Supernus Pharmaceuticals (NASDAQ:SUPN) investors are up 3.6% in the past week, but earnings have declined over the last three years

By buying an index fund, you can roughly match the market return with ease. But if you buy good businesses at attractive prices, your portfolio returns could exceed the average market return. Just take a look at Supernus Pharmaceuticals, Inc. (NASDAQ:SUPN), which is up 64%, over three years, soundly beating the market return of 18% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 37% in the last year.

Since the stock has added US$76m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

View our latest analysis for Supernus Pharmaceuticals

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last three years, Supernus Pharmaceuticals failed to grow earnings per share, which fell 30% (annualized).

Thus, it seems unlikely that the market is focussed on EPS growth at the moment. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

It may well be that Supernus Pharmaceuticals revenue growth rate of 18% over three years has convinced shareholders to believe in a brighter future. If the company is being managed for the long term good, today's shareholders might be right to hold on.

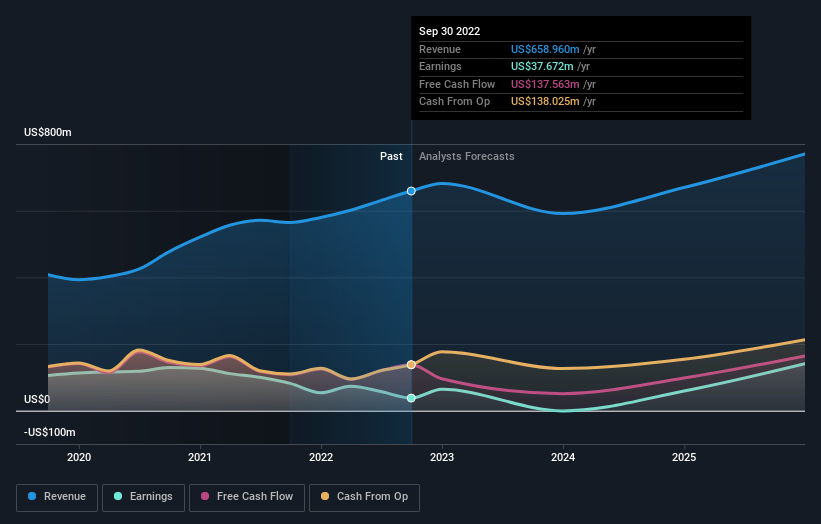

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Take a more thorough look at Supernus Pharmaceuticals' financial health with this free report on its balance sheet.

A Different Perspective

We're pleased to report that Supernus Pharmaceuticals shareholders have received a total shareholder return of 37% over one year. That certainly beats the loss of about 1.4% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Supernus Pharmaceuticals has 2 warning signs we think you should be aware of.

But note: Supernus Pharmaceuticals may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here