Swedbank AB's Dividend Analysis

Assessing the Sustainability of Swedbank AB's Upcoming Dividend

Swedbank AB (SWDBY) recently announced a dividend of $1.48 per share, payable on 2024-04-15, with the ex-dividend date set for 2024-03-27. As investors look forward to this upcoming payment, the spotlight also shines on the company's dividend history, yield, and growth rates. Using the data from GuruFocus, let's delve into Swedbank AB's dividend performance and evaluate its sustainability.

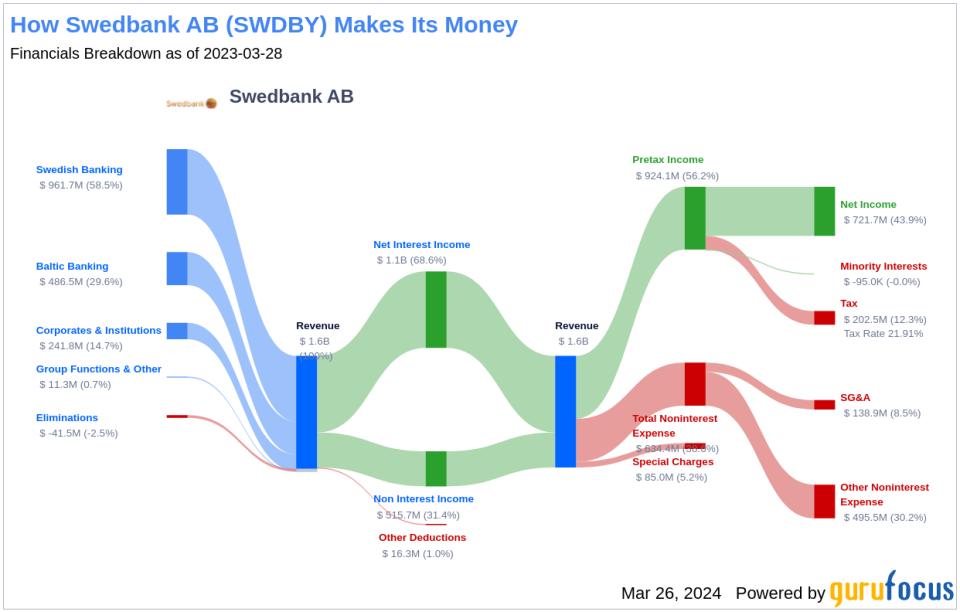

What Does Swedbank AB Do?

This Powerful Chart Made Peter Lynch 29% A Year For 13 Years

How to calculate the intrinsic value of a stock?

Swedbank is one of the oldest banks in Sweden, where it derives the lion's share of its income. The bank emerged from the merger of savings and union banks in Sweden following the financial crisis in the early 1990s. The remaining independent savings banks in Sweden remain closely affiliated with Swedbank, acting as an additional product distribution channel. Moreover, Swedbank operates in the Baltic states of Estonia, Latvia, and Lithuania, where it enjoys a market-leading position in retail banking, contributing 16% to its revenue.

A Glimpse at Swedbank AB's Dividend History

Swedbank AB has upheld a steady dividend payment track record since 2021, with distributions occurring annually. Understanding the historical trends in dividends can offer insights into the company's commitment to returning value to shareholders.

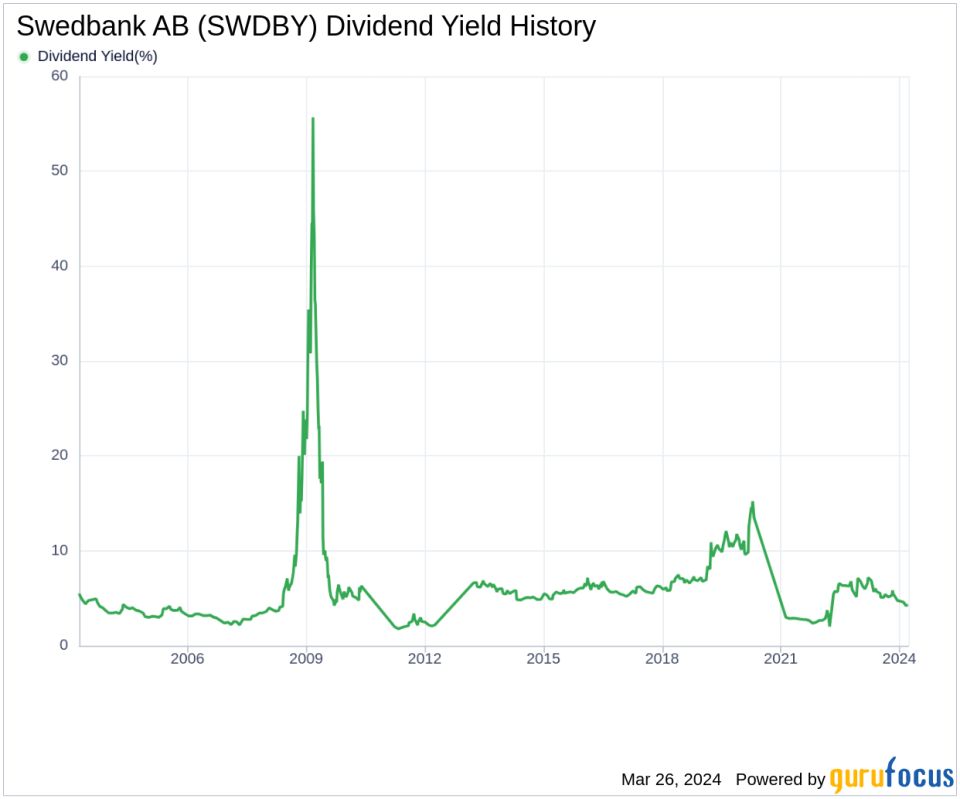

Breaking Down Swedbank AB's Dividend Yield and Growth

As of today, Swedbank AB boasts a 12-month trailing dividend yield of 4.38% and a forward dividend yield of 6.95%. This forward-looking metric indicates an anticipated increase in dividend payments over the next year. Additionally, Swedbank AB's 5-year yield on cost stands at approximately 4.38%, reflecting the yield an investor would receive if the stock was purchased five years ago.

The Sustainability Question: Payout Ratio and Profitability

To gauge the sustainability of the dividend, it's crucial to examine the company's payout ratio. Swedbank AB's dividend payout ratio is 0.32 as of 2023-12-31, suggesting a balanced approach to dividend distribution and earnings retention. Swedbank AB's profitability rank of 6 out of 10, along with consistent positive net income over the past decade, underscores its financial health and capacity to maintain its dividend payments.

Growth Metrics: The Future Outlook

The future sustainability of dividends relies heavily on a company's growth prospects. Swedbank AB's growth rank of 6 out of 10 indicates a solid growth trajectory. The bank's revenue per share and 3-year revenue growth rate, averaging an impressive 16.90% annually, outperform 82.81% of global competitors. Moreover, Swedbank AB's 3-year EPS growth rate and 5-year EBITDA growth rate, at 29.50% and 9.60% respectively, surpass the performance of many global competitors, signaling strong potential for ongoing dividend sustainability.

Next Steps

In conclusion, Swedbank AB's upcoming dividend, consistent dividend growth, prudent payout ratio, and robust profitability and growth metrics paint a picture of a financially sound institution with a shareholder-friendly approach. These factors combined suggest that Swedbank AB is well-positioned to sustain its dividends in the future, making it an attractive option for income-focused investors. For those seeking to discover more high-dividend yield opportunities, GuruFocus Premium offers a comprehensive High Dividend Yield Screener.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.