SunTx Capital Management Corp. Reduces Stake in Construction Partners Inc.

This article focuses on the recent transaction executed by SunTx Capital Management Corp. (Trades, Portfolio), a Dallas-based investment firm. The firm reduced its stake in Construction Partners Inc., a leading infrastructure and road construction company based in the USA. This transaction is of particular interest to value investors, given the potential implications it may have on the stock's performance and the firm's portfolio.

Details of the Transaction

The transaction took place on September 19, 2023, with SunTx Capital Management Corp. (Trades, Portfolio) reducing its shares in Construction Partners Inc. by a significant 91.13%. This resulted in a change of -7,955,994 shares, leaving the firm with a total of 774,139 shares in the construction company. Despite this substantial reduction, the transaction had no impact on the firm's portfolio. The shares were traded at a price of $35.2, and the firm's current holdings in Construction Partners Inc. account for 1.47% of the traded stock.

Profile of SunTx Capital Management Corp. (Trades, Portfolio)

SunTx Capital Management Corp. (Trades, Portfolio), located at 5420 LBJ Freeway, Suite 1000, Dallas, TX 75240, is a firm with a focused investment philosophy. The firm currently holds one stock, Construction Partners Inc., in its portfolio, with an equity of $21 million.

Overview of Construction Partners Inc.

Construction Partners Inc., symbolized as ROAD, is a renowned infrastructure and road construction company. The company, which went public on May 4, 2018, provides construction products and services to both public and private sectors. Its services include the construction of highways, roads, bridges, airports, and commercial and residential sites. The company also supplies hot mix asphalt. With a market capitalization of $1.83 billion, the company's stock is currently priced at $34.8.

Analysis of Construction Partners Inc.'s Financials

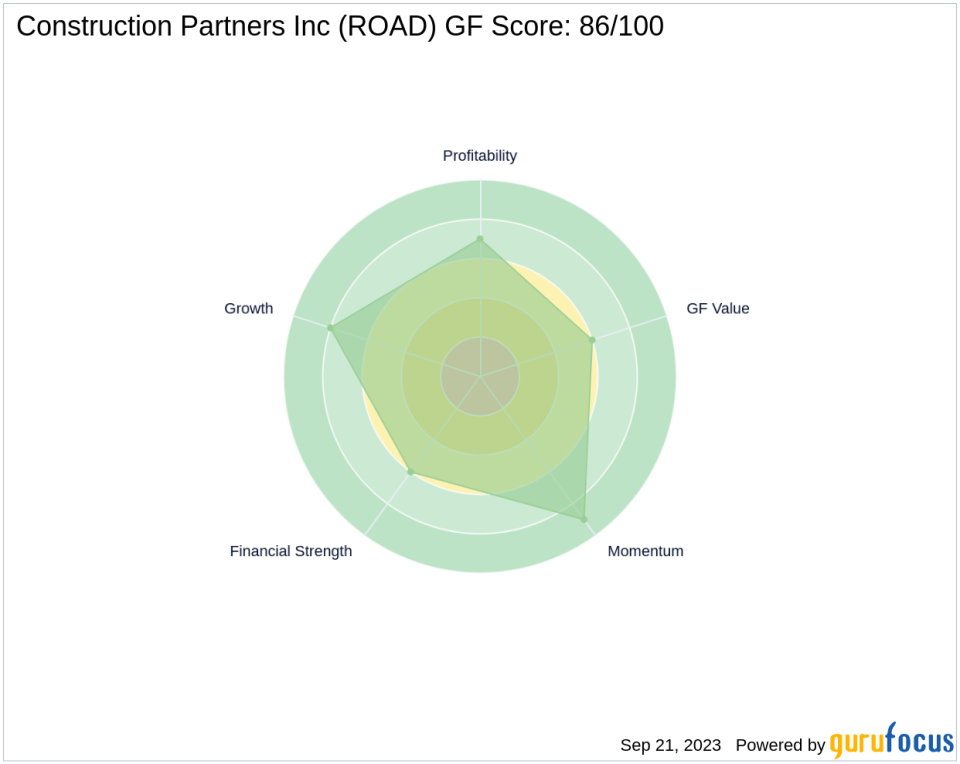

Construction Partners Inc. has a PE Percentage of 59.00, indicating that the company is profitable. According to GuruFocus's GF Value Rank, the stock is modestly undervalued with a GF Value of $39.43 and a Price to GF Value of 0.88. The company's Financial Strength is ranked 6/10, while its Profitability Rank and Growth Rank are 7/10 and 8/10, respectively.

Evaluation of Construction Partners Inc.'s Stock Performance

Since the transaction, the stock has seen a decrease of 1.14%. However, since its Initial Public Offering (IPO), the stock has gained 167.69%. The year-to-date price change ratio stands at 33.33%. The stock's GF Score is 86/100, indicating good outperformance potential. The stock's Momentum Rank is 9/10, suggesting strong momentum.

Examination of Construction Partners Inc.'s Financial Health

The company's cash to debt ratio is 0.13, and its interest coverage is 2.94. The company's ROE and ROA are 6.85 and 2.80, respectively. The company's gross margin growth is -6.40, while its operating margin growth is -20.30. The 3-year revenue growth is 18.00, and the EBITDA growth over the same period is 4.30.

Conclusion

In conclusion, SunTx Capital Management Corp. (Trades, Portfolio)'s recent reduction in its stake in Construction Partners Inc. is a significant move that may have implications for the stock's performance and the firm's portfolio. Despite the reduction, Construction Partners Inc. remains the firm's top holding. The construction company's financial health and stock performance indicate potential for future growth. However, investors should keep an eye on the company's operating margin growth and gross margin growth, which have shown a downward trend. As always, investors are advised to conduct their own thorough research before making investment decisions.

This article first appeared on GuruFocus.