Supernus Pharmaceuticals Inc (SUPN) Reports Robust Growth in Key Products for Full Year 2023

Net Sales Growth: Qelbree's net sales surged by 129% to $140.2 million in 2023, while GOCOVRI increased by 15% to $119.6 million.

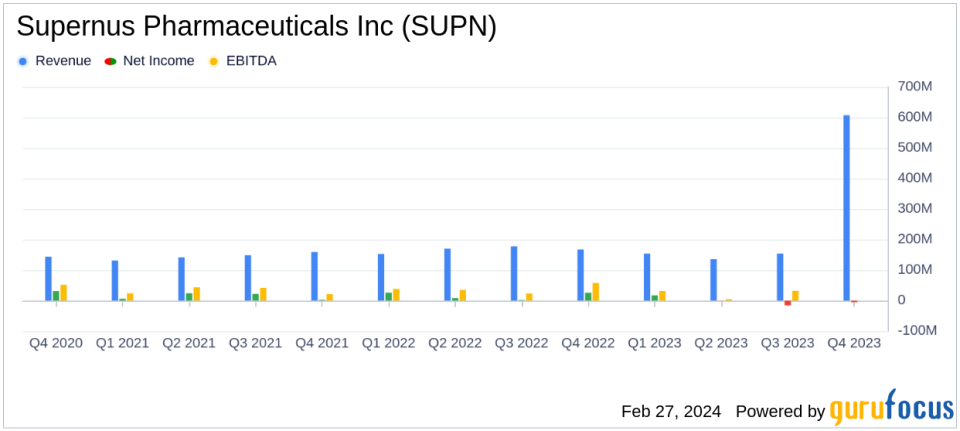

Total Revenue: Full year 2023 total revenues reached $607.5 million, with a non-GAAP increase of 26% excluding Trokendi XR net product sales.

Operating Earnings: Operating loss (GAAP) was $(5.3) million for 2023, with non-GAAP operating earnings of $125.1 million.

Net Earnings: Net earnings (GAAP) for the full year stood at $1.3 million, with diluted earnings per share at $0.02.

Balance Sheet: Cash, cash equivalents, and marketable securities were approximately $271.5 million as of December 31, 2023.

2024 Financial Guidance: Total revenue guidance set at $580 million to $620 million, with non-GAAP operating earnings projected between $80 million and $110 million.

On February 27, 2024, Supernus Pharmaceuticals Inc (NASDAQ:SUPN) released its 8-K filing, announcing financial results for the fourth quarter and full year of 2023. The company, a specialty pharmaceutical firm engaged in developing and commercializing products for central nervous system diseases, reported significant growth in its key products, Qelbree and GOCOVRI, which helped offset declines in legacy product sales.

Financial Performance and Challenges

Supernus Pharmaceuticals Inc (NASDAQ:SUPN) faced a challenging year with a decline in net product sales of Trokendi XR, which was partially offset by the growth of Qelbree and GOCOVRI. The company's total revenues for 2023 were $607.5 million, a 9% decrease from the previous year. However, when excluding Trokendi XR net product sales, the company saw a 26% increase in total revenues on a non-GAAP basis. This performance is critical as it reflects the company's ability to grow its newer products despite the challenges of declining sales from older, legacy products.

The operating loss for 2023 was $(5.3) million (GAAP), compared to operating earnings of $46.1 million in 2022. This decline was primarily due to a decrease in net product sales of Trokendi XR and impairment charges, particularly related to XADAGO. However, non-GAAP operating earnings were $125.1 million for the year, highlighting the company's ability to maintain profitability when adjusting for non-cash items and other specified items.

Financial Achievements and Importance

The growth in net sales of Qelbree and GOCOVRI is a testament to the company's strategic focus on its growth products. Qelbree's net sales increased by 129% to $140.2 million in 2023, while GOCOVRI's net sales grew by 15% to $119.6 million. These achievements are significant for Supernus Pharmaceuticals Inc (NASDAQ:SUPN) and the drug manufacturing industry, as they demonstrate the company's capacity to drive revenue growth through its diversified neuroscience portfolio, despite the competitive market and the inherent challenges of product lifecycle management.

Key Financial Metrics and Commentary

President and CEO Jack Khattar expressed confidence in the company's trajectory, stating:

"Our performance in 2023 underscores our strong execution, with combined full year 2023 net sales of $259.8 million for our growth products, Qelbree and GOCOVRI, which far exceeded the decline in net sales of Trokendi XR. Furthermore, that represents 57% growth compared to full year 2022."

He also highlighted the robust growth of Qelbree, which saw a 91% increase in prescriptions and benefited from an improved gross-to-net adjustment, resulting in significant growth in net sales.

Looking ahead to 2024, Supernus anticipates continued growth across its key products and the launch of SPN-830 in the second half of the year. The company has provided full-year 2024 total revenue guidance of $580 million to $620 million and operating earnings (non-GAAP) guidance of $80 million to $110 million.

Analysis of Company Performance

Supernus Pharmaceuticals Inc (NASDAQ:SUPN) is navigating a transitional phase, moving from legacy products to growth products. The company's ability to increase net sales of its growth products is a positive indicator of its strategic direction and execution. However, the decline in net product sales of Trokendi XR and the impairment charges related to XADAGO underscore the challenges faced by the company in a dynamic pharmaceutical market.

The company's balance sheet remains solid, with a substantial cash reserve, although it has decreased from the previous year due to the repayment of convertible senior notes. This financial stability provides Supernus with the flexibility to invest in research and development and to bring new products to market.

Overall, Supernus Pharmaceuticals Inc (NASDAQ:SUPN) has demonstrated resilience and strategic acumen in its financial performance for the full year 2023. The company's focus on growth products and pipeline development positions it well for future success, although it must continue to navigate the challenges of product lifecycle management and market competition.

For more detailed insights and analysis, investors and interested parties are encouraged to visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Supernus Pharmaceuticals Inc for further details.

This article first appeared on GuruFocus.