Sun Life (SLF) Q2 Earnings Match Estimates, Decrease Y/Y

Sun Life Financial Inc. SLF delivered a second-quarter 2023 underlying net income of $1.17 per share, which matched the Zacks Consensus Estimate. The bottom line decreased 1.7% year over year.

The underlying net income was reported at $684.87 million (C$920 million).

Wealth sales decreased 41.3% year over year to $31.55 billion (C$42.39 billion) in the quarter under review.

New business contractual service margin was $200 million (C$270 million).

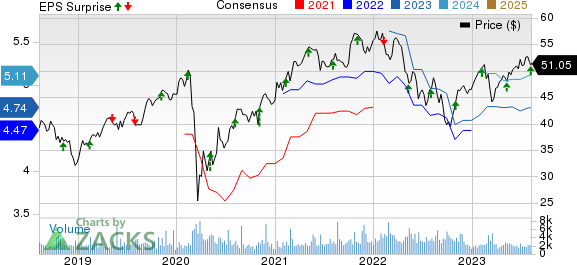

Sun Life Financial Inc. Price, Consensus and EPS Surprise

Sun Life Financial Inc. price-consensus-eps-surprise-chart | Sun Life Financial Inc. Quote

Segment Results

SLF Canada’s underlying net income was $276.9 million (C$372 million). Canada witnessed higher net investment income, driven by higher volume and yields, and improved insurance experience, offset by higher expenses.

SLF U.S.’ underlying net income was $160 million (C$215 million). The business witnessed solid performance across all businesses, contribution from the DentaQuest acquisition and favorable group disability.

SLF Asset Management reported an underlying net income of $220 million (C$296 million). Asset Management witnessed higher net investment income and impacts from foreign exchange translation and higher fee-related earnings.

SLF Asia reported an underlying net income of $111 million (C$150 million). Asia witnessed higher premiums, reflecting good sales momentum, offset by less favorable morbidity experience in Hong Kong.

Financial Update

Global assets under management were $1,030.89 billion (C$1,367 billion), up 5.3% year over year.

Sun Life Assurance’s Minimum Continuing Capital and Surplus Requirements (LICAT) ratio was 139% as of Jun 30, 2023, down 500 basis points from prior-quarter results.

The LICAT ratio for Sun Life (including cash and other liquid assets) was 148%, which remained unchanged from prior quarter results.

Sun Life’s return on equity was 12.7% in the second quarter, which contracted 650 basis points year over year. The underlying ROE of 17.7% expanded 100 basis points year over year.

The leverage ratio of 23.3% remained unchanged from the prior-quarter results.

Dividend Update

On Aug 8, the company’s board of directors approved a dividend of 75 cents per share. The amount will be paid out on Sep 29, 2023, to shareholders of record at the close of business on Aug 30.

Zacks Rank

Sun Life currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Performance of Some Other Life Insurers

Voya Financial, Inc. VOYA reported second-quarter 2023 adjusted operating earnings of $2.31 per share, which beat the Zacks Consensus Estimate by 12.7%. The bottom line increased 38.3% year over year on strong net underwriting results. Adjusted operating revenues amounted to $347 billion, which increased 43.4% year over year. The top line also beat the Zacks Consensus Estimate by 8.8%.

Net investment income declined 6.2% year over year to $545 million. Meanwhile, fee income of $474 million increased 14.8% year over year. Premiums totaled $677 million, up 13.4% from the year-ago quarter. Total benefits and expenses were $1.6 billion, up 17.2% from the year-ago quarter. As of Jun 30, 2023, VOYA’s assets under management, and assets under administration and advisement totaled $789 million.

Lincoln National Corporation (LNC) reported second-quarter 2023 adjusted earnings of $2.02 per share, which outpaced the Zacks Consensus Estimate by 5.2%. However, the bottom line slipped 5.2% year over year. Adjusted operating revenues grew 5.7% year over year to $4,730 million. The top line beat the consensus mark by 2.8%. Total expenses plunged 48.8% year over year to $2,327 million in the quarter under review and remained below our estimate of $3,103.4 million due to the incidence of a significant MRB gain.

The Annuities segment recorded an operating income of $271 million, which decreased 8% year over year and missed the estimate by 6.3%. The metric suffered from reduced prepayment income and increased expenses. Operating income in the Retirement Plan Services segment came in at $47 million, which plunged 14.5% year over year and missed our estimate of $54.1 million due to a decline in prepayment income and an elevated expense level. The Life Insurance segment reported an operating income of $33 million in the quarter under review, falling 47.6% year over year, due to run-rate impact stemming from year-ago annual review of DAC and increased expenses.

Reinsurance Group of America, Incorporated RGA reported second-quarter 2023 adjusted operating earnings of $4.40 per share, which beat the Zacks Consensus Estimate by 6.7%. However, the bottom line decreased 5.7% from the year-ago quarter’s figure. Net foreign currency fluctuations had an adverse effect of 7 cents per share on adjusted operating income.

RGA's operating revenues of $4.2 billion missed the Zacks Consensus Estimate by 1.5%. The top line, however, improved 3.2% year over year due to higher net premiums. Net premiums of $3.3 billion rose 3.3% year over year. Investment income increased 13.6% from the prior-year quarter to $857 million. The average investment yield decreased to 4.42% in the second quarter from 4.63% in the prior-year period due to lower variable investment income, partially offset by higher yields. Total benefits and expenses at Reinsurance Group increased 3.6% year over year to $3.8 billion.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Sun Life Financial Inc. (SLF) : Free Stock Analysis Report

Voya Financial, Inc. (VOYA) : Free Stock Analysis Report