Super Micro Computer: A Near-Value Opportunity

Super Micro Computer Inc. (NASDAQ:SMCI), commonly known as Supermicro, is a company that specializes in high-performance server technologies, and according to its 10K, its end markets include cloud computing, data center, Big Data, high-performance computing, and 'Internet of Things' embedded markets." Its solutions include "server, storage, blade and workstations to full racks, networking devices, and server management software.

Normally, I don't like stocks like Super Micro Computer. Not because of its business - the business itself is fine, but it carries some debt, which I usually try to avoid when it comes to long-term investments. However, the debt seems to be under control, and key indicators suggest the stock could be in for a cyclical rebound soon, meaning it may have value as a short-term play.

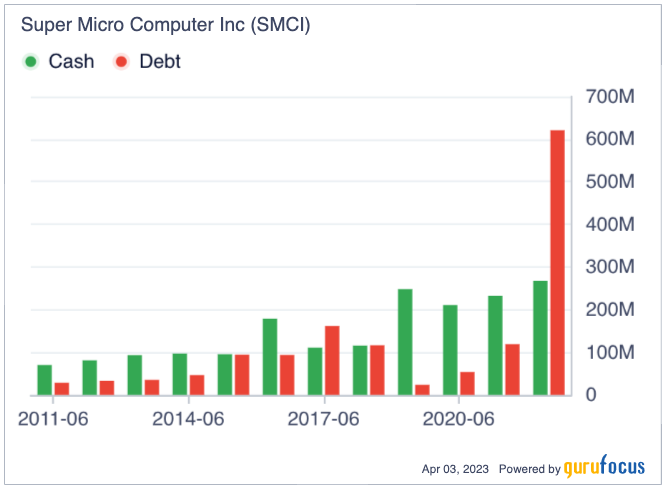

Debt

Supermicro has gone from being basically debt-free to having a significant amount of debt in just a couple of years. As the below chart shows, it went from $24 million in debt in the fiscal year that ended June 30, 2019 to $621 million in debt at the end of June 2022:

The company explained the debt as follows in its 10K for 2022: We have financed our growth primarily with funds generated from operations, in addition to utilizing borrowing facilities, particularly in relation to an increase in the need for working capital due to longer supply chain manufacturing and delivery times as well as the financing of real property acquisitions and funds received from the exercise of employee stock options.

Supermicro has put its debt to good use, growing its earnings per share without non-recurring items exponentially at an average of 56.4% per year over the past three years.

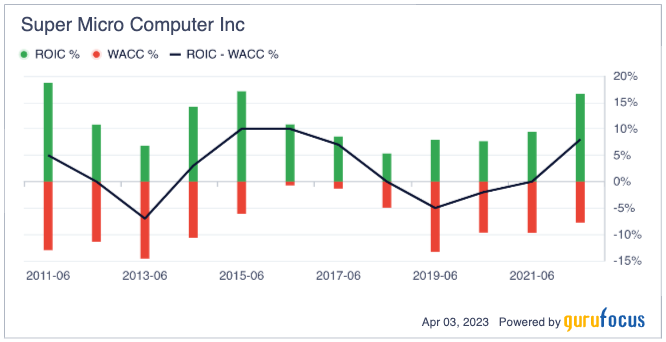

The new debt has also boosted its profitability, as return on invested capital (ROIC) has grown faster than weighted average cost of capital (WACC), making it a serious creator of shareholder value. For fiscal 2022, the WACC was 7.74%, while the ROIC was more than double that at 16.64%.

Can Supermicro comfortably meet its regular debt payments? It can, and quite comfortably at that given its interest coverage ratio of 67.99, which means it generates $67.99 in operating income for each dollar of interest.

At the end of the company's fiscal 2022, which ended in June 2022, the company had $267 million in cash and cash equivalents. That represents roughly 43% of its $621 million in debt.

The company is highly profitable. Over the past 10 years, Supermicros Ebitda grew by an average of 13.40% per year. Over the past five years, its Ebitda growth rate was even higher at 20.70% and over the past three years, it increased again to an average growth rate of 44.40% per year. Is that rate sustainable? I don't think so given that we just had a boom and bust in the semiconductor industry. It's promising for the next industry rebound, though.

