Will Strong Production Drive Murphy Oil's (MUR) Q2 Earnings?

Murphy Oil Corporation MUR is slated to report second-quarter 2023 financial results on Aug 3 before market open. The company delivered an earnings surprise of 30.5% in the last reported quarter.

Let’s discuss the factors that are likely to have impacted the quarterly performance.

Factors to Consider

Murphy Oil’s low-cost multi-basin portfolio provides optionality in all price environments and is likely to have benefited the company amid fluctuating commodity prices.

Production volume in the second quarter is expected to remain strong in Eagle Ford Shale and Tupper Montney, as 10 operated wells in Eagle Ford Shale and 5 operated wells in Tupper Montney pressed in service during the first quarter. More wells came online during the second quarter in these regions, further boosting production volumes. Murphy Oil’s Samurai #5 well was operational in the Gulf of Mexico, which will also contribute to second-quarter production volumes.

Despite strong production volumes, a drop in realized prices of commodities compared with the previous year’s quarter might have adversely impacted the second quarter’s earnings.

Expectations

The Zacks Consensus Estimate for second-quarter 2023 net Crude oil and condensate production is 97,840 barrels per day, while the company expects its oil production volume for the quarter to be 95,000 barrels per day. The major oil production for the quarter is expected to come from the Gulf of Mexico region.

Murphy Oil anticipates second-quarter natural gas production to be 428.1 million cubic feet per day (MMCFD), while the Zacks Consensus Estimate for the quarter is 425.63 MMCFD. Murphy expects its Tupper Montney assets in Canada to contribute a major portion of natural gas production, with an expected production volume of 320 MMCFD in the second quarter.

What Our Quantitative Model Predicts

Our proven model does not conclusively predict an earnings beat for Murphy Oil this time. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is not the case here, as you will see below.

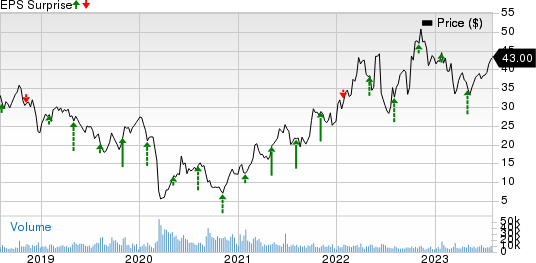

Murphy Oil Corporation Price and EPS Surprise

Murphy Oil Corporation price-eps-surprise | Murphy Oil Corporation Quote

Earnings ESP: Murphy Oil has an Earnings ESP of -2.22%. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: MUR currently carries a Zacks Rank #3.

Stocks to Consider

Investors can consider the following players from the same sector that have the right combination of elements to beat on earnings this reporting cycle.

Pembina Pipeline Corporation PBA is likely to deliver an earnings surprise when it posts second-quarter earnings on Aug 3, 2023, after market close. PBA has an Earnings ESP of +1.48% and a Zacks Rank #2. You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for PBA’s 2023 earnings implies a year-over-year decline of 23.2%.

Enbridge Inc. ENB is likely to deliver an earnings surprise when it reports second-quarter earnings on Aug 4, 2023. ENB has an Earnings ESP of +0.78% and currently has a Zacks Rank #3.

The Zacks Consensus Estimate for 2023 earnings of ENB suggests a year-over-year increase of 0.93%.

Cactus Inc. WHD is likely to deliver an earnings surprise when it posts second-quarter earnings on Aug 7, 2023, after market close. WHD has an Earnings ESP of +3.97% and a Zacks Rank #3.

The Zacks Consensus Estimate for PBA’s 2023 earnings implies year-over-year growth of 40.8%.

Stay on top of upcoming earnings announcements with the Zacks Earnings Calendar.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Murphy Oil Corporation (MUR) : Free Stock Analysis Report

Enbridge Inc (ENB) : Free Stock Analysis Report

Pembina Pipeline Corp. (PBA) : Free Stock Analysis Report

Cactus, Inc. (WHD) : Free Stock Analysis Report