Sun Life Financial Inc's Dividend Analysis

Assessing the Upcoming Dividend and Historical Performance of SLF

Sun Life Financial Inc (NYSE:SLF) recently announced a dividend of $0.78 per share, payable on 2023-12-29, with the ex-dividend date set for 2023-11-28. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's look into Sun Life Financial Inc's dividend performance and assess its sustainability.

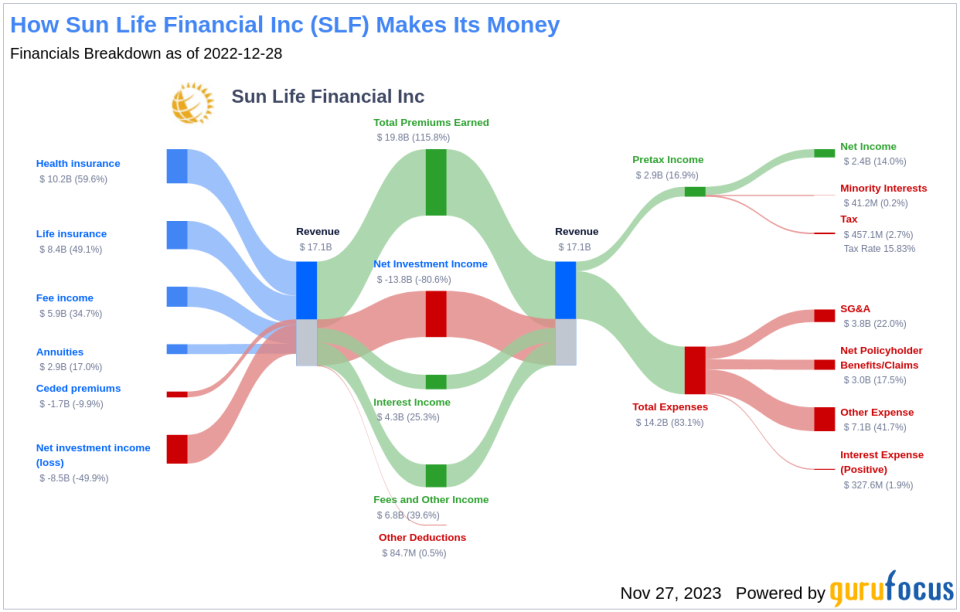

What Does Sun Life Financial Inc Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Sun Life Financial Inc provides life insurance, retirement, and asset management products to individuals and corporate customers in Canada, the United States, and Asia. The company's investment management business contributes approximately 38% of its adjusted earnings and has around CAD 1 trillion in assets under management as of the second quarter of 2023. The Canada business contributes about 32% of adjusted earnings and provides individual life and health insurance, group insurance, retirement services, and wealth management solutions. The U.S. business contributes approximately 14% of earnings and is mainly focused on providing group insurance products and managing the in-force life insurance policies. Finally, the Asia segment contributes around 16% of earnings.

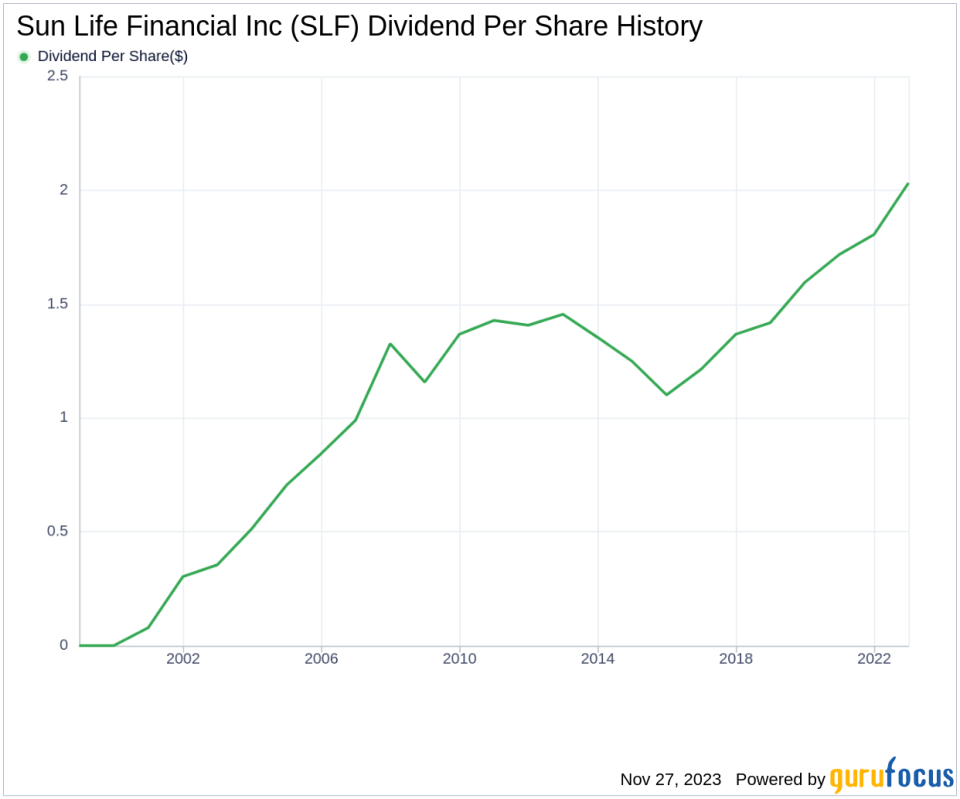

A Glimpse at Sun Life Financial Inc's Dividend History

Sun Life Financial Inc has maintained a consistent dividend payment record since 2000, with dividends currently distributed on a quarterly basis. The stock is recognized as a dividend achiever, a title bestowed upon companies that have increased their dividend each year for at least the past 23 years. Below is a chart showing annual Dividends Per Share for tracking historical trends.

