Strong week for United States Cellular (NYSE:USM) shareholders doesn't alleviate pain of five-year loss

Statistically speaking, long term investing is a profitable endeavour. But unfortunately, some companies simply don't succeed. For example, after five long years the United States Cellular Corporation (NYSE:USM) share price is a whole 57% lower. We certainly feel for shareholders who bought near the top. And it's not just long term holders hurting, because the stock is down 49% in the last year. The falls have accelerated recently, with the share price down 37% in the last three months. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report.

While the last five years has been tough for United States Cellular shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

Check out our latest analysis for United States Cellular

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

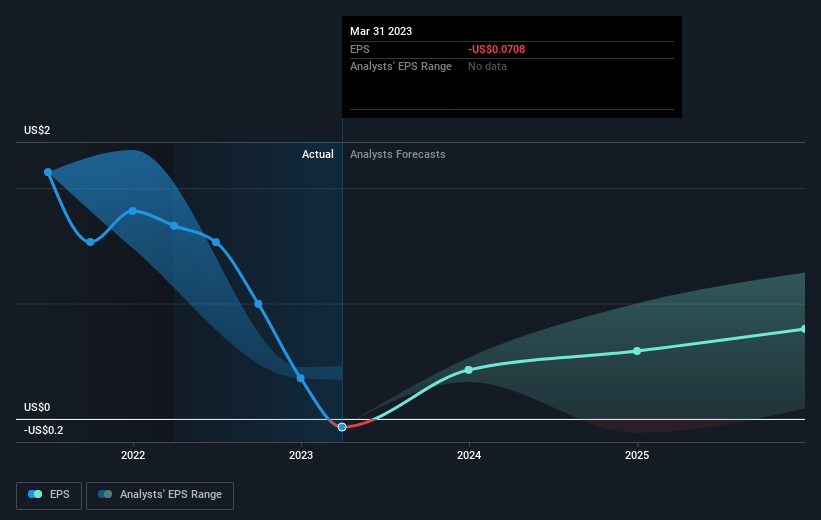

In the last half decade United States Cellular saw its share price fall as its EPS declined below zero. The recent extraordinary items contributed to this situation. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. But we would generally expect a lower price, given the situation.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Dive deeper into United States Cellular's key metrics by checking this interactive graph of United States Cellular's earnings, revenue and cash flow.

A Different Perspective

United States Cellular shareholders are down 49% for the year, but the market itself is up 5.9%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with United States Cellular , and understanding them should be part of your investment process.

We will like United States Cellular better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here