Sumitomo Realty & Development Co Ltd's Dividend Analysis

Dissecting the Dividend Prospects of Sumitomo Realty & Development Co Ltd

Sumitomo Realty & Development Co Ltd (SURDF) recently announced a dividend of $30 per share, payable on a date yet to be announced, with the ex-dividend date set for 2024-03-28. As investors anticipate this upcoming payment, it's crucial to examine the company's dividend history, yield, and growth rates. Utilizing GuruFocus data, we will delve into Sumitomo Realty & Development Co Ltd's dividend performance and evaluate its long-term viability.

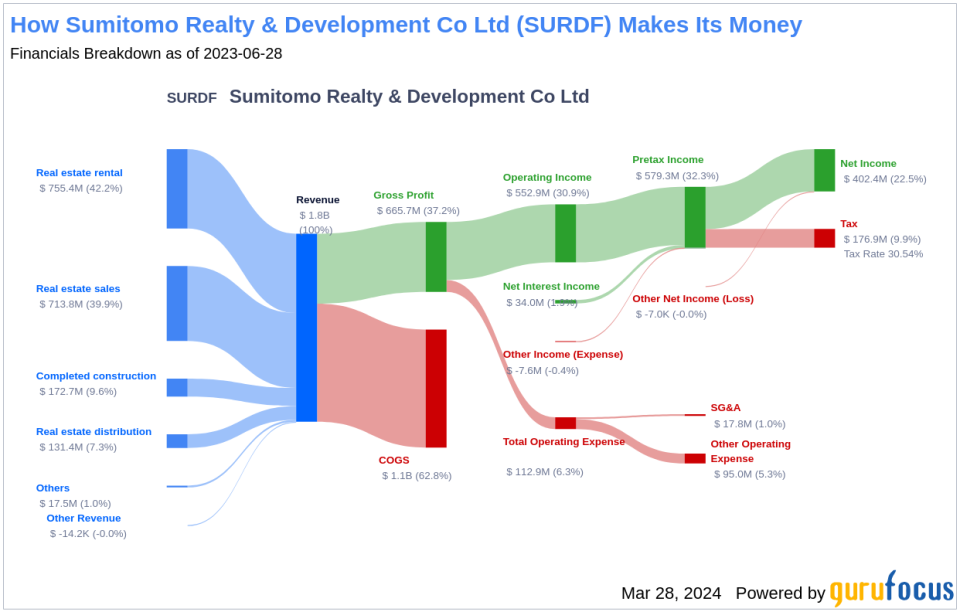

What Does Sumitomo Realty & Development Co Ltd Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Sumitomo Realty & Development Co Ltd is a prominent player in Japan's real estate sector. The company has strategically built a diverse portfolio across central Tokyo by acquiring and redeveloping land opportunistically. With office leasing and condo development as its core businesses, Sumitomo Realty & Development contributes significantly to Tokyo's urban landscape. Although slightly smaller by assets compared to its peers Mitsubishi Estate and Mitsui Fudosan, it operates with higher financial leverage.

