Summit Materials Inc Reports Record Annual Revenue and Profitability in 2023

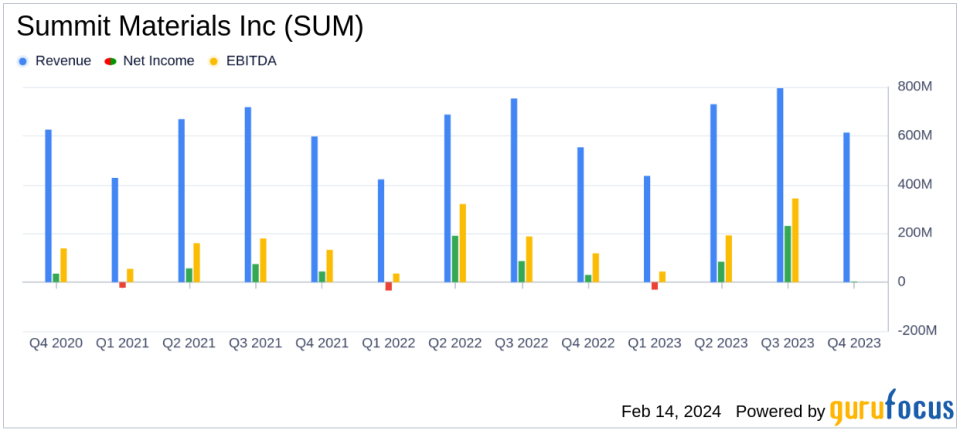

Net Revenue: Increased by 9.9% to $2.4 billion in 2023.

Operating Income: Grew by 15.5% to $310.6 million in 2023.

Net Income: Rose to $289.6 million, a 5.0% increase from the previous year.

Basic EPS: Increased to $2.40 per share, up from $2.27 per share in 2022.

Adjusted EBITDA: Climbed by 17.6% to $578.0 million in 2023.

Capital Expenditures: Expected to be between $430 million to $470 million in 2024.

Liquidity: $374.2 million in cash and $2.3 billion in debt as of December 30, 2023.

On February 14, 2024, Summit Materials Inc (NYSE:SUM) released its 8-K filing, announcing its financial results for the fourth quarter and full year ended December 30, 2023. The company, a leading supplier of aggregates and cement in the United States and British Columbia, Canada, reported record annual revenue and profitability, with significant growth in net revenue and operating income.

Summit Materials Inc operates in 22 U.S. states and British Columbia, Canada, providing high-quality materials for the construction industry. The company's products include aggregates, cement, ready-mix concrete, and asphalt paving mix, which are essential for public infrastructure, residential, and non-residential construction projects.

Performance Highlights and Challenges

The company's performance in 2023 was marked by a 9.9% increase in net revenue to $2.4 billion, driven by strong pricing across all lines of business and contributions from acquisitions. Operating income saw a 15.5% rise to $310.6 million, reflecting higher revenue that more than offset increases in costs. However, net income saw a significant decrease of 88.8% in the fourth quarter, attributed to transaction and integration costs related to the Argos USA transaction.

Summit Materials' financial achievements are particularly important in the building materials industry, where pricing power and cost management are critical to maintaining profitability. The company's record organic pricing growth for aggregates and cement underscores its ability to navigate market dynamics effectively.

Financial Metrics and Importance

Key financial metrics from the income statement include a basic earnings per share (EPS) of $2.40 for the full year, up from $2.27 in the previous year. Adjusted diluted EPS was $1.58, a 24.4% increase from 2022. The balance sheet shows the company had $374.2 million in cash and $2.3 billion in debt, with significant liquidity to pursue growth opportunities.

Adjusted EBITDA, a critical metric for evaluating a company's operating performance, increased by 17.6% to $578.0 million. This measure is important as it provides insight into the company's profitability from core business operations before the impact of financing and accounting decisions.

Summit is at an exciting and pivotal point in our company's history, commented Anne Noonan, Summit Materials President and CEO. Our team has effectively capitalized on dynamic, yet constructive market conditions to drive record revenue and profitability. And were building on our record setting performance by swiftly and safely advancing our Argos integration - a move that we expect will only strengthen our materials-led business. For 2024, with an improved footprint and increased scale we anticipate delivering another year of strong growth and returns.

Analysis of Company's Performance

Summit Materials' performance in 2023 reflects a strategic focus on pricing and cost management, which has allowed the company to achieve record revenue and profitability despite challenges such as inflationary pressures and transaction costs. The company's integration of Argos USA is expected to further strengthen its position in the market, providing a solid foundation for continued growth and shareholder value creation.

The company's guidance for 2024, with projected Adjusted EBITDA of approximately $950 million to $1,010 million, indicates confidence in its ability to maintain momentum and capitalize on market opportunities. The planned capital expenditures of $430 million to $470 million will support ongoing growth initiatives and reinforce Summit Materials' commitment to investing in its future.

In conclusion, Summit Materials Inc's strong financial performance in 2023, characterized by record revenue and profitability, positions the company well for continued success in the building materials industry. With a robust balance sheet and strategic growth initiatives underway, Summit Materials is poised to deliver value to its shareholders and capitalize on the positive market outlook for 2024.

Explore the complete 8-K earnings release (here) from Summit Materials Inc for further details.

This article first appeared on GuruFocus.