Super Micro Computer Stock Is Down 19% From 52-Week Highs: Here's Why That's Great News for Investors

Super Micro Computer (NASDAQ: SMCI) stock has been pulling back in recent sessions after the company revealed the pricing of its common stock offering, which would dilute existing shareholders. As it turns out, shares of the high-flying server manufacturer are down 19% from their 52-week high, which it hit on March 8.

Savvy investors looking to invest in a top artificial intelligence (AI) stock right now should consider capitalizing on Supermicro's drop by buying it hand over fist. Here's why.

Supermicro investors should focus on the bigger picture

Super Micro Computer is offering 2 million shares of its common stock for $875 per share. Moreover, underwriter Goldman Sachs has a 30-day option to purchase an additional 300,000 shares as a part of this offering.

The fact that this announcement came at a time when each Supermicro share was trading at just over $1,000 seems to have dented investor confidence. The company priced the sale at a discount, and the market was quick to press the panic button.

However, a look at the bigger picture will tell us that this is a smart move by Super Micro Computer management because the company aims to raise $1.75 billion in gross proceeds through this exercise. Management adds that the proceeds will be deployed for supporting "its operations, including for purchase of inventory and other working capital needs, manufacturing capacity expansion and increased R&D [research and development] investments."

The company's focus on expanding its manufacturing capacity is the right thing to do considering the booming demand for its server solutions that are used for deploying AI chips. On its fiscal 2024 second-quarter earnings conference call, Supermicro pointed out that the utilization rate of its production facilities in the U.S., Taiwan, and the Netherlands was 65%. Management also added that its remaining production capacity was quickly filling up.

Supermicro, therefore, needed to bring new production facilities online to cater to the fast-growing AI server market. Not surprisingly, CEO Charles Liang pointed out on the call:

To address this immediate capacity challenge, we are adding two new production facilities and warehouses near our Silicon Valley HQ, which will be operating in a few months. The new Malaysia facility will focus on expanding our building blocks with lower costs and increased volume, while other new sites will support our annual revenue capacity above $25 billion.

Supermicro is on track to generate $14.5 billion in revenue this fiscal year at the midpoint of its guidance range. That would be more than double the $7.1 billion in revenue it generated in fiscal 2023. Now that the company has already built up a revenue capacity of $25 billion, it would need to bring more capacity online, given how fast the market for AI servers has been growing.

According to Global Market Insights, the AI server market was worth an estimated $38 billion in 2023. By 2032, this market is expected to generate a whopping $177 billion in revenue, for a compound annual growth rate of 18% during the forecast period. Supermicro's share of AI servers has been improving since it has been growing at a much faster pace than this market.

Considering the lucrative end-market opportunity on offer in the long run, it would make sense for the company to grab a bigger share of this space. This probably explains why management has decided to capitalize on the stock's terrific surge this year and go for a stock offering to raise more capital. Additionally, Supermicro's pullback means investors can now buy it at a relatively cheaper valuation.

Another reason to buy the stock following the pullback

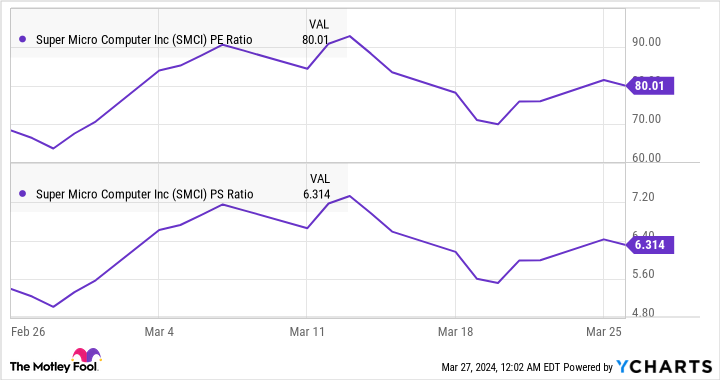

Supermicro's earnings and sales multiples have retreated of late.

The stock was trading at more than 90 times earnings at one point this month, while its sales multiple stood at almost 7.5. Some might argue that Supermicro is still expensive as far as its earnings multiple is concerned. However, buying the stock right now is a no-brainer.

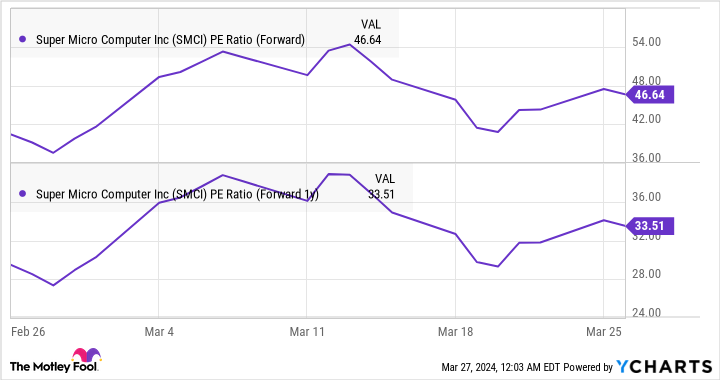

Supermicro's forward earnings multiples are significantly lower than the trailing price-to-earnings ratio because of the massive bottom-line growth that the company is predicted to deliver. Analysts expect Supermicro's earnings to increase a solid 86% in fiscal 2024, followed by a 40% jump in fiscal 2025 to $30.83 per share.

Now that Supermicro is looking to boost capacity through its common stock offering, there's a good chance it will be able to boost its manufacturing levels and deliver stronger growth, considering the market in which it operates. That's why savvy investors should consider buying this tech stock as it could regain momentum quickly.

Should you invest $1,000 in Super Micro Computer right now?

Before you buy stock in Super Micro Computer, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Super Micro Computer wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of March 25, 2024

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Super Micro Computer Stock Is Down 19% From 52-Week Highs: Here's Why That's Great News for Investors was originally published by The Motley Fool