Stryker Corp (SYK) Reports Strong Q4 and Full Year 2023 Results; Forecasts Continued Growth

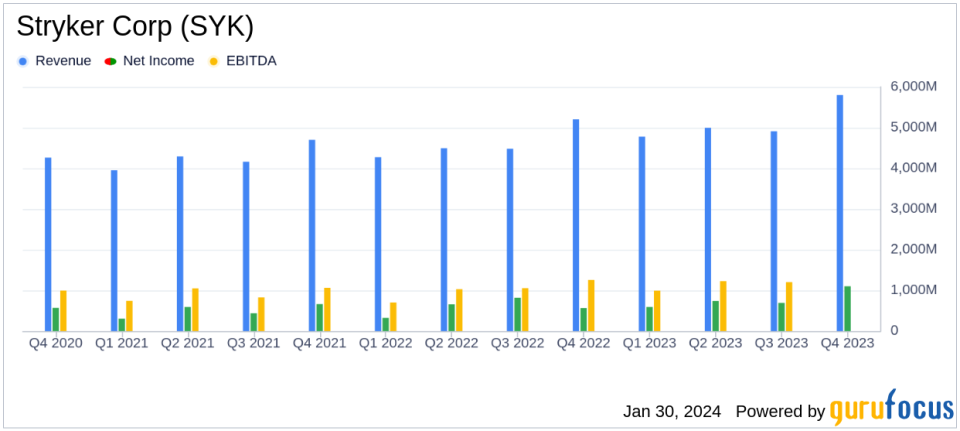

Reported Net Sales: Increased by 11.8% to $5.8 billion in Q4 and 11.1% to $20.5 billion for the full year.

Organic Net Sales: Grew by 11.4% in Q4 and 11.5% for the full year, driven by unit volume and price increases.

Operating Income Margin: Reported operating income margin was 21.6% in Q4; adjusted operating income margin rose 60 basis points to 27.2%.

Earnings Per Share (EPS): Reported EPS soared by 102.7% to $2.98 in Q4; adjusted EPS increased by 15.3% to $3.46.

2024 Outlook: Stryker projects organic net sales growth between 7.5% to 9.0% and adjusted EPS in the range of $11.70 to $12.00.

On January 30, 2024, Stryker Corp (NYSE:SYK) released its 8-K filing, detailing a successful fourth quarter and full year of 2023. The company, a global leader in medical technologies, reported an 11.8% increase in net sales to $5.8 billion for the fourth quarter and an 11.1% increase to $20.5 billion for the full year. This growth was attributed to a robust 11.4% and 11.5% rise in organic net sales for the respective periods.

Stryker's performance is particularly noteworthy in the context of the Medical Devices & Instruments industry, where innovation and market expansion are critical. The company's ability to drive organic sales growth of over 11% in both the fourth quarter and the full year, as highlighted by CEO Kevin Lobo, underscores its competitive edge and operational efficiency. The reported operating income margin stood at 21.6% for the quarter, with an adjusted operating income margin increase of 60 basis points to 27.2%, indicating strong profitability.

The earnings analysis revealed a significant increase in reported net earnings, which surged by 103.0% to $1.1 billion in the quarter and by 34.2% to $3.2 billion for the full year. The reported EPS followed suit, increasing by 102.7% to $2.98 for the quarter. Adjusted EPS, which excludes certain non-recurring items, increased by 15.3% to $3.46 for the quarter and by 13.5% to $10.60 for the full year, reflecting the company's strong earnings capacity.

Looking ahead, Stryker anticipates continued growth in 2024, with organic net sales growth expected to be between 7.5% and 9.0%. The company also projects adjusted EPS to range from $11.70 to $12.00, inclusive of potential foreign exchange impacts.

Key financial highlights from the balance sheet include an increase in total assets from $36.884 billion in 2022 to $39.881 billion in 2023. The company also reported a healthy cash and cash equivalents position of $2.940 billion, up from $1.844 billion the previous year. The condensed consolidated statements of cash flows show a net cash provided by operating activities of $3.680 billion for the full year of 2023, an improvement from $2.624 billion in 2022.

It is important to note that Stryker's financial achievements are set against a backdrop of challenges such as pricing pressures, supply chain disruptions, and regulatory changes. However, the company's strong performance in 2023 and positive outlook for 2024 suggest that it is well-positioned to navigate these challenges and continue its growth trajectory.

For investors and stakeholders, Stryker's latest earnings report is a testament to the company's resilience and strategic focus. With a comprehensive portfolio of medical technologies and a commitment to innovation, Stryker is poised to remain a leading force in the healthcare sector.

For more detailed information and analysis, investors are encouraged to review the full earnings report and join the conference call scheduled for January 30, 2024, at 4:30 p.m. Eastern Time.

Explore the complete 8-K earnings release (here) from Stryker Corp for further details.

This article first appeared on GuruFocus.