Suburban Propane Partners LP Reports Mixed Q1 Results Amid Warm Weather Challenges

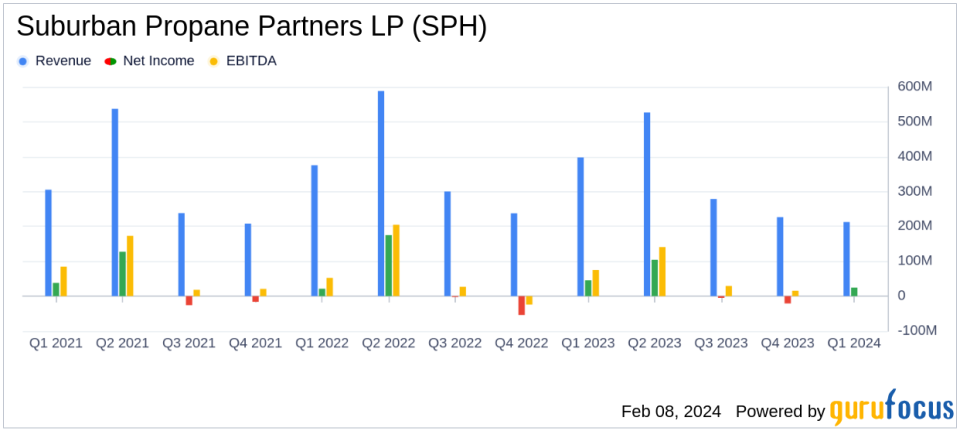

Net Income: $24.5 million in Q1 FY2024, down from $45.4 million in Q1 FY2023.

Adjusted EBITDA: Decreased to $75.2 million in Q1 FY2024 from $90.0 million in Q1 FY2023.

Propane Volumes: Slight decrease of 2.0% in retail gallons sold due to warmer weather.

Gross Margin: Slight decrease of 0.9% to $212.8 million in Q1 FY2024, excluding mark-to-market adjustments.

Operating Expenses: Increased by 6.4% primarily due to higher payroll and RNG facility costs.

Debt Position: Total debt increased by $54.8 million due to seasonal borrowings.

Distribution: Quarterly distribution of $0.325 per Common Unit announced.

On February 8, 2024, Suburban Propane Partners LP (NYSE:SPH) released its 8-K filing, announcing its financial results for the first quarter ended December 30, 2023. The company, a leading distributor of propane and provider of other refined fuels and energy services, faced a challenging quarter due to unseasonably warm weather, which led to a decrease in net income to $24.5 million, or $0.38 per Common Unit, compared to $45.4 million, or $0.71 per Common Unit, in the same quarter of the previous fiscal year.

Suburban Propane Partners LP operates in three segments: Propane; Fuel Oil and Refined Fuels; and Natural Gas and Electricity, with the Propane segment being the primary revenue generator. Despite the warm weather impacting customer demand for heating, the company's propane volumes only saw a marginal decrease of 2.0% compared to the prior year's first quarter. This was partly offset by solid agricultural demand and positive customer base trends.

President and CEO Michael A. Stivala commented on the quarter's performance, emphasizing the company's operational efficiency and readiness to meet increased demand as more seasonable weather sets in. He also highlighted the ongoing investments in renewable natural gas (RNG) operations, including capital deployment to enhance efficiency at the RNG production facility in Stanfield, Arizona, and the development of RNG offtake arrangements.

The fiscal 2024 first quarter was dominated by unseasonably warm weather that persisted across the country, especially during the critical last six weeks of the quarter, which negatively impacted customer demand for heating purposes. - Michael A. Stivala, President and CEO

The company's total gross margin for the fiscal 2024 first quarter decreased slightly by $2.0 million, or 0.9%, compared to the prior year first quarter, including a $10.8 million unrealized loss due to mark-to-market adjustments for derivative instruments. Excluding these adjustments, the total gross margin decreased by $4.9 million, or 2.2%, primarily due to lower propane volumes sold and lower propane unit margins.

Operating and general and administrative expenses for the quarter increased by 6.4%, mainly due to higher payroll and benefit-related expenses and operating costs associated with the RNG production facilities. The company's total debt increased by $54.8 million compared to September 2023, attributed to seasonal borrowings under the Partnerships revolving credit facility to fund working capital.

Suburban Propane Partners LP declared a quarterly distribution of $0.325 per Common Unit for the three months ended December 30, 2023, which is payable on February 13, 2024, to Common Unitholders of record as of February 6, 2024.

The company's focus on operational efficiency, despite the warm weather's impact on demand, and its strategic investments in renewable energy initiatives, position it to potentially benefit from the ongoing energy transition and to meet the seasonal demand for heating. However, the increased operating expenses and the debt position warrant close monitoring by investors.

For a more detailed analysis of Suburban Propane Partners LP's financial results, including the complete consolidated financial statements, investors are encouraged to review the company's forthcoming Quarterly Report on Form 10-Q, which will be filed with the SEC and available on the public EDGAR electronic filing system.

Explore the complete 8-K earnings release (here) from Suburban Propane Partners LP for further details.

This article first appeared on GuruFocus.