Sutro Biopharma Inc (STRO) Earnings: A Mixed Bag Amidst Strategic Advances

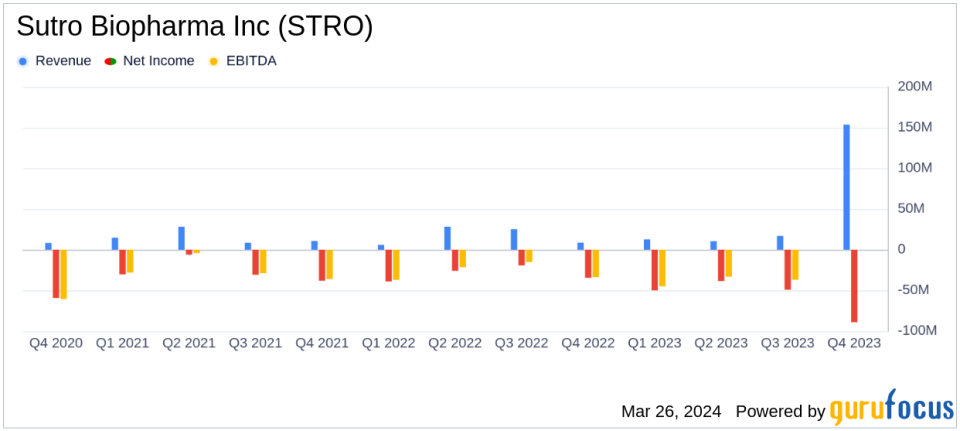

Revenue: Soared to $153.7 million for FY 2023, a significant increase from $67.8 million in the prior year, primarily due to strategic collaborations.

Net Loss: Widened to $(106.793) million or $(1.78) per share, compared to $(119.204) million or $(2.35) per share in FY 2022.

Cash Position: Robust with $333.7 million in cash, cash equivalents, and marketable securities, plus $41.9 million in Vaxcyte stock, extending runway into H2 2025.

Operating Expenses: Increased to $243.0 million for 2023, up from $196.7 million in 2022, reflecting investment in research and development.

Strategic Milestones: Highlighted luveltamab tazevibulin's potential, advanced clinical trials, and fortified leadership with key promotions.

On March 25, 2024, Sutro Biopharma Inc (NASDAQ:STRO) released its 8-K filing, detailing its financial results for the full year 2023. The clinical-stage company, known for its innovative cancer therapeutics, reported significant revenue growth, largely attributed to its strategic collaborations and licensing agreements. However, the company's net loss widened, and operating expenses surged as it continued to invest heavily in its research and development efforts.

Sutro Biopharma Inc is at the forefront of drug discovery, development, and manufacturing, focusing on next-generation protein therapeutics for cancer and autoimmune disorders. Its proprietary integrated cell-free protein synthesis platform, XpressCF, has enabled the development of promising products such as STRO-001 and STRO-002, aimed at treating multiple myeloma, non-Hodgkin lymphoma, ovarian, and endometrial cancers.

Financial Performance and Challenges

The company's financial performance reflects a strong year in terms of revenue, which was primarily driven by the Vaxcyte manufacturing rights agreement and collaborations with Astellas and Merck. This revenue surge is critical as it helps fund Sutro's extensive R&D pipeline, which is vital for a biotechnology firm where success hinges on the ability to innovate and bring new therapies to market.

Despite the revenue upswing, Sutro's net loss and operating expenses for the year indicate the costly nature of advancing clinical programs. The increased expenses are part of the company's strategic growth and reflect ongoing investment in its pipeline, which includes the promising ADC luveltamab tazevibulin (luvelta). However, these financial challenges underscore the importance of efficient capital management and the need to balance R&D spending with financial sustainability.

Strategic Milestones and Outlook

Throughout the year, Sutro achieved several milestones, including the advancement of luvelta in clinical trials for various cancers and the promotion of Jane Chung to President and COO. These milestones are not just operational successes but also strategic moves that strengthen the company's leadership and potential market positioning.

Looking ahead, Sutro plans to initiate additional trials and IND submissions, which are critical steps in bringing its therapies closer to commercialization. The company's cash runway projection into the second half of 2025 provides a buffer to reach these milestones, although the current challenging financing environment warrants careful financial stewardship.

Key Financial Details

Notable aspects of Sutro's financials include:

A strong cash and investment position, providing a runway into H2 2025.

An unrealized gain of $9.9 million from the increase in value of Vaxcyte common stock, showcasing the strategic value of equity holdings.

A substantial increase in revenue year-over-year, highlighting successful collaboration efforts.

Significant investment in R&D, essential for the company's long-term success but also a contributor to the net loss.

In conclusion, Sutro Biopharma Inc (NASDAQ:STRO) has demonstrated a capacity for strategic growth and revenue generation, yet it faces the ongoing challenge of managing its R&D expenses. The company's focus on advancing its clinical programs will be crucial for future success, and its solid cash position provides some stability as it navigates the path towards potential commercialization of its innovative therapies.

Explore the complete 8-K earnings release (here) from Sutro Biopharma Inc for further details.

This article first appeared on GuruFocus.