Surgery Partners Inc (SGRY) Reports Solid Revenue and EBITDA Growth in Full Year 2023 Results

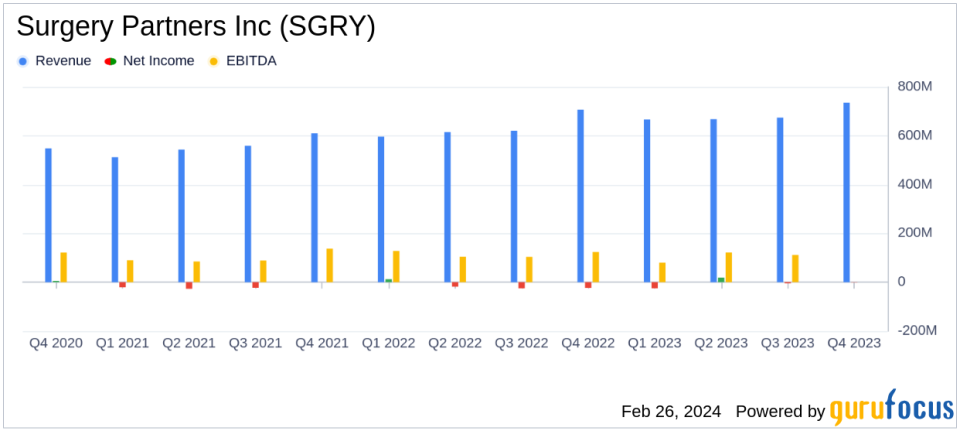

Annual Revenue Growth: Revenue increased by 8.0% to $2.74 billion in 2023.

Quarterly Revenue Growth: Fourth quarter revenue rose by 4.0% to $735.4 million.

Adjusted EBITDA Growth: Full-year Adjusted EBITDA grew by 15.2% to $438.1 million.

Net Loss: Net loss attributable to common stockholders was $11.9 million for the full year and $1.0 million for the fourth quarter.

2024 Outlook: Revenue for 2024 is projected to be greater than $3.0 billion with Adjusted EBITDA expected to exceed $495 million.

Surgery Partners Inc (NASDAQ:SGRY) released its 8-K filing on February 26, 2024, announcing its financial results for the fourth quarter and full year ended December 31, 2023. The company, a leading operator of short-stay surgical facilities, reported an 8.0% increase in annual revenue to $2.74 billion and a 4.0% increase in fourth-quarter revenue to $735.4 million compared to the same periods in 2022.

Surgery Partners Inc operates in approximately 30 states, providing a range of healthcare services through its two segments: Surgical Facility Services and Ancillary Services. The Surgical Facility Services segment, which drives the majority of the company's revenue, saw significant growth, contributing to the overall positive financial results.

The company's performance is particularly noteworthy given the challenges faced by the healthcare industry, including regulatory changes and competitive pressures. The growth in revenue and Adjusted EBITDA reflects the company's ability to navigate these challenges effectively. Adjusted EBITDA margins also improved, reaching 16.0% for the full year and 19.4% for the fourth quarter of 2023.

Financial Highlights and Challenges

The company's net loss attributable to common stockholders was $11.9 million for the full year and $1.0 million for the fourth quarter. Despite the net losses, the company's Adjusted EBITDA saw a significant increase, with a 15.2% growth to $438.1 million for the full year and a 17.8% increase to $142.3 million for the fourth quarter compared to the previous year. This growth in Adjusted EBITDA is a critical metric for Surgery Partners Inc, as it indicates the company's operational efficiency and profitability before interest, taxes, depreciation, and amortization.

Wayne DeVeydt, Chairman of the Board, expressed satisfaction with the mid-teens growth in 2023 Adjusted EBITDA, attributing it to strategic initiatives that will further catalyze growth into 2024. CEO Eric Evans highlighted the company's consistent growth story and the strong momentum entering 2024, supported by same-facility revenue growth of over 11% in 2023.

Chief Financial Officer Dave Doherty commented on the disciplined management approach and the benefits of multi-year growth investments. He also noted the successful credit facility refinancing in December 2023, which effectively shifted material debt maturities to the end of the decade while reducing interest costs. The company's liquidity position is near $900 million, bolstering confidence in its ability to continue funding accretive mergers and acquisitions (M&A).

Income Statement and Balance Sheet Summary

The company's balance sheet shows cash and cash equivalents of $195.9 million and a borrowing capacity of $694.3 million under its revolving credit facility as of December 31, 2023. Operating cash flows increased significantly to $293.8 million for the full year, compared to $158.8 million in 2022. Free Cash Flow for the full year was $109.9 million.

The ratio of total net debt to EBITDA is now 3.5x, reflecting the company's stable financial leverage. Looking ahead, Surgery Partners Inc projects 2024 revenues to exceed $3.0 billion and Adjusted EBITDA to be greater than $495 million, indicating a positive outlook for the next fiscal year.

Analysis and Future Prospects

The company's solid performance in revenue and Adjusted EBITDA growth, along with its positive guidance for 2024, suggests a strong financial position and the potential for continued growth. The strategic initiatives and investments made by Surgery Partners Inc appear to be paying off, positioning the company to capitalize on industry trends and achieve sustainable growth.

For value investors and potential GuruFocus.com members, Surgery Partners Inc's latest earnings report presents an opportunity to consider the company's growth trajectory and operational efficiency. The company's ability to generate increased Adjusted EBITDA and manage its debt effectively, despite the net losses, may be of particular interest to those focused on long-term value creation.

To learn more about Surgery Partners Inc and its financial performance, interested parties are encouraged to visit the company's website and review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Surgery Partners Inc for further details.

This article first appeared on GuruFocus.