Student loan servicer appeals landmark $220,000 bankruptcy ruling

A student loan servicer is appealing a bankruptcy judge’s watershed decision to discharge all of a U.S. Navy veteran’s student debt.

Educational Credit Management Corporation (ECMC) — a nonprofit that guarantees and services student loans on behalf of the Department of Education (ED) — is challenging the January 7 decision made by Chief U.S. Bankruptcy Judge Cecelia G. Morris, who discharged $221,385.49 in student loan debt for Navy veteran and lawyer Kevin Rosenberg under chapter 7 bankruptcy.

The decision belies the common notion that student debt is not dischargeable under chapter 7.

Judge Morris had applied the Brunner test — a three-factor standard used to identify if the borrower is facing undue hardship and cannot make repayments — to evaluate whether Rosenberg was eligible for discharge.

“This Court will not participate in perpetuating these myths,” Morris wrote her decision. “Rather, this Court will apply the Brunner test as it was originally intended.”

ECMC’s main contention in their appeal is that Rosenberg was licensed to practice law but did not pursue job opportunities in the same field: “Instead of pursuing those opportunities available to him, and paying back his taxpayer-backed federal student loans, Plaintiff, for the past 10 years, has held various positions in the outdoor adventure industry, including starting up and running his own tour guide business.”

The loan servicer also implied that Judge Morris’ interpretation of the Brunner test was lax.

“Inability to pay one’s debts by itself cannot be sufficient to establish an undue hardship; otherwise all bankruptcy litigants would have an undue hardship,” they stated. “The Bankruptcy Court in the case at hand rejected 32 years of case law applying the Brunner test in order to determine, on summary judgment, that Plaintiff met his burden to establish an undue hardship, thereby discharging Plaintiff’s entire student loan debt of approximately $221,385.”

Yahoo Finance reached out to ECMC, which said it does not comment on pending litigation.

‘Very few student loan cases get appealed’

Jason Iuliano, an assistant professor of law at Villanova University and an expert on bankruptcy, told Yahoo Finance that “very few student loan cases get appealed, so the Rosenberg case is unusual in that regard.”

Iuliano, who has done years of research related to student loans potentially being discharged in bankruptcy, added that the appeal rate is under 5% for student loan adversary proceedings.

“It’s not surprising that the Rosenberg case was appealed, though,” he added. “Given the publicity the case has received and the judge’s strong rhetoric against the undue hardship standard, ECMC had no choice but to appeal.”

In the latest filing, ECMC elected to “have the appeal heard by the United States District Court rather than by the Bankruptcy Appellate Panel.“

Rosenberg told Yahoo Finance that “the appeals process is beyond my level of knowledge and experience, so I’m reaching out to advocacy groups and attorneys in hopes of finding pro bono representation.”

He added: “The case is likely to go the Supreme Court so whomever represents me in the case will truly make a name for themselves. So, on one hand, I wish this was over already. And on the other, I’m excited about what this means for those still suffering under the weight of an unjust system.”

What happens next?

Following the motion to appeal, ECMC’s appeal will go to a district court judge in the Southern District of New York. That judge will then review the case and determine if the bankruptcy court applied the Brunner test correctly.

If the district judge rules in Rosenberg’s favor, “it could have an immediate impact for borrowers across the region,” Mike Pierce, policy director and general counsel at the Student Borrower Protection Center, told Yahoo Finance. “This may also be the first step toward bringing issues of justice and equity in student loan bankruptcy before the Supreme Court. Ultimately, Congress also has the power to change the law to level the playing field for everyone.”

Not everyone agreed that this case would go all the way to D.C.

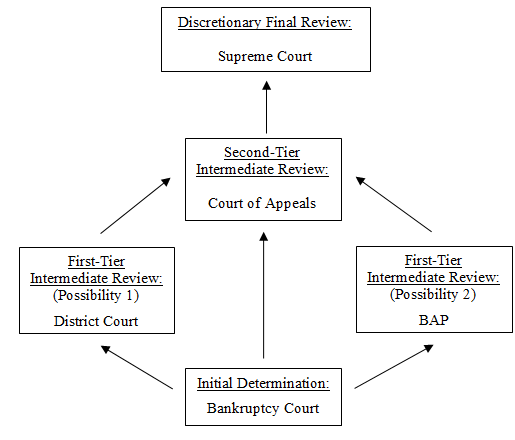

“The chance of any case getting to the Supreme Court is low. The Supreme Court agrees to hear only about 3-4% of the cases appealed to it, which results in around 70 cases each year,” Robert M. Lawless, a law professor at the University of Illinois’s College of Law, who specializes in bankruptcy and consumer finance, told Yahoo Finance. “This case is at the lowest rung of the bankruptcy appeals ladder.”

He continued: “From here, it would have to go to the Court of Appeals and then to the Supreme Court. To get the Supreme Court to hear the case, the loser at the Court of Appeals would have to convince the Supreme Court that the Court of Appeals decision conflicted with the decision of other Courts of Appeal.”

—

Aarthi is a writer for Yahoo Finance. She can be reached at aarthi@yahoofinance.com. Follow her on Twitter @aarthiswami.

Read more:

'I have a chance now to have a life': Navy vet who won watershed student loan ruling tells his story

‘I’m working until I’m 75’: Factory worker describes family’s student debt nightmare

'I can't afford that': Woman in student loan limbo since 1997 decries a muddy system

Read the latest financial and business news from Yahoo Finance

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.