Super Micro Computer Is Down 12% From Its All-Time Highs. Time to Buy?

It's hard to proclaim any stock other than Super Micro Computer (NASDAQ: SMCI) as the stock of 2024 (so far). It has been an unbelievable investment and has gained more than 267% so far this year. However, the stock is cooling a bit, as that number used to be as high as 318%.

So, with Super Micro Computer sitting around 15% off from its all-time high, is now a second opportunity to hop into the stock?

Super Micro Computer is a leader in server design

Super Micro Computer is an investor's second chance at buying Nvidia (NASDAQ: NVDA), the stock that ruled 2023. While Nvidia sells the GPUs that make up data centers that can be used to create powerful artificial intelligence (AI) models, many companies don't have the expertise to assemble their own data centers to get the most use out of them.

Instead, they turn to companies like Supermicro that specialize in server design. With Supermicro's expertise, customers can highly customize their server to meet any workload size or specialization, be it drug discovery, AI model training, or engineering simulations.

Because Supermicro is essentially one order down the value chain, it didn't see the benefits from growing AI demand until now. In the first quarter of fiscal year 2024 (ending Sept. 30, 2023), its revenue rose 14% year over year to $2.12 billion. But in Q2 (ending Dec. 31), its revenue rocketed 103% higher to $3.67 billion, confirming investors' suspicions that Super Micro Computer was slated for massive revenue growth due to AI demand.

Alongside that massive quarter was a huge bump to its annual revenue forecast. In Q1, management's fiscal 2024 revenue guidance was $10 billion to $11 billion. However, thanks to strong Q2 results and impressive demand, management raised its 2024 guidance, forecasting $14.3 billion to $14.7 billion.

This massive guidance increase excited many investors and ignited Super Micro Computer's run-up.

But is it worth buying at its current price, even with the pullback?

The stock still trades at a hefty premium

When a company rises that much, it's safe to assume the stock has gotten a bit expensive. While that's true, there's also another part to the story.

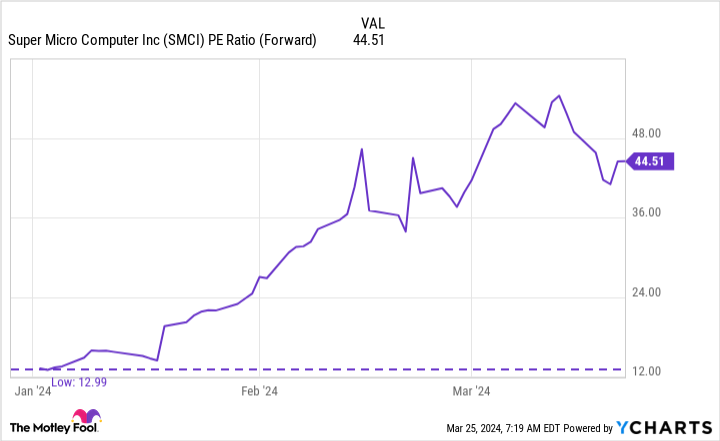

Supermicro entered the year trading around 13 times forward earnings. The market should have known great quarters were coming due to its industry, so the first 100% return was essentially getting Supermicro to where it should have been trading all along.

However, its current price tag of 45 times forward earnings seems a bit steep, especially when Nvidia is currently trading for 38 times forward earnings and has never traded for more than 51 times throughout the massive AI-fueled run-up.

Supermicro also has much more competition than Nvidia, as it faces companies like Hewlett-Packard and IBM in the server business. In contrast, Nvidia essentially had the best-in-class graphics processing units (GPUs) for AI.

As a result, I can't recommend Supermicro at this price. The company will likely continue to do well throughout this year, as it's slated to post strong growth thanks to server demand. But, the stock has already priced in massive success, making it difficult to grow meaningfully.

If you bought Super Micro Computer stock based on my Jan. 10 recommendation, congratulations -- you're up around 205%. But I think now is the time to take gains and move on, as there are plenty of other options in the market that will be easier to make money on.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Keithen Drury has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.

Super Micro Computer Is Down 12% From Its All-Time Highs. Time to Buy? was originally published by The Motley Fool