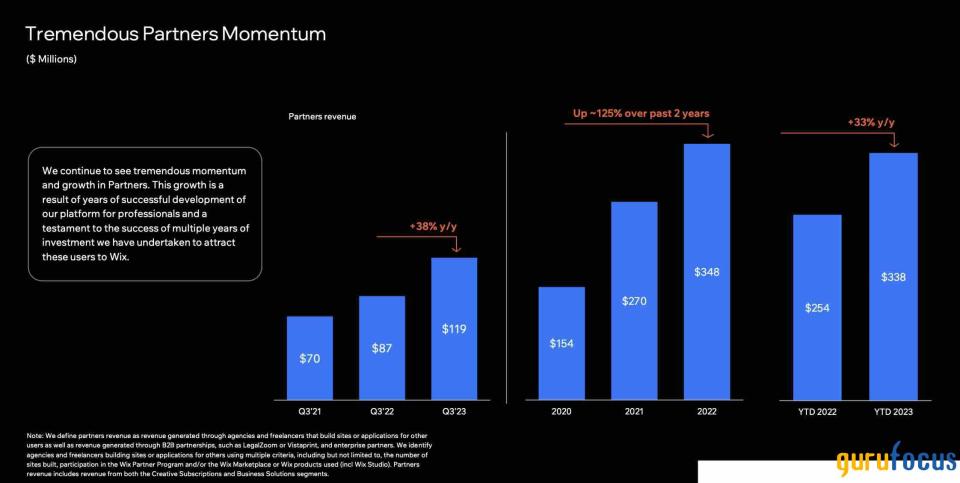

Wix has also been very creative in extending its user base to other categories and has partnered with creative agencies' clients in building out websites for them. This has started to increase revenue for the company while reducing marketing costs, as can be seen in the chart below.

Competition

While Shopify (NYSE:SHOP) and Squarespace (NYSE:SQSP) are other major players in the web development and e-commerce domain, Wix's valuation and margins give it a strong competitive advantage.

For example, while Shopify's forward price-earnings ratio of 73 is sure to cause a nosebleed for some, Squarespace is still more expensive, trading at a forward price-earnings ratio of 31 compared to Wix's forward price-earnings of 23. Wix's forward price-earnings ratio is closer to the S&P 500's forward earnings multiple of 18.9 and suggests it is undervalued as compared to Shopify and Squarespace.

Conclusion

Expanding margins, aided by strong growth in its business coupled with growing free cash flow, have turned Wix into a formidable stock. AI tools and product differentiation are also driving acceleration in the company's web development business, sure enough to increase productivity and boost margins further.

Wix is definitely a buy at these levels. At today's price levels of $112, I see more room for upside given its advantages.

This article first appeared on GuruFocus.