Surmodics (SRDX) Q3 Earnings Beat Estimates, Guidance Raised

Surmodics, Inc. SRDX delivered adjusted earnings per share (EPS) of 15 cents in third-quarter fiscal 2019 which surpassed the Zacks Consensus Estimate by a whopping 200%. The bottom line however declined 44.4% from the year-ago quarter.

Reported EPS came in at 11 cents against reported loss per share of 20 cents a year ago.

Revenues in the quarter increased 9.5% year over year to $24.3 million. This figure outpaced the Zacks Consensus Estimate by 6.6%.

Fiscal Q3 Highlights

In the quarter under review, Product sales were $9.9 million, down 5.7% year over year. Royalty and license fee revenues totaled $11.6 million, up 20.8% from the prior-year quarter. Research, development and other were $2.9 million, up 31.8% year over year.

In the reported quarter, enrolments under Surmodics’ TRANSCEND clinical trial continued and 90% of it was completed.

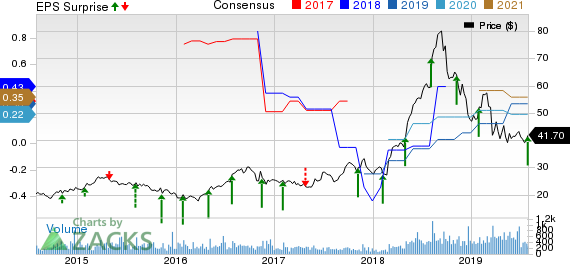

Surmodics, Inc. Price, Consensus and EPS Surprise

Surmodics, Inc. price-consensus-eps-surprise-chart | Surmodics, Inc. Quote

Segmental Analysis

Medical Device

In the reported quarter, sales at the segment rose 13% to $18.9 million, including $2 million from the SurVeil agreement with Abbott. The Medical Device business unit recorded $0.8 million of operating income in the third quarter against an operating loss of $6.2 million a year ago.

In Vitro Diagnostics

In the quarter under review, sales declined 2% to $5.4 million. Operating income at the segment was $2.5 million in the reported quarter, up 13.6% from the same period last year.

Operational Details

Gross profit rose 15.8% to $20.9 million during the quarter. Gross margin expanded 465 bps to 86.2%.

Surmodics registered Product costs of $3.4 million in the quarter, down 18% year over year.

The company’s research and development costs totaled $13.3 million, up 36.2% year over year.

Selling, general and administrative expenditures were almost $5.9 million, down 0.6% from the prior-year quarter.

Adjusted operating costs and expenses in the quarter were $19.3 million, up 22.2% year over year. Adjusted operating margin contracted 359 bps to 7.1%.

Fiscal 2019 Guidance Raised

Surmodics raised its fiscal 2019 revenue expectation to $92-94 million from the earlier $88.5-91.5 million. The Zacks Consensus Estimate for the metric is pegged at $91.2 million, below the guided range.

Adjusted EPS is now projected between 41 cents and 49 cents compared with the previous projection of 26-36 cents. The Zacks Consensus Estimate for the metric is pegged at 30 cents, much below the guided range.

Our Take

Surmodics exited the fiscal third quarter on a strong note with EPS and revenues outpacing estimates. The company continues to gain from its core Medical Devices unit, which saw significant contribution from the SurVeil deal with Abbott in the quarter. Management is also upbeat about the ongoing TRANSCEND enrolment. A raised guidance for fiscal 2019 buoys optimism.

On the flip side, surging operating expenses raise concern. Softness in IVD and product sales are disheartening as well. Contraction in operating margin adds to the woes.

Zacks Rank & Other Key Picks

Surmodics currently carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks, which posted solid results this earning season, are Stryker Corporation SYK, Baxter International Inc. BAX and Intuitive Surgical, Inc. ISRG.

Stryker delivered second-quarter 2019 adjusted EPS of $1.98, beating the Zacks Consensus Estimate by 2.6%. Revenues of $3.65 billion surpassed the Zacks Consensus Estimate by 1.4%. The company carries a Zacks Rank of 2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Baxter delivered second-quarter 2019 adjusted EPS of 89 cents, which surpassed the Zacks Consensus Estimate of 81 cents by 9.9%. Revenues of $2.84 billion beat the Zacks Consensus Estimate of $2.79 billion by 1.9%. The company holds a Zacks Rank #2.

Intuitive Surgical reported second-quarter 2019 adjusted EPS of $3.25, which beat the Zacks Consensus Estimate of $2.85. Revenues were $1.1 billion, surpassing the Zacks Consensus Estimate of $1.03 billion. The company sports a Zacks Rank #1.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana. Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Surmodics, Inc. (SRDX) : Free Stock Analysis Report

Stryker Corporation (SYK) : Free Stock Analysis Report

Baxter International Inc. (BAX) : Free Stock Analysis Report

To read this article on Zacks.com click here.