SunPower (SPWR) Q3 Earnings Miss Estimates, Sales Down Y/Y

SunPower Corporation SPWR reported a third-quarter 2023 adjusted loss of 12 cents per share against earnings of 8 cents in the prior-year period. The loss also came in wider than the Zacks Consensus Estimate of a loss of a penny per share.

Including one-time adjustments, the company reported a GAAP loss of 17 cents per share against the prior-year quarter’s earnings of 73 cents.

Revenues

During the quarter under review, SunPower’s adjusted revenues totaled $432.2 million, while GAAP revenues amounted to $432 million. The top-line estimate was pegged at $430 million. The adjusted top line deteriorated 9.3% from the year-ago quarter’s figure of $476.3 million.

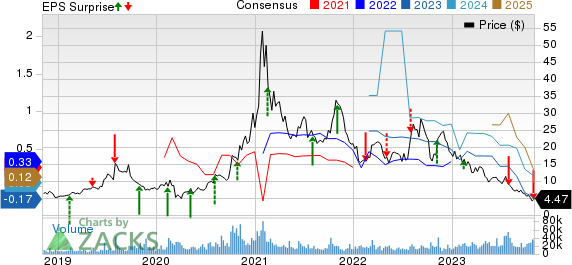

SunPower Corporation Price, Consensus and EPS Surprise

SunPower Corporation price-consensus-eps-surprise-chart | SunPower Corporation Quote

Operating Results

Total operating expenses in the quarter dropped 1.1% year over year to $94.5 million. Lower SG&A and research and development expenses led to the downside.

The company’s gross profit declined 37.2% to $66.4 million rom $105.7 million in the third quarter of 2022.

Its interest expense surged a solid 77% to $6.60 million.

Financial Position

SunPower had cash and cash equivalents of $103.7 million as of Oct 1, 2023, compared with $377 million as of Jan 1, 2023.

The long-term debt totaled $302.6 million as of Oct 1, 2023, compared with $308 million as of Jan 1, 2023.

The company’s cash outflow from operating activities totaled $107.2 million during the first nine months of 2023 compared with $170 million in the year-ago period.

2023 Outlook

SunPower updated its 2023 guidance. For 2023, SPWR now expects negative adjusted EBITDA in the band of $25-$35 million against the previously guided range of $55-$75 million for adjusted EBITDA.

Meanwhile, residential customers are projected in the band of 70,000-80,000, down from the previously estimated range of 70,000-90,000.

Zacks Rank

SunPower currently has a Zacks Rank #5 (Strong Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Recent Solar Releases

Enphase Energy, Inc. ENPH reported third-quarter 2023 adjusted earnings of $1.02 per share, which highlights an 18.4% decline from $1.25 reported in the prior-year quarter. The bottom line came in line with the Zacks Consensus Estimate.

Enphase Energy’s third-quarter revenues of $551.1 million missed the Zacks Consensus Estimate of $562 million by 1.9%. The top line also declined 13.2% from the prior-year quarter’s reported figure of $634.7 million.

JinkoSolar Holding Co. Ltd.’s JKS reported third-quarter 2023 earnings per American Depositary Share (ADS) of $2.59, which beat the Zacks Consensus Estimate of $1.96 by 32.1%. The company reported earnings per ADS of 59 cents in the year-ago quarter.

In the quarter under review, JinkoSolar’s total revenues of $4,363.2 million surpassed the Zacks Consensus Estimate of $4,224 million by 3.3%. The top line surged 63.1% on a year-over-year basis, driven by an increase in solar module shipments.

First Solar FSLR reported third-quarter 2023 earnings of $2.50 per share against the prior-year quarter’s reported loss of 46 cents per share. The bottom line beat the Zacks Consensus Estimate of $2.09 by 19.6%.

First Solar’s third-quarter net sales were $801.1 million, which lagged the Zacks Consensus Estimate of $901 million by 11.1%. However, the top line improved 27.4% from the year-ago quarter’s figure of $628.9 million.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

JinkoSolar Holding Company Limited (JKS) : Free Stock Analysis Report

First Solar, Inc. (FSLR) : Free Stock Analysis Report

SunPower Corporation (SPWR) : Free Stock Analysis Report

Enphase Energy, Inc. (ENPH) : Free Stock Analysis Report