SunOpta (NASDAQ:STKL) Exceeds Q4 Expectations

Plant-based food and beverage company SunOpta (NASDAQGS:STKL) reported Q4 FY2023 results topping analysts' expectations , with revenue down 17.9% year on year to $181.6 million. The company expects the full year's revenue to be around $685 million, in line with analysts' estimates. It made a non-GAAP profit of $0.05 per share, improving from its profit of $0.04 per share in the same quarter last year.

Is now the time to buy SunOpta? Find out by accessing our full research report, it's free.

SunOpta (STKL) Q4 FY2023 Highlights:

Revenue: $181.6 million vs analyst estimates of $172.1 million (5.5% beat)

EPS (non-GAAP): $0.05 vs analyst estimates of $0.02 ($0.03 beat)

Management's revenue guidance for the upcoming financial year 2024 is $685 million at the midpoint, in line with analyst expectations and implying -10.6% growth (vs -8.4% in FY2023)

Free Cash Flow was -$4.42 million compared to -$14.05 million in the previous quarter

Gross Margin (GAAP): 14.1%, down from 15% in the same quarter last year

Sales Volumes were up 14.7% year on year

Market Capitalization: $712 million

“Our latest results provide validation of the powerful potential of our platform. We are a growth company in growing categories and are armed with an optimized product portfolio and high-quality base of leverageable assets that provide significant runway for continued growth,” said Brian Kocher, Chief Executive Officer of SunOpta.

Committed to clean-label foods, SunOpta (NASDAQGS:STKL) is a sustainability-focused food and beverage company specializing in the sourcing, processing, and packaging of natural and organic products.

Packaged Food

Packaged food stocks are considered resilient investments because people always need to eat. These companies therefore can enjoy consistent demand as long as they stay on top of changing consumer preferences. But consumer preferences can be a double-edged sword, as companies that aren't at the front of trends such as health and wellness and natural ingredients can fall behind. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

SunOpta is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

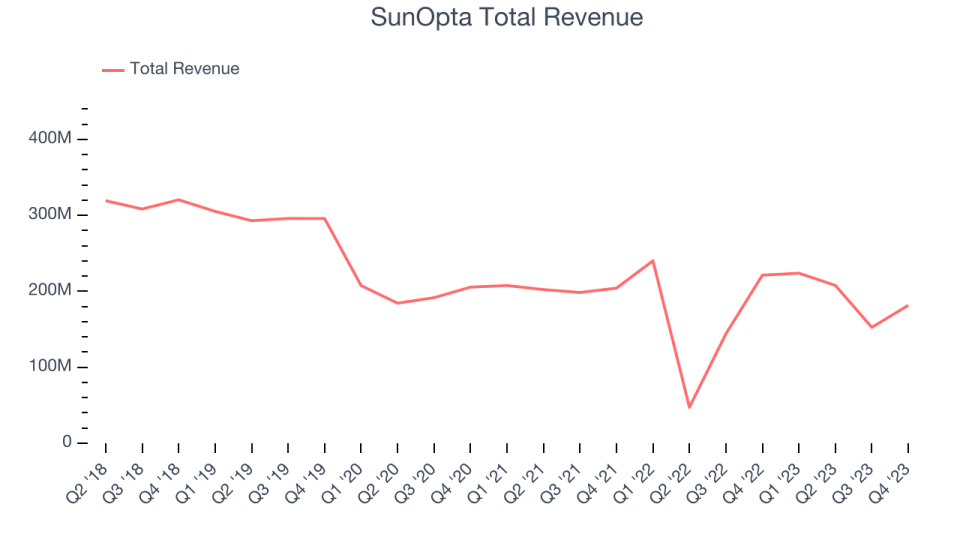

As you can see below, the company's revenue was flat over the last three years. This is poor for a consumer staples business.

This quarter, SunOpta's revenue fell 17.9% year on year to $181.6 million but beat Wall Street's estimates by 5.5%. Looking ahead, Wall Street expects revenue to decline 10.3% over the next 12 months.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

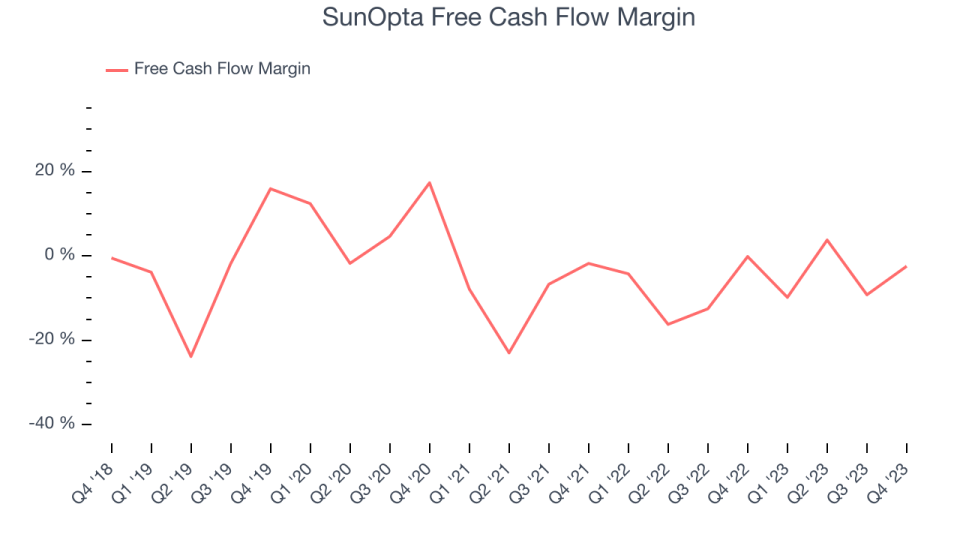

SunOpta burned through $4.42 million of cash in Q4, representing a negative 2.4% free cash flow margin. The company reduced its cash burn by 1,224% year on year.

Over the last two years, SunOpta's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 6.2%. However, its margin has averaged year-on-year increases of 3.8 percentage points over the last 12 months, showing the company is at least improving.

Key Takeaways from SunOpta's Q4 Results

We were impressed that both revenue and EPS beat expectations pretty meaningfully this quarter. Revenue guidance was in line with expectations, showing that the company is staying on track. Overall, this was a fine quarter for SunOpta. The stock is up 5% after reporting and currently trades at $6.31 per share.

So should you invest in SunOpta right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.