Sturm Ruger & Co Inc (RGR) Reports Decline in Annual Sales and Earnings for 2023

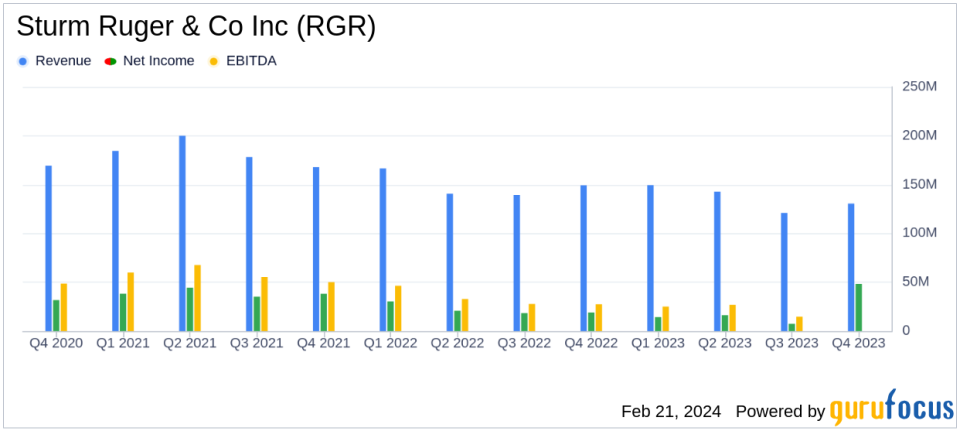

Net Sales: Decreased to $543.8 million in 2023 from $595.8 million in 2022.

Diluted Earnings Per Share: Dropped to $2.71 in 2023 from $4.96 in 2022.

Dividend: A dividend of 23 cents per share declared for the fourth quarter.

Balance Sheet: Strong, debt-free balance sheet with reduced inventories at independent distributors.

New Products: Introduction of new products and special editions to mark the 75th Anniversary.

EBITDA Margin: Declined to 14.0% in 2023 from 22.1% in 2022.

On February 21, 2024, Sturm Ruger & Co Inc (NYSE:RGR) released its 8-K filing, announcing its financial results for the year 2023. The company, a leading manufacturer of firearms for the commercial sporting market, reported a decrease in net sales and diluted earnings per share compared to the previous year. The company's net sales fell to $543.8 million in 2023 from $595.8 million in 2022, and diluted earnings per share decreased to $2.71 from $4.96.

Sturm Ruger & Co Inc, with its subsidiary, is primarily engaged in the design, manufacture, and sale of firearms to domestic customers. The company's products, which include rifles, pistols, and revolvers, are sold through independent wholesale distributors, mainly to the commercial sporting market. Sturm Ruger & Co Inc prides itself on its American-made products and has been a model of corporate and community responsibility for 75 years.

Despite the challenging market conditions characterized by soft consumer demand, inflationary pressures, and rising interest rates, the company maintained its long-term focus. CEO Christopher J. Killoy emphasized the company's disciplined approach to production and promotions, which aimed to protect its long-term strategy over short-term gains. The company enters 2024 with a strong, debt-free balance sheet and reduced inventories at independent distributors.

To celebrate its 75th Anniversary, Sturm Ruger & Co Inc has launched commemorative firearms and special limited production editions, including the Diamond Anniversary Limited Edition 1911 Pistol. These new products have been met with strong demand and excitement, signaling potential for future growth.

The company's financial achievements are particularly important in the Aerospace & Defense industry, where a strong balance sheet and innovative product pipeline are critical for sustaining growth and navigating economic headwinds. Sturm Ruger & Co Inc's ability to maintain a debt-free status and introduce new products despite a sales downturn demonstrates resilience and strategic planning.

Financial Highlights and Challenges

Sturm Ruger & Co Inc's financial performance in 2023 reflects the broader challenges faced by the industry. The reduction in sales and earnings can lead to concerns about the company's ability to maintain its market position and profitability in a competitive and fluctuating market. However, the company's strategic initiatives, including new product launches and anniversary editions, are designed to reinvigorate sales and strengthen the brand.

The company's financial statements reveal key metrics that are important to investors. The gross profit for 2023 was $133.6 million, a decrease from $180.1 million in 2022. Operating income also saw a decline, coming in at $52.1 million for 2023, compared to $103.5 million in the previous year. The EBITDA margin, a measure of a company's operating profitability as a percentage of its total revenue, decreased to 14.0% in 2023 from 22.1% in 2022.

"We remained disciplined and continued to focus on the long-term reducing production levels where appropriate and offering only modest promotions on select product families, resisting the temptation to enhance short-term results at the expense of our long-term strategy," said CEO Christopher J. Killoy.

The company's balance sheet remains robust, with total assets of $398.8 million as of December 31, 2023, down from $484.8 million in the previous year. The decrease in assets is primarily due to a reduction in cash and cash equivalents and short-term investments. The company's strong financial position is further evidenced by its lack of debt, which provides flexibility and stability in uncertain economic times.

Analysis of Performance

Sturm Ruger & Co Inc's performance in 2023 indicates a challenging year with reduced sales and profitability. However, the company's strategic decisions to manage production and inventory levels, coupled with the introduction of new products, position it to potentially rebound as market conditions improve. The company's commitment to innovation and its strong financial foundation are key factors that may contribute to its future success.

Investors and potential members of GuruFocus.com should consider the company's long-term strategy, product pipeline, and financial health when evaluating its prospects. Sturm Ruger & Co Inc's ability to navigate a difficult year while preparing for future opportunities may appeal to value investors looking for companies with a solid track record and a clear vision for growth.

For a more detailed analysis and to access the complete Annual Report on Form 10-K for 2023, investors can visit the SEC website at SEC.gov or the Ruger website at Ruger.com/corporate.

Explore the complete 8-K earnings release (here) from Sturm Ruger & Co Inc for further details.

This article first appeared on GuruFocus.