Strong Team Aids Charles River (CRAI) Amid Currency Risks

CRA International, Inc., which conducts business as Charles River Associates CRAI is benefiting from itsglobal presence and strong professional team which enables it to provide high-quality consulting services.

In the past year, CRA International has outperformed the consulting services industry, growing 15.4%, compared with its industry’s 11.5% increase and 14.6% growth of the S&P 500 composite.

CRA International, Inc., reported mixed first-quarter fiscal 2023 results, wherein earnings missed the Zacks Consensus Estimates but revenues beat the same.

Non-GAAP earnings per share (excluding 6 cents from non-recurring items) were $1.29, which missed the Zacks Consensus Estimate by 3%. Moreover, quarterly earnings decreased 16% from the year-ago fiscal quarter’s reported number. Revenues of $152.8 million surpassed the consensus estimate by 0.2% and increased 3% from the year-ago fiscal quarter’s reported figure.

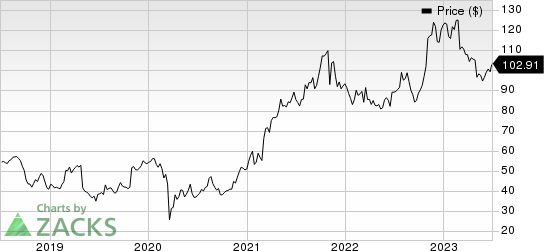

Charles River Associates Price

Charles River Associates price | Charles River Associates Quote

Current situation of CRAI

Charles River has a diversified business along with a global presence with service offerings across areas of functional expertise, client base and geographical regions. The diversification in business helps reduce the company’s dependence on any specific market, industry or geographic area. It also increases the company’s ability to adapt to changing conditions. The company’s offerings help it to expand geographically and improve its topline.

A strong professional team helps the company provide high-quality consulting services. Almost three-fourths of the company’s senior consultants are highly educated, with a doctorate or other advanced degrees and are recognized experts in their respective fields. In 2022, the company had 939 consulting staff, which includes 149 officers, 496 other senior staff and 294 junior staff. In a company like CRA International, human capital is of dire need.

CRAI has been consistent with returning value to its shareholders. In the last year, the company has returned $27.6 million to its shareholders in the form of share repurchases and $9.58 million as dividends.

Some Concerning Points

Charles River's current ratio at the end of first-quarter 2023 was pegged at 1.02, lower than the current ratio of 1.16 reported at the end of the year-ago quarter. It indicates the company may have problems meeting its short-term debt obligations.

The global presence of the company exposes it to foreign exchange risk. Around 22% of the company’s revenues are currently being generated outside the United States. Likewise, the exchange rate of the dollar with respect to the currencies of the countries where the company conducts its business affects its financials. In the first quarter of 2023, foreign currency loss amounted to $5.28 million.

Zacks Rank and Stocks to Consider

CRAI currently carries a Zacks Rank #3 (Hold).

Investors interested in the broader Zacks Business Services can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate of Green Dot’s revenues suggests a decline of 4.8% year over year to $338.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earning surprise history, beating the consensus mark in all four trailing quarters, the average surprise being 37.3%.

GDOT has a Value score of A and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate of Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earning surprise history, beating the consensus mark in three instances and missing on one instance, the average surprise being 9.6%.

MMS has a VGM score of B along with a Zacks Rank of 1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate of Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earning surprise history, beating the consensus mark in three of the four trailing quarters and missing on one instance, the average surprise being 5.53%.

ROL currently carries a Zacks Rank of 2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Charles River Associates (CRAI) : Free Stock Analysis Report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report