Valuation

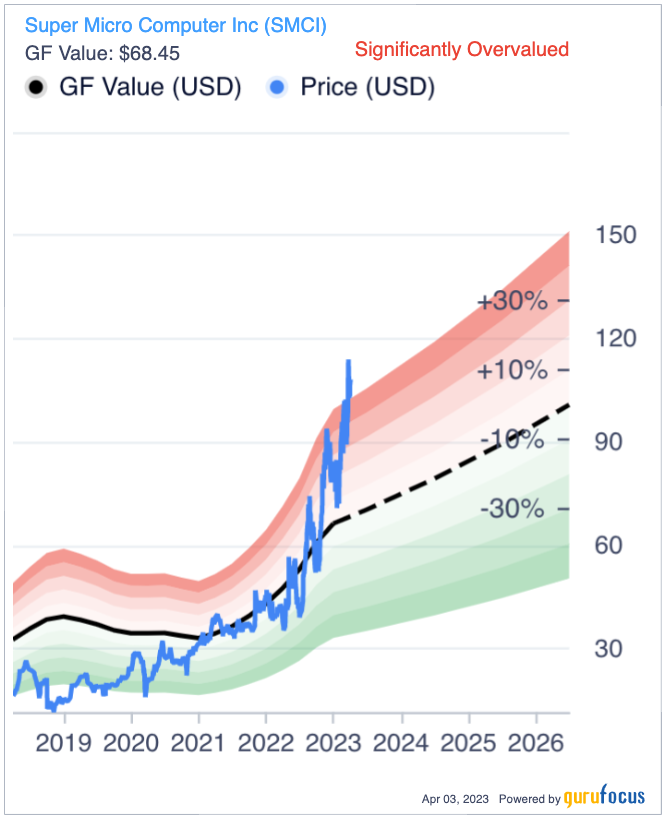

At first glance, there are steeply divergent views of Supermicros pricing based on several valuation models. For example, the GF Value chart, which is based on historical multiples, a proprietary adjustment factor for past stock returns and estimates of future business performance, sees significant overvaluation:

