Supply Chain Issues Push French Trainmaker To The Brink

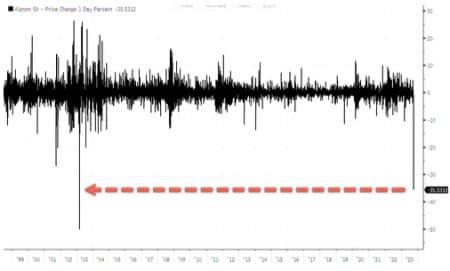

Shares of the French train maker Alstom crashed as much as 38%, and its bonds fell the most on record on Thursday, following the company's disclosure of preliminary financial information indicating a significant decline in its free cash flow projections, attributed to rising inventories.

The results showed Alstom's free cash flow had plunged from -45 million euros to a whopping -1.15 billion euros. It now expects negative 500-750 million euros for the full year, compared with earlier forecasts that were "significantly positive."

FIRST-HALF RESULTS

Alstom forecast negative free cash flow for the full year; the guidance missed the average analyst estimate.

2024 YEAR FORECAST

Sees negative free cash flow EU500 million to EU750 million, estimate positive EU287.5 million (Bloomberg Consensus)

Still sees adjusted Ebit margin about 6%, estimated 6.16%

Alstom has the world's most extensive portfolio of components for the rail sector. This news concerns Wall Street analysts who warn that a capital raise could be nearing.

Deutsche Bank analyst Gael de-Bray told clients the warning is a "major blow" to top executives' credibility. The analyst sees a capital increase that is "increasingly likely" due to the troubled $5.5 billion acquisition of Canadian manufacturer Bombardier.

Shares of Alstom trading on the Paris Stock Exchange crashed 35%. Biggest one day crash in two decades.

Bonds of the French train maker due 2029 sank more than 3% - the most on record - to about 78 cents on the euro.

Alstom blamed surging inventories on supply chain snarls in the US and Europe:

This, combined with tight supply chain conditions, resulted in a significant increase in the level of inventories and contract assets built in order to avoid production disruption and delivery delays during the first half of the year, particularly in Americas and in Europe.

Here's what other Wall Street analysts are saying (courtesy of Bloomberg):

Jefferies (buy)

Analyst Simon Toennessen says hit from delay in completing UK Aventra program and the significant revising down of free cash flow are key focus

Despite this, orders and organic growth were "decent" in 1H

Strong market momentum and orders to be booked in 2H should help support a recovery, but inventory normalization will take more time

Citi (buy)

Results update points toward a significant cash drag in 1H24, analyst Martin Wilkie writes

Notes that Alstom wouldn't be drawn on free cash flow guidance for FY25, and based on track record means cash improvement is very much a "show me" story

Although Alstom has ruled out an equity raise, expect shares to remain depressed ahead of full results on Nov. 15.

The French government will likely intervene if the situation worsens.

By Zerohedge.com

More Top Reads From Oilprice.com: