Supernus Pharmaceuticals (SUPN): A Hidden Gem in the Market? A Comprehensive Analysis of Its ...

Supernus Pharmaceuticals Inc (NASDAQ:SUPN) has recently seen a daily gain of 2.28%, despite a 3-month loss of -3.88%. With an Earnings Per Share (EPS) of 0.73, the question arises: is the stock modestly undervalued? This article provides an in-depth valuation analysis of Supernus Pharmaceuticals, encouraging readers to delve into the company's financials and intrinsic value.

Introduction to Supernus Pharmaceuticals

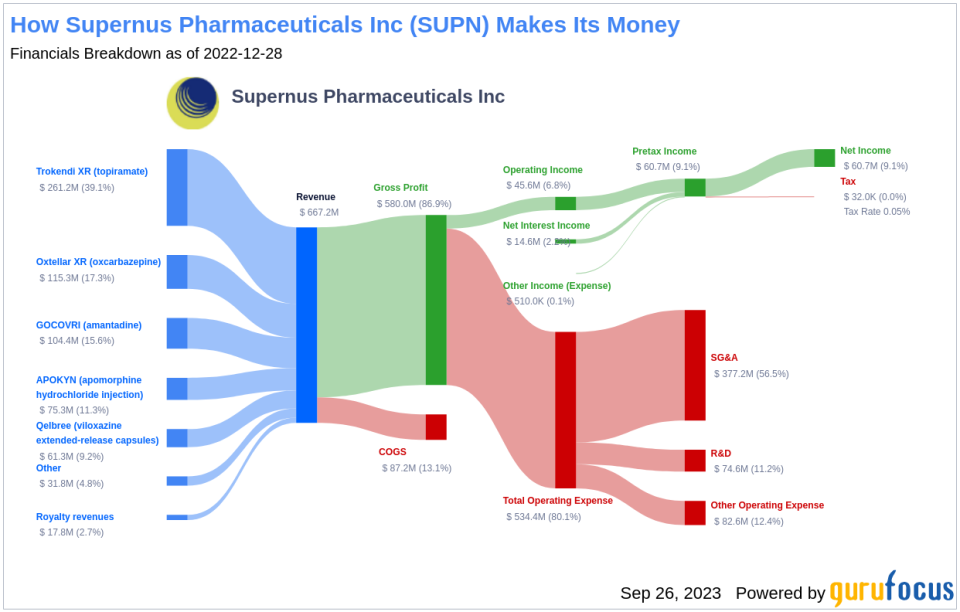

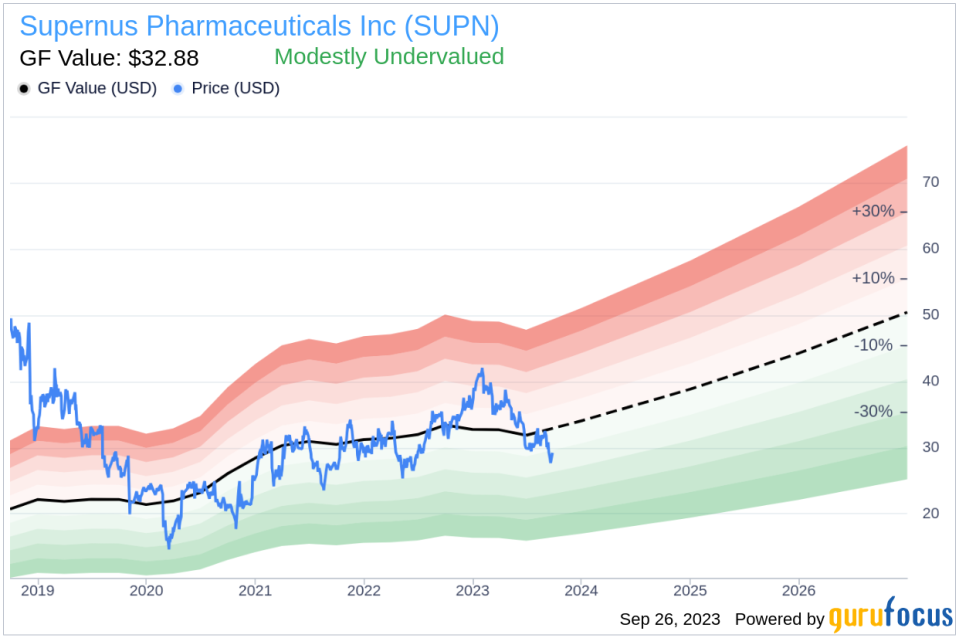

Supernus Pharmaceuticals Inc is a specialty pharmaceutical company engaged in developing and commercializing products for the treatment of central nervous system diseases, including neurological and psychiatric disorders. The company's diverse neuroscience portfolio includes approved treatments for epilepsy, migraine, and attention-deficit hyperactivity disorder (ADHD), among others. With a current stock price of $29.21 and a GF Value of $32.88, Supernus Pharmaceuticals appears to be modestly undervalued.

Understanding the GF Value

The GF Value represents the current intrinsic value of a stock derived from our exclusive method. It is calculated based on historical trading multiples, a GuruFocus adjustment factor based on the company's past performance and growth, and future business performance estimates. The GF Value Line on our summary page gives an overview of the fair value that the stock should be traded at.

According to GuruFocus Value calculation, the stock of Supernus Pharmaceuticals (NASDAQ:SUPN) appears to be modestly undervalued. At its current price of $29.21 per share and the market cap of $1.60 billion, Supernus Pharmaceuticals stock is likely to deliver higher returns than its business growth due to its undervalued status.

Financial Strength of Supernus Pharmaceuticals

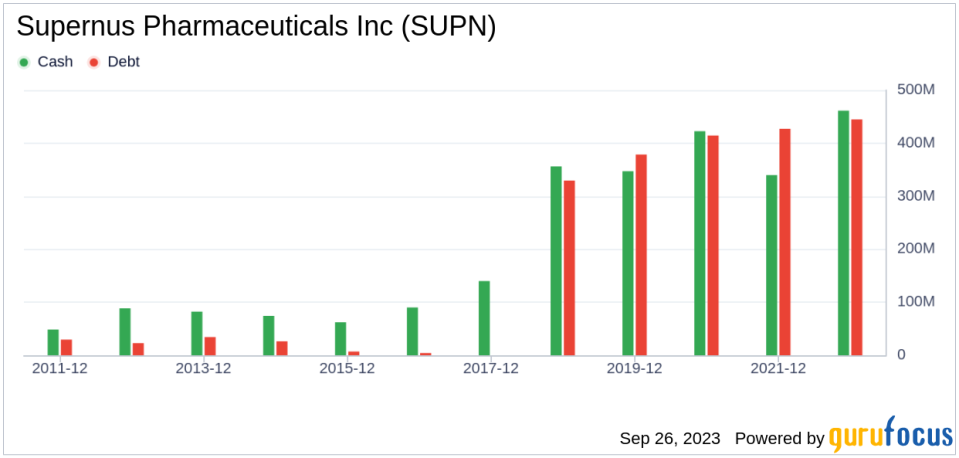

Before investing, it's crucial to assess the financial strength of a company. Investing in companies with poor financial strength carries a higher risk of permanent loss. Supernus Pharmaceuticals has a cash-to-debt ratio of 3.59, superior to 67.3% of 1058 companies in the Drug Manufacturers industry. This indicates that the financial strength of Supernus Pharmaceuticals is strong.

Profitability and Growth of Supernus Pharmaceuticals

Investing in profitable companies, especially those with consistent profitability over the long term, is typically less risky. Supernus Pharmaceuticals has been profitable 8 times over the past 10 years. Its operating margin is 2.78%, which ranks worse than 57.94% of 1051 companies in the Drug Manufacturers industry. However, the overall profitability of Supernus Pharmaceuticals is ranked 8 out of 10, indicating strong profitability.

Growth is probably the most important factor in the valuation of a company. The 3-year average annual revenue growth rate of Supernus Pharmaceuticals is14%, which ranks better than 73.81% of 924 companies in the Drug Manufacturers industry. However, the 3-year average EBITDA growth rate is -8.9%, which ranks worse than 76.44% of 887 companies in the Drug Manufacturers industry.

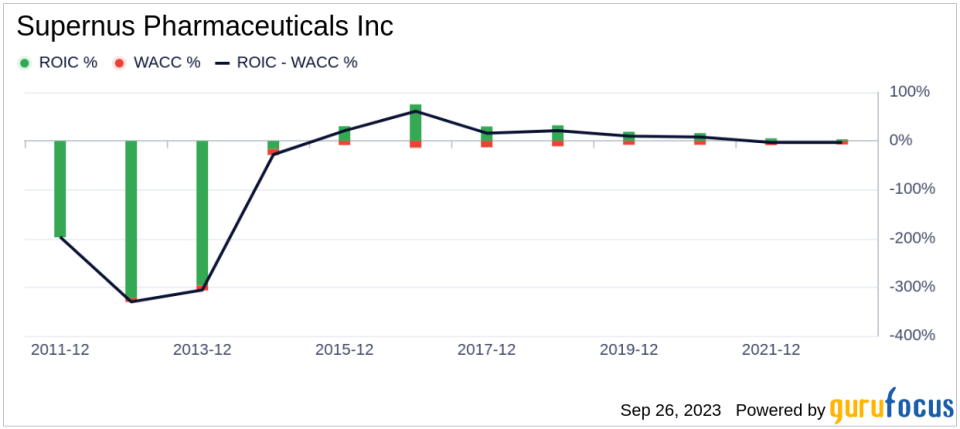

ROIC vs WACC

Comparing a company's return on invested capital (ROIC) to its weighted cost of capital (WACC) is another way to evaluate its profitability. If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Supernus Pharmaceuticals's ROIC was 2.1, while its WACC came in at 6.8.

Conclusion

In conclusion, the stock of Supernus Pharmaceuticals (NASDAQ:SUPN) gives every indication of being modestly undervalued. The company's financial condition is strong and its profitability is strong. However, its growth ranks worse than 76.44% of 887 companies in the Drug Manufacturers industry. To learn more about Supernus Pharmaceuticals stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.