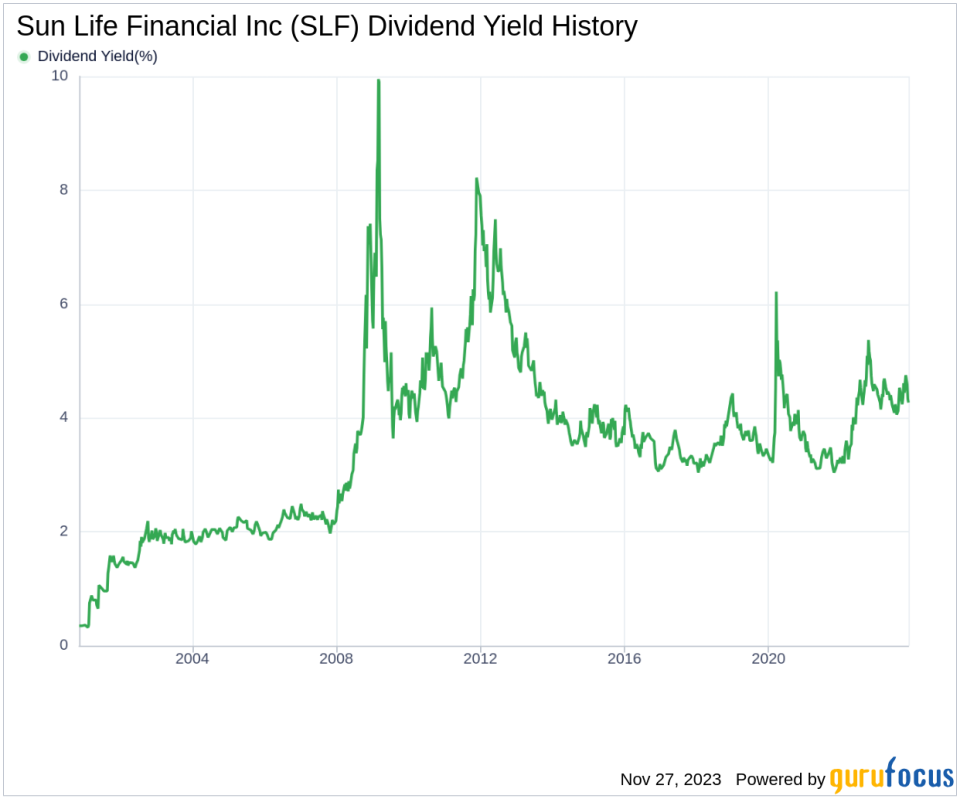

Breaking Down Sun Life Financial Inc's Dividend Yield and Growth

Sun Life Financial Inc currently boasts a 12-month trailing dividend yield of 4.25% and a forward-looking 12-month forward dividend yield of 4.40%, indicating an anticipated increase in dividend payments over the next year. Over the past three years, the company's annual dividend growth rate was 9.50%, which decreases slightly to 8.70% per year over a five-year span, and stands at 6.80% over the past decade. The 5-year yield on cost for Sun Life Financial Inc stock is approximately 6.45%.

The Sustainability Question: Payout Ratio and Profitability

The dividend payout ratio is a critical measure of dividend sustainability, and Sun Life Financial Inc's ratio stands at 0.47 as of 2023-09-30, suggesting a balanced approach to dividend distribution and earnings retention. The company's profitability rank of 6 out of 10, coupled with a decade of positive net income, reflects its strong profitability and supports ongoing dividend payments.

Growth Metrics: The Future Outlook

For dividends to be sustainable, robust growth metrics are essential. Sun Life Financial Inc's growth rank of 6 out of 10 indicates fair growth prospects. Despite a 3-year revenue growth rate that underperforms 91.87% of global competitors, Sun Life Financial Inc's revenue per share remains strong. Its 3-year EPS growth rate of 6.70% per year, although underperforming 42.55% of global competitors, and a 5-year EBITDA growth rate of 8.20%, which underperforms 41.36% of global competitors, still provide a foundation for future dividend sustainability.

Concluding Thoughts on Sun Life Financial Inc's Dividend Prospects

Sun Life Financial Inc's consistent dividend payments, impressive growth rate, moderate payout ratio, and solid profitability suggest a sustainable dividend profile that could appeal to value investors. While the company's growth metrics indicate areas for improvement, its financial health and dividend achiever status may offer a degree of confidence for those seeking stable income streams. Investors keen on exploring high-dividend yield opportunities may benefit from the High Dividend Yield Screener available to GuruFocus Premium users, where Sun Life Financial Inc and other dividend-paying stocks can be evaluated for investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.