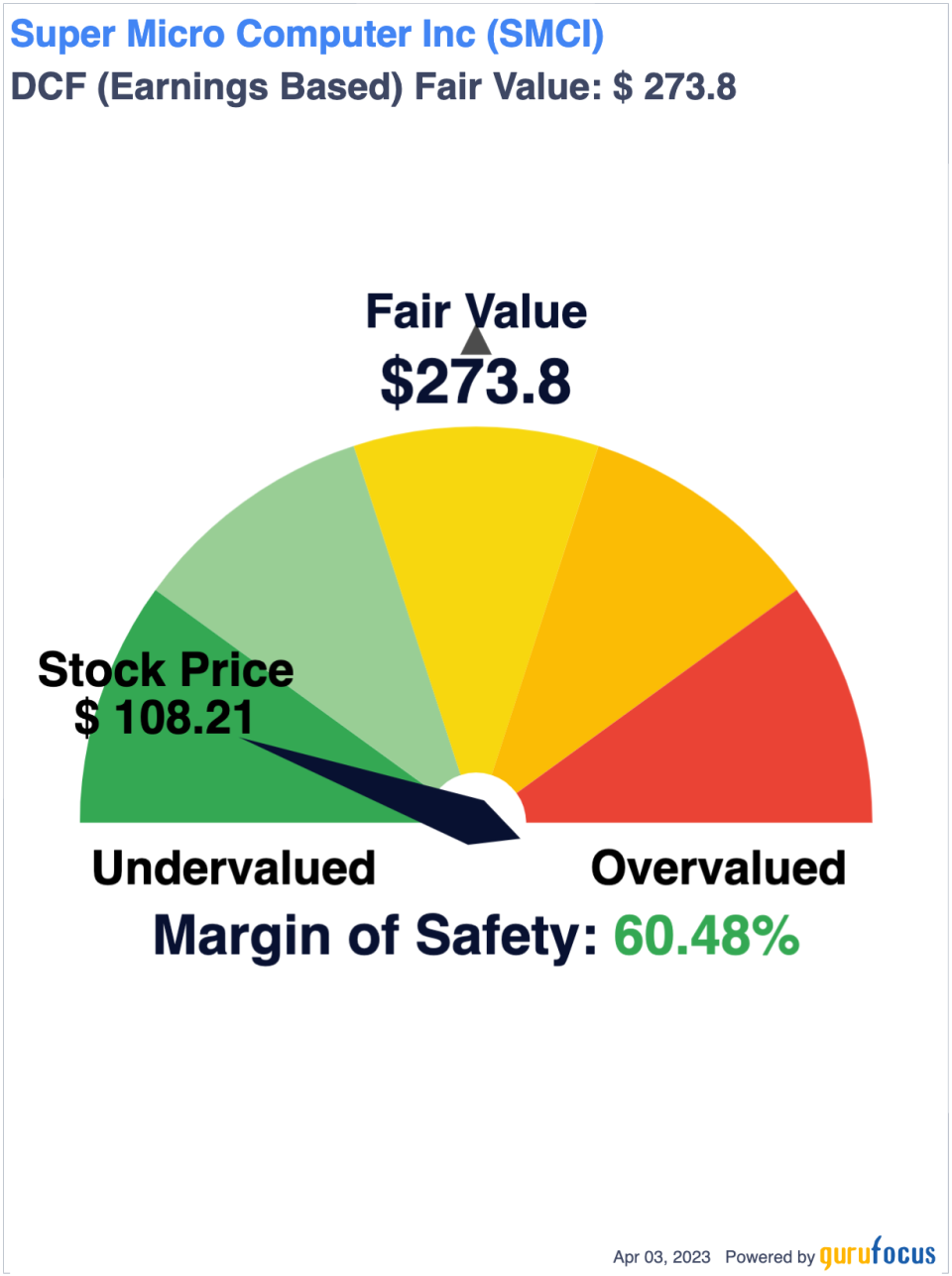

On the other hand, the discounted cash flow calculator considers the company deeply undervalued if we assume the historical 10-year EPS growth rate will continue over the next 10 years, combined with a discount rate of 10%.

The price-earnings ratio is 10.29, which is well below the hardware industry median of 18.84. The five-year Ebitda growth rate is 20.70%, meaning the PEG ratio is just 0.49, which is solidly in undervalued territory.

Turning to the five-year price chart, its immediately obvious Supermicro has enjoyed above average growth. Looking beyond that growth, though, we can see the sawtooth shape of the share price, indicating cyclicality.

During the three jumps and dips between June 2022 and January 2023, the stock fell $15 to $20 each cycle. That suggests a technical strategy could be profitable for short-term traders.

Gurus

According to GuruFoucs data, seven Premium investing gurus own shares of Supermicro. Out of those, four reduced their holdings according to their most recent 13F filings, while two others added Supermicro as a new holding and Jim Simons (Trades, Portfolio) of Renaissance Technologies increased his holding by 52.28% in the fourth quarter of 2022.

Investors should be aware that 13F reports do not provide a complete picture of a gurus holdings. They include only a snapshot of long equity positions in U.S.-listed stocks and American depository receipts as of the quarters end. They do not include short positions, non-ADR international holdings or other types of securities. However, even this limited filing can provide valuable information.

Institutional investors have only a modest share of the outstanding shares at 53.83%. Insiders own a large proportion of the shares at 13.62%.

President, Chairman and CEO Charles Liang is a 10% owner; he held 6,722,717 shares as of Feb. 10, 2023. Other insiders hold relatively small stakes.

Conclusion

Supermicro does not quite make it as a value stock in my opinion because it has debt and cyclical characteristics. I personally don't see much long-term value in the stock for these reasons, but it does have characteristics that could make it a good short-term opportunity. For patient growth investors, Supermicro may be worth it, if they can stomach the volatility.

This article first appeared on GuruFocus.