Subdued Growth No Barrier To Tango Therapeutics, Inc. (NASDAQ:TNGX) With Shares Advancing 25%

Tango Therapeutics, Inc. (NASDAQ:TNGX) shares have had a really impressive month, gaining 25% after a shaky period beforehand. Taking a wider view, although not as strong as the last month, the full year gain of 20% is also fairly reasonable.

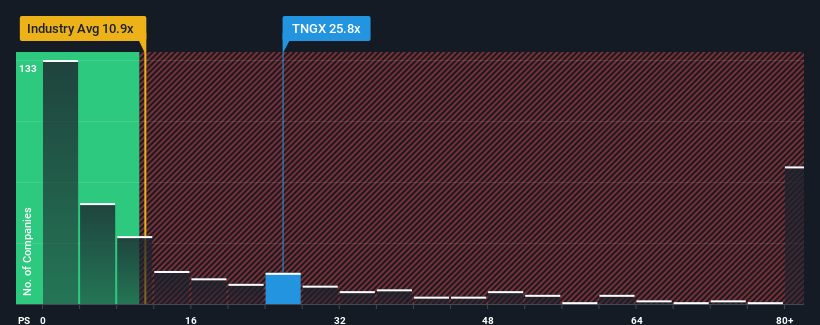

After such a large jump in price, Tango Therapeutics may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 25.8x, when you consider almost half of the companies in the Biotechs industry in the United States have P/S ratios under 10.9x and even P/S lower than 3x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Tango Therapeutics

What Does Tango Therapeutics' Recent Performance Look Like?

Tango Therapeutics certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Tango Therapeutics.

Is There Enough Revenue Growth Forecasted For Tango Therapeutics?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Tango Therapeutics' to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 55% last year. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 6.2% per annum over the next three years. That's shaping up to be materially lower than the 216% per year growth forecast for the broader industry.

In light of this, it's alarming that Tango Therapeutics' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does Tango Therapeutics' P/S Mean For Investors?

Shares in Tango Therapeutics have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Tango Therapeutics, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 4 warning signs for Tango Therapeutics (1 is a bit concerning!) that you should be aware of.

If these risks are making you reconsider your opinion on Tango Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.