SunCoke Energy Inc (SXC) Reports Full-Year 2023 Results and Issues 2024 Guidance

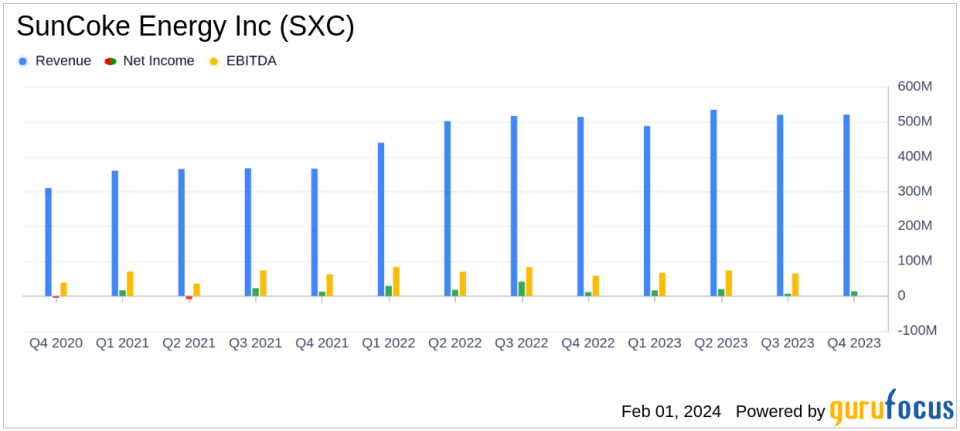

Net Income: $57.5 million for FY 2023, down from $100.7 million in FY 2022.

Adjusted EBITDA: $268.8 million for FY 2023, a decrease from $297.7 million in FY 2022.

Revenue: Increased to $2,063.2 million in FY 2023 from $1,972.5 million in FY 2022.

Operating Cash Flow: $249.0 million for FY 2023.

2024 Guidance: Consolidated Adjusted EBITDA expected to be between $240 million and $255 million.

Debt Reduction: Reduced gross debt by approximately $44 million in FY 2023.

Dividend Increase: Quarterly dividend increased by 25% in FY 2023.

On February 1, 2024, SunCoke Energy Inc (NYSE:SXC) released its 8-K filing, announcing its financial results for the full year of 2023 and providing guidance for the full year of 2024. The company, a leading independent producer of coke in the Americas, operates through three segments: Domestic Coke, Brazil Coke, and Logistics, offering metallurgical and thermal coal and providing handling and/or mixing services to various industries.

Financial Performance and Challenges

SunCoke Energy Inc reported a net income of $57.5 million, or $0.68 per diluted share, for the full year of 2023, a decrease from the $100.7 million, or $1.19 per diluted share, recorded in the previous year. The company's Adjusted EBITDA for the year was $268.8 million, down from $297.7 million in 2022. Despite these declines, the company saw an increase in revenue to $2,063.2 million in 2023, up from $1,972.5 million in the prior year.

The company's performance reflects solid results from the Domestic Coke segment, which was offset by challenges in the Logistics segment due to weakness in the thermal coal markets. The company's net income was impacted by tax law changes in the United States and Brazil, as well as the establishment of a valuation allowance related to foreign tax credits.

Financial Achievements and Industry Significance

Among the financial achievements, SunCoke Energy Inc notably reduced its gross debt by approximately $44 million and increased its quarterly dividend by 25%. These actions demonstrate the company's commitment to a balanced approach to capital allocation and shareholder returns, which is particularly important in the steel industry where cyclical demand and price volatility can impact financial stability.

Key Financial Metrics

Key metrics from the Income Statement, Balance Sheet, and Cash Flow Statement highlight the company's financial health and operational efficiency:

"In 2023, the SunCoke team successfully navigated through challenging market conditions and proved our operational capability, with strong Domestic Coke performance driving solid results," said Katherine Gates, President of SunCoke Energy, Inc.

The company's operating cash flow was robust at $249.0 million for the full year of 2023. Capital expenditures were projected between $75 million and $80 million, with operating cash flow estimated to be between $185 million and $200 million for 2024.

For the full year of 2024, SunCoke expects its consolidated Adjusted EBITDA to be between $240 million and $255 million, with Domestic Coke segment continuing to operate at full capacity.

Analysis of Company Performance

Despite the decrease in net income and Adjusted EBITDA, SunCoke Energy Inc's revenue growth and debt reduction reflect a resilient business model capable of weathering market fluctuations. The company's focus on operational excellence and safety performance, alongside strategic capital allocation, positions it to continue delivering value to stakeholders.

For more detailed information on SunCoke Energy Inc's financial results and outlook, investors are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from SunCoke Energy Inc for further details.

This article first appeared on GuruFocus.