Surmodics' (SRDX) Receipt of New FDA Nod to Boost Patient Care

Surmodics, Inc. SRDX announced its receipt of the FDA’s 510(k) clearance for its Pounce LP (Low Profile) Thrombectomy System. The system, which is the latest addition to its Pounce platform, is indicated for use in vessels ranging from 2 mm to 4 mm in diameter, which are typical sizes of vessels found below the knee.

Surmodics expects to initiate limited market evaluation (LME) for the Pounce LP Thrombectomy System by the end of the first quarter of fiscal 2024. The company is planning the commercialization following the completion of the LME.

The latest regulatory clearance is expected to boost Surmodics’ vascular intervention medical devices business under the broader Medical Device segment and solidify its foothold in the niche space.

Significance of the Approval

The Pounce Thrombectomy System was introduced in 2021 and was intended for the non-surgical removal of thrombi (a blood clot that forms in a vein) and emboli (anything that moves through the blood vessels until it reaches a vessel that is too small to let it pass) from the peripheral arterial vasculature in vessels of 3.5 mm to 6 mm in diameter. The Pounce LP Thrombectomy System is expected to allow efficient clot removal in below-the-knee peripheral arteries. This will likely expand the addressable market for the Pounce platform.

Per management, the latest FDA approval is expected to extend the range of treatment for the Pounce platform to include the removal of organized thrombotic or embolic occlusions in smaller vessels below the knee. Catheter-directed thrombolysis in these vessels is limited against organized clots and requires ICU admission, while small-diameter aspiration thrombectomy devices may struggle to remove organized material in the distal lower extremity.

Following the FDA’s clearance, the treatment range of the Pounce platform is likely to be expanded to address tibial clots, an important component of treatment in this vulnerable patient population. This, in turn, is likely to boost patient outcomes.

Industry Prospects

Per a report by Allied Market Research, the global thrombectomy devices market was valued at $1.3 billion in 2020 and is anticipated to reach $2.6 billion by 2030 at a CAGR of 7.4%. Factors like the increase in the incidence of cardiovascular diseases and growth in demand for minimally invasive procedures are likely to drive the market.

Given the market potential, the latest regulatory clearance raises optimism about Surmodics.

Notable Development

In April, Surmodics reported its second-quarter fiscal 2023 results, wherein it witnessed a solid uptick in the overall top line. The company registered robust revenues in its Medical Device segment as well as in its Product sales, and Research, development and other revenues. During the quarter, Surmodics saw strong contributions from sales of its Pounce and Sublime products, indicating their continued solid demand.

The same month, Surmodics announced the enrollment of the first patient in PROWL, the Pounce Thrombectomy System Retrospective Registry. PROWL is an open-label, retrospective, multi-center U.S. registry of the Surmodics Pounce system for the non-surgical removal of emboli and thrombi in the peripheral arterial vasculature.

Also, in April, Surmodics announced the first usage of the company’s Sublime radial access microcatheter. The Sublime microcatheter is currently in limited market evaluation. The full suite of Sublime microcatheters will be launched in fiscal 2024.

Price Performance

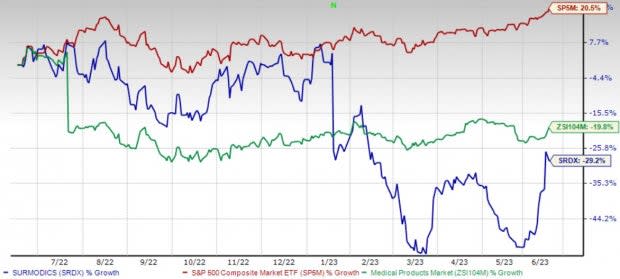

Shares of Surmodics have lost 29.2% in the past year compared with the industry’s 19.8% decline. The S&P 500 has risen 20.5% in the said time frame.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

Currently, Surmodics carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are Hologic, Inc. HOLX, Merit Medical Systems, Inc. MMSI and Boston Scientific Corporation BSX.

Hologic, carrying a Zacks Rank #2 at present, has an estimated growth rate of 5.1% for fiscal 2024. HOLX’s earnings surpassed estimates in all the trailing four quarters, the average being 27.3%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hologic has gained 19.4% compared with the industry’s 19.9% rise in the past year.

Merit Medical, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11%. MMSI’s earnings surpassed estimates in all the trailing four quarters, the average surprise being 20.2%.

Merit Medical has gained 58.1% compared with the industry’s 21.7% rise over the past year.

Boston Scientific, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 11.5%. BSX’s earnings surpassed estimates in two of the trailing four quarters and missed in the other two, the average surprise being 1.9%.

Boston Scientific has gained 49.9% against the industry’s 19.8% decline over the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Boston Scientific Corporation (BSX) : Free Stock Analysis Report

Hologic, Inc. (HOLX) : Free Stock Analysis Report

Surmodics, Inc. (SRDX) : Free Stock Analysis Report

Merit Medical Systems, Inc. (MMSI) : Free Stock Analysis Report