Surmodics Inc (SRDX) Posts Revenue Growth and Narrows Net Loss in Q1 Fiscal 2024

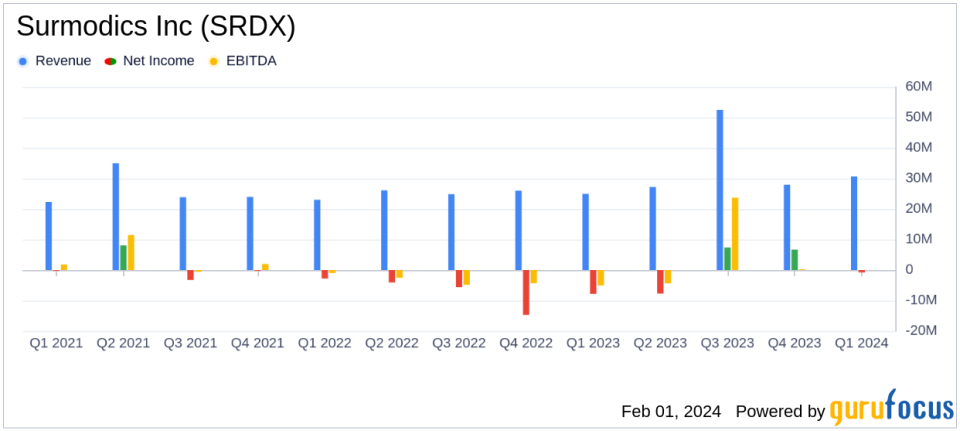

Total Revenue: Increased by 23% year-over-year to $30.6 million.

Medical Device Segment: Revenue up 24% with record product sales.

GAAP Net Loss: Improved to $(0.8) million from $(7.8) million in the prior-year period.

Adjusted EBITDA: Turned positive at $3.9 million, a significant improvement from the prior-year period.

Product Gross Margin: Decreased to 53.2% from 63.0% due to sales mix and production inefficiencies.

Operating Costs: Decreased by 18% year-over-year, reflecting lower R&D and SG&A expenses.

Cash Position: Ended the quarter with $35.2 million in cash and investments.

On February 1, 2024, Surmodics Inc (NASDAQ:SRDX) released its 8-K filing, detailing financial results for the first quarter of fiscal year 2024, which ended on December 31, 2023. The company, a leading provider of medical device and in vitro diagnostic technologies, reported a significant year-over-year increase in total revenue and a substantial reduction in net loss, signaling a strong start to the fiscal year.

Surmodics Inc (NASDAQ:SRDX) operates in two primary segments: Medical Device, which focuses on performance coatings for a variety of medical devices, and In Vitro Diagnostics, which produces components for diagnostic tests and research. The majority of the company's revenue is derived from the Medical Device segment, which saw a notable increase in product sales, particularly from the vascular interventions portfolio.

Financial Performance Highlights

The company's revenue growth was driven by a 24% increase in the Medical Device segment, with product sales climbing by 43% year-over-year, largely due to the success of the SurVeil drug-coated balloon and Pounce thrombectomy products. The In Vitro Diagnostics segment also contributed to the growth, with an 18% increase in revenue.

Despite the positive revenue trends, the product gross margin experienced a decline from the previous year, attributed to the sales of newer products that have not yet achieved scale and the associated production inefficiencies. However, Surmodics Inc (NASDAQ:SRDX) managed to reduce operating costs significantly, primarily due to lower research and development expenses and the implementation of a spending reduction plan.

The company's balance sheet remains robust, with $35.2 million in cash and investments. However, there was an increase in total cash used, which amounted to $10.2 million for the quarter.

Operational and Strategic Developments

Surmodics Inc (NASDAQ:SRDX) highlighted several key operational achievements, including the launch of the Preside medical device coating technology and the presentation of positive clinical trial data for its SurVeil and Sundance drug-coated balloons. Additionally, the early clinical use of the Pounce LP Thrombectomy System was announced, addressing a critical need in thrombectomy procedures.

President and CEO Gary Maharaj expressed satisfaction with the quarter's results and the company's operational progress. He stated,

We delivered total revenue growth in the first quarter that exceeded our expectations, increasing 23% year-over-year 25% excluding SurVeil DCB license fees(1) with impressive performance in both our Medical Device and In Vitro Diagnostics business segments."

Updated Fiscal Year 2024 Guidance

Based on the strong performance in the first quarter, Surmodics Inc (NASDAQ:SRDX) has raised its fiscal 2024 total revenue and EPS guidance. The company now expects total revenue to range from $117 million to $121 million, with a GAAP diluted loss per share ranging from $(1.40) to $(1.10). The updated guidance reflects the company's confidence in achieving total revenue growth of 10% or higher for the full year, excluding SurVeil DCB license fees.

Surmodics Inc (NASDAQ:SRDX) will host a conference call to discuss the first-quarter results and provide further insights into the company's strategic objectives and outlook for the remainder of the fiscal year.

For value investors and potential GuruFocus.com members, Surmodics Inc (NASDAQ:SRDX)'s latest earnings report demonstrates a company on the rise, with improved financial metrics and strategic advancements that may position it for sustainable long-term growth. The company's commitment to innovation and operational efficiency, coupled with a solid financial foundation, make it a noteworthy consideration in the Medical Devices & Instruments industry.

Explore the complete 8-K earnings release (here) from Surmodics Inc for further details.

This article first appeared on GuruFocus.