SunPower Corp (SPWR) Faces Net Loss in Q4 and FY 2023 Despite Revenue Growth

Customer Growth: Added 16,000 customers in Q4 and 75,900 in FY 2023.

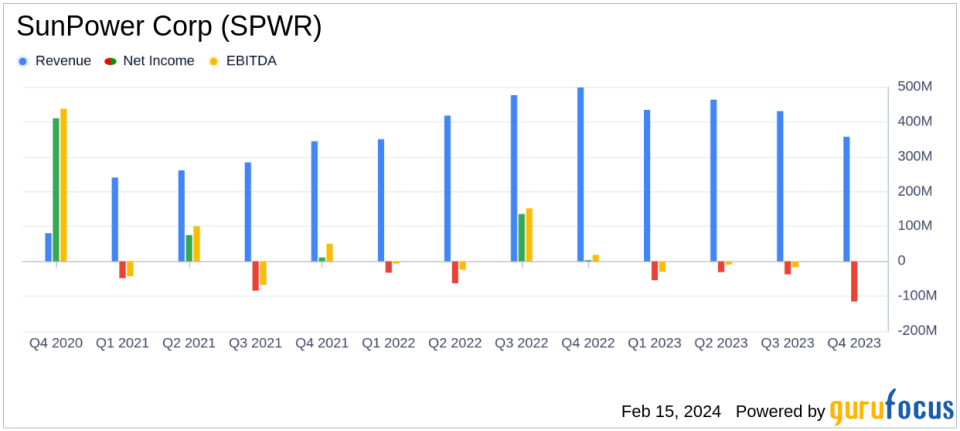

Revenue: Q4 revenue of $357 million; FY 2023 revenue of $1.7 billion.

Net Loss: Q4 GAAP Net Loss of ($124) million; FY 2023 GAAP Net Loss of ($247) million.

Adjusted EBITDA: Q4 Adjusted EBITDA of ($68) million; FY 2023 Adjusted EBITDA of ($84) million.

Capital and Debt: Secured $175 million in additional capital and $25 million in additional revolving debt capacity.

Guidance: Anticipates positive free cash flow in the second half of 2024.

On February 15, 2024, SunPower Corp (NASDAQ:SPWR) released its 8-K filing, detailing the financial outcomes for the fourth quarter and the full year of 2023. SunPower, a leading solar technology and energy services provider, reported significant customer growth and revenue increases, yet faced a net loss both quarterly and annually. The company's sales channels cater to residential and commercial markets in North America, offering integrated solar and storage solutions.

Financial Performance and Challenges

SunPower's Q4 revenue stood at $357 million, contributing to the annual revenue of $1.7 billion. Despite this, the company reported a GAAP Net Loss of ($124) million for Q4 and ($247) million for the full year. Adjusted EBITDA was also negative, at ($68) million for Q4 and ($84) million for FY 2023. These losses were attributed to restatement impacts and one-time charges, which CFO Beth Eby believes are not expected to recur. The company's performance is crucial as it reflects the challenges faced in the highly competitive and capital-intensive solar industry, where profitability and cash flow management are key to sustainability.

Financial Achievements and Industry Significance

The company's ability to secure $175 million in additional capital and $25 million in additional revolving debt capacity is a testament to its resilience and the confidence of its financial partners. This capital infusion is particularly important for SunPower, as it provides the necessary resources to navigate market uncertainties and invest in strategic growth areas. For the semiconductor industry, which is integral to solar technology, such financial backing is essential for continuous innovation and maintaining a competitive edge.

Key Financial Metrics

Important metrics from SunPower's financial statements include a GAAP gross margin of 3.1% for Q4 and 14.1% for FY 2023, a significant decrease from the previous year's figures. The company ended the year with $87.4 million in cash, a decrease from the previous year's $123.7 million. These metrics are important as they provide insight into the company's profitability, liquidity, and operational efficiency.

"With the recent infusion of capital, SunPower is focused on driving positive free cash flow and profitability," said Peter Faricy, SunPower CEO. "This is a new opportunity for SunPower to reinforce our strong foundation as we continue to navigate an uncertain market in early 2024."

Analysis of Company's Performance

While SunPower's revenue growth indicates a strong market demand for its solar solutions, the net losses highlight the challenges in cost management and the impact of one-time financial adjustments. The company's strategic focus on profitability and positive cash flow in the latter half of 2024 suggests a proactive approach to overcoming these challenges. The extended tax credits and lower equipment costs are expected to provide tailwinds that could help improve future financial performance.

For detailed financial information and future updates, investors and analysts can refer to the earnings conference call and supplemental financial information available on SunPower's investor website.

Value investors and potential GuruFocus.com members interested in the solar energy sector may find SunPower's journey towards profitability and cash flow positivity a compelling narrative to follow, as the company leverages industry tailwinds and strategic capital allocation to strengthen its market position.

Explore the complete 8-K earnings release (here) from SunPower Corp for further details.

This article first appeared on GuruFocus.