A Glimpse at Sumitomo Realty & Development Co Ltd's Dividend History

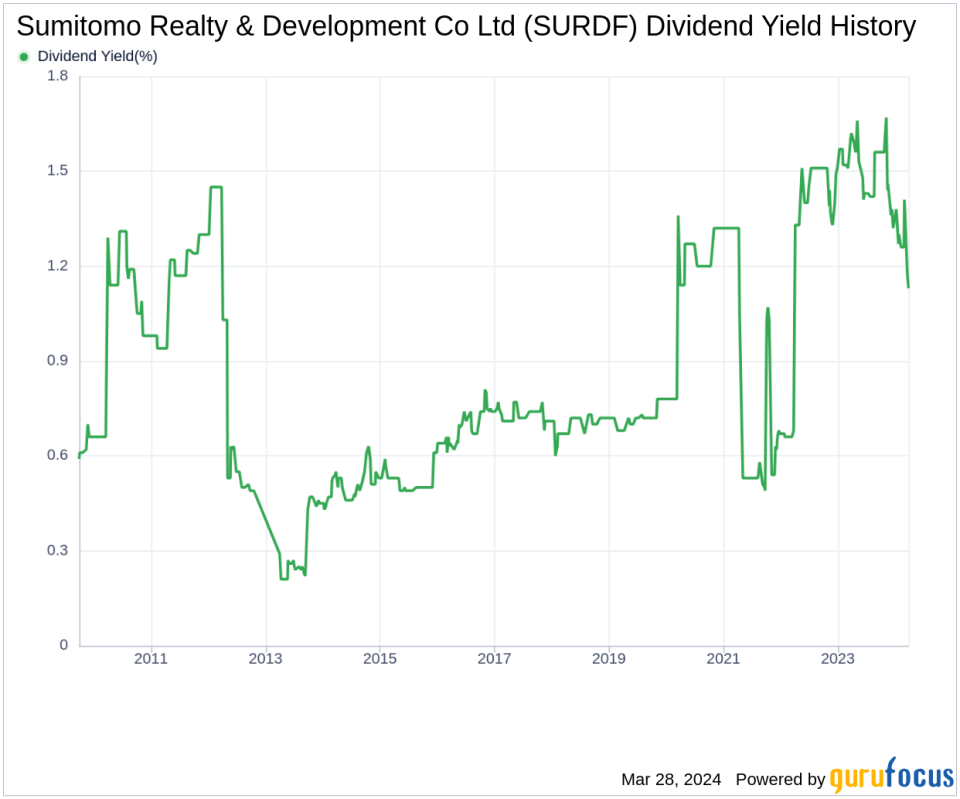

Sumitomo Realty & Development Co Ltd has demonstrated a steady commitment to dividend payments since 2013, distributing dividends bi-annually. This consistency is a positive indicator for income-focused investors. Below is a chart illustrating the annual Dividends Per Share to visualize historical trends.

Breaking Down Sumitomo Realty & Development Co Ltd's Dividend Yield and Growth

Sumitomo Realty & Development Co Ltd boasts a 12-month trailing dividend yield of 1.09% and a forward dividend yield of 1.23%, hinting at an anticipated increase in dividend payments over the next year. The company's dividend growth has been robust, with an annual growth rate of 14.10% over the past three years, slightly tapering to 14.00% over a five-year period. Over the past decade, the growth rate has been an impressive 10.50%. These figures culminate in a 5-year yield on cost for the stock of approximately 2.10%.

The Sustainability Question: Payout Ratio and Profitability

Assessing the sustainability of dividends involves examining the dividend payout ratio, which for Sumitomo Realty & Development Co Ltd stands at a prudent 0.16. This low ratio indicates that the company retains a substantial portion of its earnings, providing a buffer for growth initiatives and potential downturns. The company's profitability rank of 7 out of 10 underscores its strong earning potential, supported by a decade-long track record of positive net income.

Growth Metrics: The Future Outlook

Sumitomo Realty & Development Co Ltd's growth rank of 7 out of 10 reflects a favorable growth trajectory. However, the company's revenue and earnings growth rates have been modest, with a 3-year revenue decline of -2.50% per year and a 3-year EPS growth rate of 3.30%. The 5-year EBITDA growth rate of 4.60% also suggests moderate growth, with each metric trailing a significant portion of global competitors.

Next Steps

Considering Sumitomo Realty & Development Co Ltd's dividend payments, growth rate, payout ratio, and profitability, investors should weigh these factors against their individual investment goals. While the company has shown a strong commitment to dividends and profitability, its growth metrics present a more nuanced picture. Investors intrigued by dividend opportunities may find value in exploring the High Dividend Yield Screener available to GuruFocus Premium users.

GuruFocus Premium users can screen for high-dividend yield stocks using the High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.